Bybit vs PrimeXBT: Comparing Features and Performance for Traders

Bybit vs PrimeXBT: Comparison at a Glance

When considering your options for cryptocurrency trading platforms, Bybit and PrimeXBT stand out as robust choices. Knowing the key differences can help you decide which suits your trading style and needs better.

Bybit, launched in 2018, has positioned itself as a dedicated cryptocurrency trading platform. It prides itself on low fees and a wide array of features, including a native NFT marketplace and P2P trading.

PrimeXBT, also launched in 2018, offers a varied trading environment, supporting not only multiple cryptocurrencies but also forex, indices, and commodities.

Here’s a succinct table to help you quickly grasp the primary attributes of each platform:

| Feature | Bybit | PrimeXBT |

|---|---|---|

| Founded | 2018 | 2018 |

| Supported Cryptocurrencies | Over 300 | Around 40 |

| Leverage | Up to 100x for certain pairs | Up to 100x for cryptocurrencies |

| Trading Volume | High, particularly for derivatives | Comparatively lower |

| Deposit Methods | Multiple, including fiat on-ramp options | Multiple, including bitcoin deposits |

| Other Trading Options | Margin, Copy Trading | Forex, commodities, indices, and more |

| Fees | Low, with competitive maker/taker rates | Varies, generally low with conditions |

Remember, the choice between Bybit and PrimeXBT should rest on what you’re looking to achieve with your trades. Assess features like the types of assets available, the level of leverage you’re comfortable with, trading volume which reflects liquidity, and the types of deposit methods you prefer. Your decision should align with your investment strategy and risk tolerance.

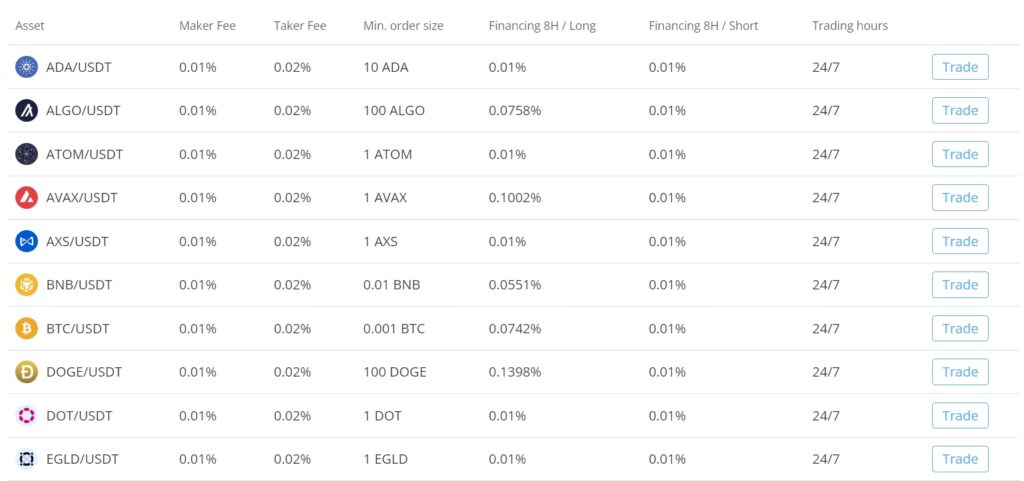

Bybit vs PrimeXBT: Futures Products and Services

When you compare Bybit and PrimeXBT, it’s evident that both platforms cater to the needs of diverse traders with their futures products and services. Bybit, well-regarded for its dedicated cryptocurrency focus, offers futures trading with competitive fees, including a 0.02% maker fee and a 0.055% taker fee. This can be a cost-effective option for your frequent trading activities.

Bybit’s future services are complemented by innovative offerings like leveraged tokens, a noteworthy NFT marketplace, and additional P2P services. These features may enhance your trading experience by providing more diversified options beyond traditional futures contracts.

| Feature | Bybit | PrimeXBT |

|---|---|---|

| Maker Fee | 0.02% | – |

| Taker Fee | 0.055% | – |

| Leverage | Up to 100x | Up to 1000x for other assets |

| NFT Marketplace | Yes | No |

| P2P Services | Yes | No |

| Asset Coverage | Cryptocurrencies | Cryptos, Stocks, Forex, Commodities, Indices |

On the flip side, PrimeXBT broadens your trading horizon beyond cryptocurrencies. You have access to a multitude of assets like stocks, forex, commodities, and indices, which you can trade with leverage up to 1000x for certain assets. This expansive leverage facility is a double-edged sword; while it allows for greater exposure with smaller capital, it also increases the risk considerable.

