Bybit vs Kraken: A Comprehensive Exchange Comparison

Bybit Vs Kraken: Introduction

When you are navigating the cryptocurrency trading landscape, two platforms you might encounter are Bybit and Kraken. Each exchange offers unique features tailored to different types of traders.

Bybit was founded in 2018 and is known for its user-friendly interface and derivative trading options. Its competitive fees and deep liquidity make it a popular choice for both beginners and experienced traders.

Kraken, established earlier in 2011 by Jesse Powell, is one of the longest-standing crypto exchanges. It is well-regarded for its comprehensive security measures, a wide range of cryptocurrencies, and additional services like staking.

Here is a concise comparison of the main features and offerings of Bybit and Kraken:

| Feature | Bybit | Kraken |

|---|---|---|

| Founded | 2018 | 2011 |

| Founder(s) | – | Jesse Powell |

| Trading Fees | Starting at 0.1% | Variable, depending on volume and currency pair |

| Supported Coins | Various, including leading tokens | Wide range, including fiat/crypto pairs |

| Leverage | Competitive leverage options | Up to 5x for certain pairs |

| Trading Volume | High-volume traders receive fee discounts | High-volume discounts available |

| Deposit Methods | Multiple, including cryptocurrencies | Diverse, including fiat and cryptocurrencies |

| Additional Features | Market maker orders free for top-level traders | Staking, loan services, and excellent security |

While both exchanges aim to serve a global market, Bybit and Kraken cater to their users with different approaches. Bybit focuses on a simple and competitive trading environment, while Kraken prides itself on being a secure and versatile platform that serves novice to experienced traders. Your choice between the two will depend on your specific trading needs and preferences.

Bybit vs Kraken: Futures Products and Services

Bybit and Kraken are both established cryptocurrency exchanges that offer a variety of trading products, including futures.

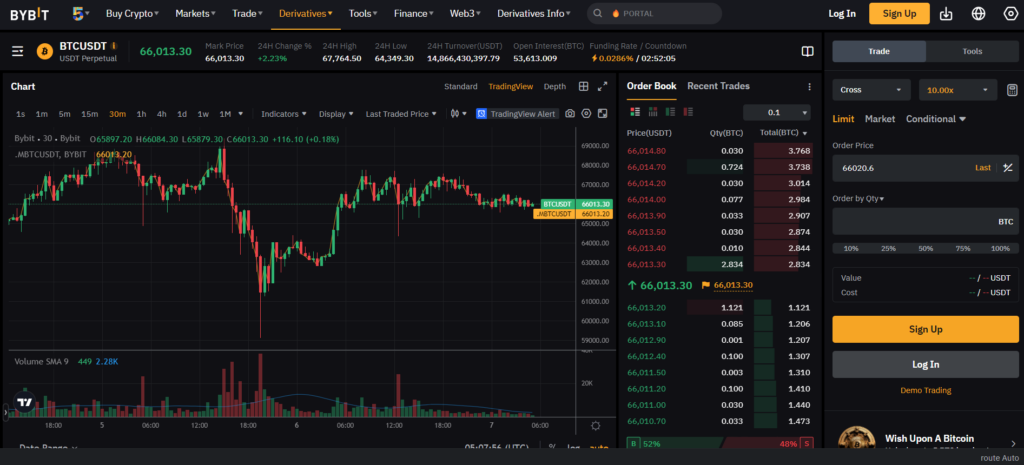

Bybit is recognized for its futures trading platform which is designed with an interface catering to both novice and experienced traders. You can trade with substantial leverage on Bybit, and they offer perpetual futures contracts, which have no expiry date, thus allowing positions to be held indefinitely.

- Leverage: Up to 100x

- Contracts: Perpetual

- Variety: Offers a good selection of cryptocurrency pairs

- User Experience: Generally praised for its platform responsiveness and intuitive design

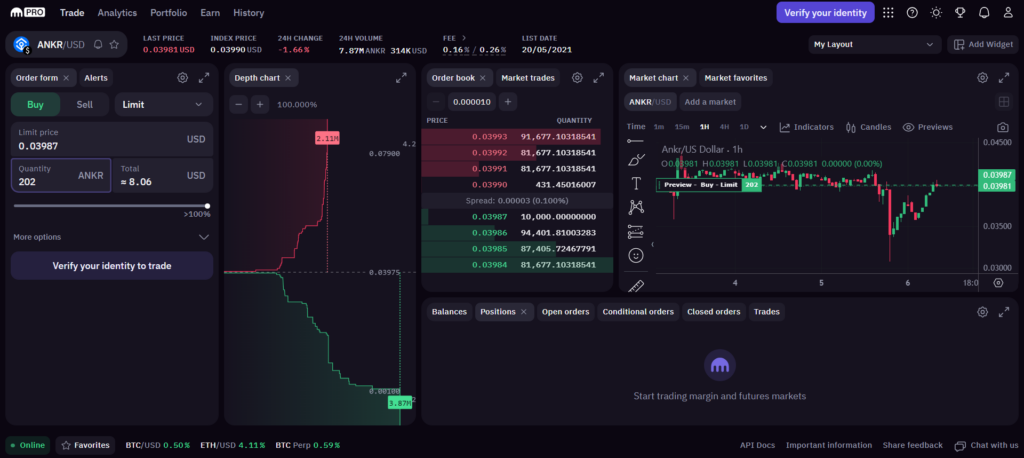

In contrast, Kraken provides a slightly different futures product service. While also offering leverage, its platform is known for integrating spot and futures trading seamlessly.

- Leverage: Up to 50x

- Contracts: Perpetual, fixed expiries

- Variety: Includes a diverse range of pairs, including fiat-crypto futures

- User Experience: Prioritizes security and an easy-to-navigate platform, suitable for various levels of traders

Your choice between Bybit and Kraken may depend on preferences for leverage, the type of contracts you’re interested in, and the user experience you prioritize. Bybit’s high leverage could be suitable for high-risk traders, while Kraken’s diverse offerings and security might appeal to traders looking for a more holistic experience. Both crypto futures trading platforms comply with industry standards and aim to provide traders with a comprehensive set of tools and resources for trading futures.

Bybit vs Kraken: Futures Contract Types Available

When you’re evaluating Bybit and Kraken, you’ll find diverse futures contract types available to suit various trading strategies. Both platforms enable you to engage in futures trading, but the specifics of what they offer can impact your trading experience.

Bybit offers a range of futures contract types, including:

- Inverse Perpetual Contracts: You can trade contracts where the margin and settlement are in the cryptocurrency of the contract, such as BTC.

- Linear Perpetual Contracts: Here, contracts use USDT or another stablecoin as the margin and settlement currency.

- Inverse Futures Contracts: These have a pre-set expiration date, and again, cryptocurrency is used for margin and settlement purposes.

- USD-M Futures: These contracts are margined and settled in US dollars.

Bybit allows for high leverage, with some contracts offering up to 100x, appealing to traders seeking significant exposure with smaller capital investment.

Kraken, on the other hand, provides:

- COIN-M Futures: These contracts are margined in the cryptocurrency itself, allowing you to leverage the underlying asset directly.

- USD-M Futures: Similar to Bybit, these contracts are margined and settled in US dollars.

- Options: Kraken also offers options trading, which Bybit does not currently provide.

Kraken