PrimeXBT lacks certain specialized features such as an NFT marketplace but compensates with tools like copy trading, attracting both intermediate and professional traders looking to mirror the strategies of seasoned players.

In essence, you’ll find Bybit’s strengths in its crypto-centric features and services, while PrimeXBT offers a broader spectrum of assets with potentially higher leverage options. Your choice should align with what you prioritize in your trading endeavors – specificity in cryptocurrency services or the variety and potential gains from a wide range of tradeable assets.

Bybit vs PrimeXBT: Futures Contract Types Available

Bybit Futures Contracts

Bybit offers a variety of futures contracts to cater to different trading strategies. You’ll find:

- Inverse Perpetual Contracts: These contracts use cryptocurrency as the base currency and enable you to trade against USD. You can leverage up to 1:100 on assets like BTC, ETH, XRP, EOS, and LTC.

- USDT Perpetual Contracts: Known as linear contracts, these are quoted and settled in USDT, offering traders simpler risk management with up to 1:100 leverage.

- Inverse Futures Contracts: Offering quarterly settlements, these futures contracts use the corresponding cryptocurrency as collateral, similar to inverse perpetual contracts.

PrimeXBT Futures Contracts

On PrimeXBT, your futures trading options include:

- Inverse Perpetual Contracts: Although not as varied as Bybit, PrimeXBT supports leveraged trading for a selection of cryptocurrencies.

- COIN-M Futures: These contracts are based and settled in the actual cryptocurrency.

- USD-M Futures: These contracts are quoted in USD but settle in cryptocurrency, similar to inverse futures contracts on Bybit.

Both platforms offer substantial leverage, but it’s essential to note that while high leverage can amplify gains, it also significantly increases risk, potentially leading to rapid losses if the market moves against your position.

Margin Requirements

Bybit uses a tiered margin system where larger positions require higher maintenance margin percentages, which helps manage risk during volatile market conditions. In contrast, PrimeXBT typically has a set margin requirement irrespective of the position size, potentially making it easier for you to calculate risks and requirements.

Remember that futures trading requires a solid understanding of the markets and risk management to navigate effectively.

Bybit vs PrimeXBT: Liquidity and Volume

When you examine Bybit’s liquidity and volume, you’ll find that it typically ranks high on metrics across various aggregators. High liquidity on Bybit ensures that you can enter and exit positions close to your desired price points, reducing the likelihood of slippage. Bybit’s volume, the total amount traded over a given period, reinforces its liquidity, showcasing the platform’s active trading community.

Bybit Liquidity:

- Consistently high rankings on market aggregators

- Large order book depth for a variety of pairs

| Crypto Pair | Order Book Depth |

|---|---|

| BTC/USD | High |

| ETH/USD | High |

| LTC/USD | Medium |

Bybit Volume:

- Significant 24-hour trading volume

- Presence of high volume for major cryptocurrencies

On the other hand, PrimeXBT might show lower liquidity levels compared to Bybit. This difference impacts your trading as it might lead to larger spreads and a higher chance of slippage, particularly during market volatility. Volume on PrimeXBT, while substantial, often falls behind Bybit when comparing similar crypto assets.

PrimeXBT Liquidity:

- Lower rankings on liquidity metrics

- Varied order book depth depending on assets

| Asset Type | Order Book Depth |

|---|---|

| Cryptocurrencies | Varies |

| Forex | High |

| Indices | Moderate |

PrimeXBT Volume:

- Moderate 24-hour trading volume for crypto

- More diversified volume distribution across asset types

In your trading decisions, consider these aspects, as Bybit might offer a more reliable trading experience in terms of liquidity and volume, which are essential for efficient trade execution and minimizing slippage. Sources for these metrics, such as CoinMarketCap and CoinGecko, provide up-to-date stats and rankings to assist you in analyzing these factors.

Bybit vs PrimeXBT: Trading Fees and Rewards

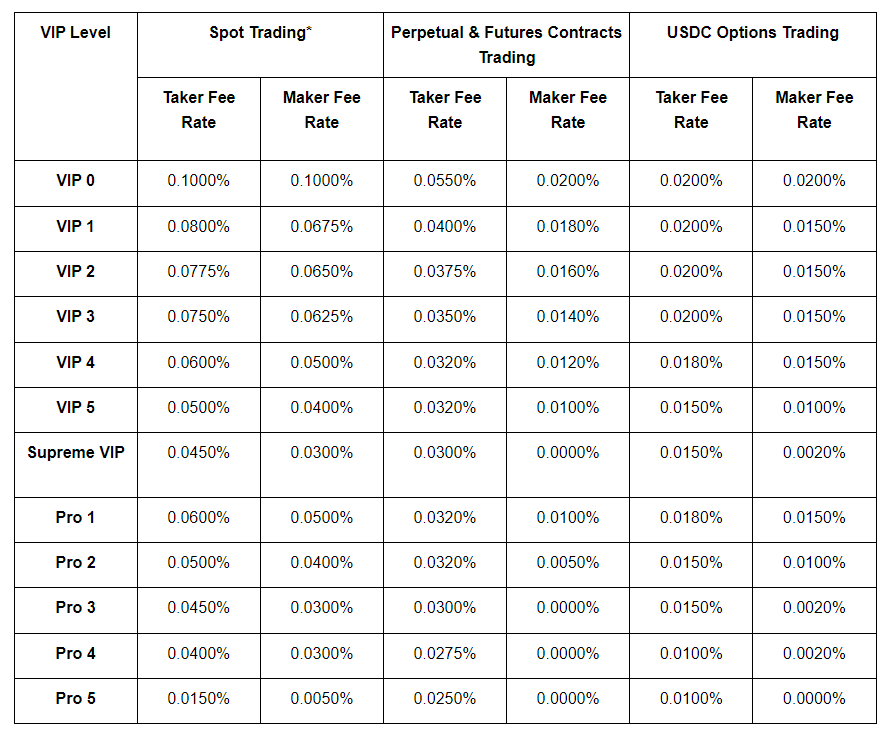

When trading on Bybit or PrimeXBT, understanding the fee structures and rewards is crucial for your profitability.

Bybit’s fee regime includes a maker fee and a taker fee. Typically, you would encounter a taker fee of 0.075%, which is applied when you fill an order at the market price immediately. For placing orders that add liquidity to the market (maker orders), you might not have to pay any fees. This incentivizes you to contribute to the market’s liquidity.

PrimeXBT, on the other hand, offers a competitive flat trading fee of up to 0.05%. This flat fee simplifies the calculation process and can be particularly cost-effective for larger trade volumes.

Fee Comparison:

Bybit Trading Fees:

- Maker: 0.01%

- Taker: 0.075%

PrimeXBT Trading Fees:

- Flat Fee: 0.05%

Both platforms may offer different withdrawal and deposit fees, and these can depend on the asset being traded and the payment method used. It’s important to check the latest fees on their respective websites as they can frequently change and may vary based on your trading volume and user level.

When considering rewards, you should look at the deposit bonuses, referral programs, and any trading competitions offered by the exchanges. These can provide additional value and enhance your trading experience. For instance, Bybit may have an NFT marketplace while PrimeXBT might offer copy trading features, both rewarding in their own right for engaging with the platform’s ecosystem.

Calculating your trading fees is straightforward: Multiply your trade size by the fee percentage. For example, a $1,000 trade on PrimeXBT at a 0.05% fee would cost you $0.50, while the same trade on Bybit as a taker would cost $0.75.

Always stay aware of the fee structures and reward systems before engaging in trading, as these directly influence your net return on investment.

Bybit vs PrimeXBT: Deposits & Withdrawal Options

When considering the ease of moving your funds, Bybit and PrimeXBT exhibit different strengths. Bybit provides a variety of deposit methods. You’re able to deposit cryptocurrencies directly or use fiat currency through debit/credit cards, bank transfers, and even digital wallets like Google Pay and Apple Pay. For even more flexibility, the platform’s P2P marketplace allows for more than 30 currencies and supports over 300 payment methods, including PayPal and Skrill.

| Bybit Deposit Methods | PrimeXBT Deposit Methods |

|---|---|

| – Crypto | – Crypto |

| – Debit/Credit Cards | – Credit (via third party) |

| – Bank Transfer | – Bank Transfer |

| – Google Pay | |

| – Apple Pay | |

| – P2P Marketplace |

PrimeXBT, comparatively, is typically limited to cryptocurrency deposits. Though some flexibility exists as you can fund your account using credit cards via a third-party service provider. This may introduce extra steps in your transaction process.

Withdrawal processes on both platforms are mostly straightforward, with Bybit offering real-time processing of withdrawal requests at designated times. PrimeXBT processes withdrawals once a day, a factor to consider if instant access to your funds is a priority. Both exchanges implement security measures such as whitelisting and multi-factor authentication to ensure the safety of your funds during transfers.

Be aware of minimum and maximum limits on both exchanges, which can impact the scalability of your transactions. Bybit has clearly defined limits that cater to a wide range of traders, from beginners to more experienced users. PrimeXBT, while similarly providing a scale, may have different limitations based on your tier of service.

Each platform’s fee structure is an important aspect of your cost considerations. Bybit’s fees are competitive, especially when drawing value from the multifunctional P2P platform. PrimeXBT’s fees may vary, depending on the asset class and transaction size. Always check the most current fee structure on each exchange’s website to avoid surprises.

Bybit vs PrimeXBT: KYC Requirements & KYC Limits

When comparing Bybit and PrimeXBT, one crucial aspect you’ll consider is their approach to Know Your Customer (KYC) procedures and the limits that accompany different verification levels.

Bybit

At Bybit, KYC is not mandatory for all operations, meaning you can start trading with just an email address. This ensures your privacy and quick access to trading activities. However, to increase your withdrawal limits and access specific features, you might decide to complete the KYC process.

- Verification Levels:

- Level 0: Email registration, no KYC, 2 BTC withdrawal limit per day.

- Level 1: Submission of ID and selfie, higher withdrawal limits.

You are not required to complete KYC verification unless you wish to lift certain restrictions on your account.

PrimeXBT

PrimeXBT adopts a slightly different stance. It permits trading without immediate KYC verification, thus facilitating rapid account creation and maintaining your privacy. Yet, there are certain conditions where KYC may become obligatory.

- Verification Levels:

- Basic: No KYC, access to all trading features, but with set deposit and withdrawal limits.

- Full: Requires personal documentation, including ID and proof of residence.

The details of the exact limits for PrimeXBT may vary but typically, increased levels of verification grant you higher deposit and withdrawal capabilities.

Both platforms balance the need for security with the desire for privacy and swift market entry. The KYC requirements and accompanying limits are instituted to safeguard against illicit activities while providing you with the flexibility to trade how you see fit, albeit with certain restrictions based on your verification status.

Bybit vs PrimeXBT: Order Types

When trading on Bybit or PrimeXBT, you have access to various order types that facilitate different trading strategies and risk management approaches.

Bybit supports these key order types:

- Market Orders: These execute immediately at the best available market price.

- Limit Orders: You set the price at which you want to buy or sell.

- Stop Orders: Triggered when the market hits your specified price, turning into market orders.

- Conditional Orders: Execute only when certain conditions are met, combining features of stop and limit orders.

- Post-Only Orders: Ensure the order is added to the order book but not filled immediately, typically to benefit from maker rebates.

- Reduce-Only Orders: Ensure that the order size doesn’t exceed your existing position, preventing an increase in position size inadvertently.

PrimeXBT offers these order types:

- Market Orders: Filled immediately at current market prices.

- Limit Orders: You control the entry price, specifying the desired purchase or sale price.

- Stop Orders: Activate a market order once a specific price level is reached.

- OCO (One-Cancels-the-Other): A pair of orders where if one is filled, the other is canceled, useful for setting simultaneous take-profit and stop-loss limits.

- Protection Orders: Include Stop Loss to limit potential losses and Take Profit to lock in gains at predetermined levels.

Both platforms equip you with the tools to execute your trading strategies effectively. Whether you are looking to enter the market at a specific price or looking to protect your investments with stop losses and take profits, both Bybit and PrimeXBT cater to your needs. By understanding and utilizing these varied order types, you can manage your risks and establish precise control over your trading activities.

Bybit vs PrimeXBT: Security and Reliability

When assessing the security and reliability of Bybit and PrimeXBT, it’s crucial to consider how each exchange safeguards your funds and personal data. Both platforms have taken extensive measures to establish a secure environment for trading.

Bybit:

- Cold Wallet Storage: Bybit stores the majority of your digital assets in offline cold wallets, significantly reducing the risk of external hacks.

- Multi-Signature Access: Transactions from cold storage require multi-signature verification, adding an extra layer of security.

- SSL Encryption: Your data on Bybit is encrypted using the SSL protocol, ensuring that sensitive information remains private.

Past Incidents: Despite rigorous security measures, it’s important to acknowledge any previous incidents. To date, Bybit has maintained a strong record without any notable breaches.

Regulatory Compliance: Bybit strives to comply with international standards and regulatory requirements to maintain a secure trading environment for you.

Customer Support: Bybit provides a 24/7 customer support service to address your security concerns promptly.

PrimeXBT:

- Bank-Level Security Protocols: PrimeXBT implements high-grade security measures comparable to those used in the banking sector.

- Two-Factor Authentication (2FA): You’re encouraged to activate 2FA on PrimeXBT for an additional security layer upon login and withdrawal requests.

Past Incidents: As with Bybit, PrimeXBT has also preserved a reliable record, without significant security breaches reported in its history.

Regulatory Compliance: PrimeXBT regularly updates its compliance protocols to meet evolving regulatory standards, aiming to protect your interests and funds.

Customer Support: An attentive customer support team at PrimeXBT is available to assist you with any security-related queries.

When trading on either platform, you must always use your best judgment and practice safe trading habits — such as using strong, unique passwords and remaining vigilant against phishing attempts.

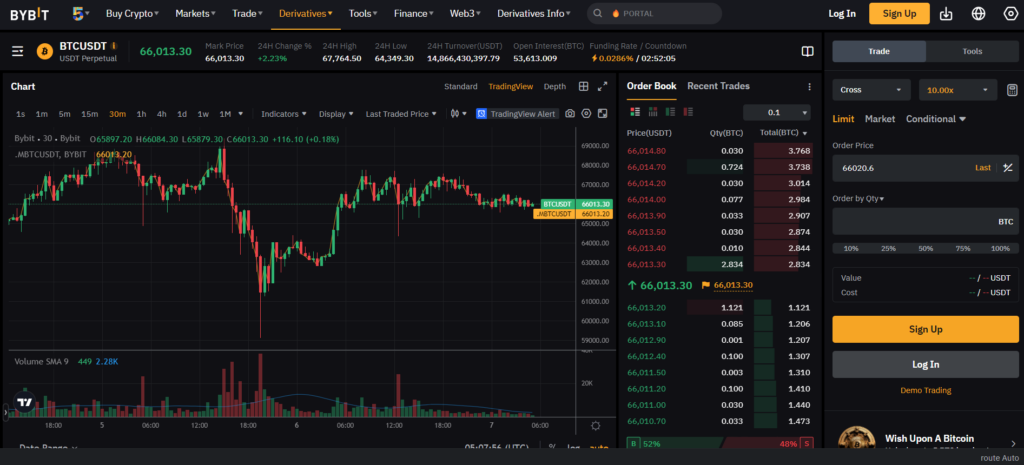

Bybit vs PrimeXBT: User Interface & Experience

When exploring Bybit and PrimeXBT, you’ll notice distinct differences in terms of user interface and overall trading experience.

Bybit:

- The interface is highly praised for its advanced charting capabilities. It is designed to be user-friendly and visually appealing.

- Functionality is enhanced with tools suitable for technical analysis, often surpassing those available on other platforms like Binance.

- The top bar remains static, allowing you easy access to various features without losing track of other information.

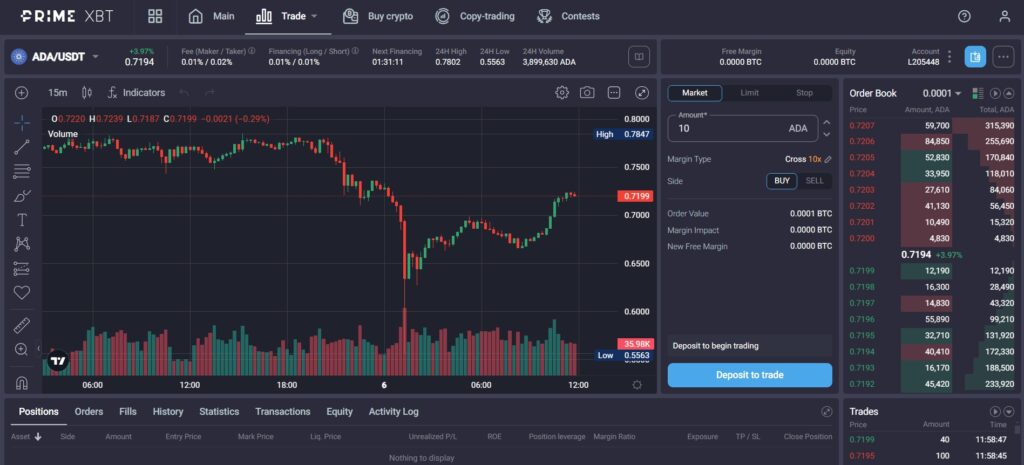

PrimeXBT:

- Offers a minimalistic and sleek design, which focuses on reducing clutter. This can particularly improve trading speed and focus.

- The platform layout is reportedly user-friendly, with a logical structure. It successfully simplifies navigation, which is a boon for users who appreciate efficiency.

When using Bybit, you may find the interface more accommodating if your trading strategies rely on technical analysis tools. In contrast, if you prefer a streamlined and straightforward experience, PrimeXBT’s design might be more to your liking.

User reviews do suggest that Bybit’s comprehensive features may have a steeper learning curve, but they contribute to a highly responsive and customizable experience. PrimeXBT’s clean design is often regarded as more approachable for new users and ensures swift navigational experiences.

In conclusion, your preference for Bybit or PrimeXBT will depend on your requirements for technical tools and your appreciation for design simplicity. Both platforms strive to create an effective environment, but they cater to different aspects of user experience.

Bybit vs PrimeXBT: Regulation and Compliance

When examining the regulatory landscape of Bybit and PrimeXBT, you’ll discover that both platforms function within the complex framework of international cryptocurrency regulations.

Bybit:

- Jurisdictions: Operates in multiple countries and complies with their respective cryptocurrency trading regulations.

- Licenses: Although specifics are not always public, Bybit ensures adherence to local laws where it conducts business.

- Certifications: The exchange tends to stay up-to-date with security certifications but formal certifications relating to regulation may not be publicly listed.

- Controversies: In the past, Bybit has faced scrutiny from regulators due to varying compliance requirements in different regions.

PrimeXBT:

- Jurisdictions: Provides services internationally and must navigate the regulatory requirements of each country it operates in.

- Licenses: Like Bybit, details about licenses may not be publicly available, but the platform commits to legal standards where available.

- Audits: PrimeXBT has showcased a commitment to security through various platform audits. However, regulatory audits if any, are not typically disclosed.

- Challenges: The exchange has had to adapt to the evolving regulatory standards and may have faced regulatory challenges, reflecting the larger industry trend.

Your choice between Bybit and PrimeXBT should consider how each platform aligns with regulatory expectations and manages compliance within your jurisdiction. Both platforms aim to maintain ethical standards and adhere to legal obligations, yet it’s crucial to review their compliance histories as regulations and enforcement evolve.

Conclusion

When comparing Bybit and PrimeXBT, your choice largely depends on your trading needs and experience. Bybit caters extensively to the cryptocurrency market with a high number of supported cryptocurrencies and crypto derivatives. It’s a platform suited for you if you require a variety of trading pairs and a robust, reliable trading engine capable of 100x leverage.

Bybit Strengths:

- Supports over 300 cryptocurrencies

- Professional-grade with 100x leverage

- Additional features like NFT marketplace and P2P trading

On the other hand, PrimeXBT could be your preference if you’re looking for a platform that offers a wider range of tradable assets. Apart from cryptocurrencies, PrimeXBT also provides forex, commodities, and indices. It’s designed for experienced traders, offering advanced features such as copy trading.

PrimeXBT Advantages:

- Multi-asset trading platform (incl. forex and commodities)

- Advanced features (e.g., copy trading)

- Suitable for experienced traders with high leverage

In terms of user-friendliness, both platforms have their merits, but PrimeXBT could present challenges for newcomers due to its high leverage and complexity.

User Experience:

- Bybit: Professional yet accessible for varied trader expertise

- PrimeXBT: High leverage may be challenging for novices

Security, fees, and available leverage are crucial aspects to also consider when making your decision. Bybit’s popularity and maturity in the crypto trading sphere might steer you towards its platform if you value a mix of performance and user accessibility. For traders and investors with an eye on diverse asset portfolios, PrimeXBT’s offerings could be more aligned with your goals.

Evaluate your experience level, your interest in diverse asset classes, the importance of low fees, and the need for advanced trading features when choosing between Bybit and PrimeXBT.

Comparing Bybit and PrimeXBT Against Competitors: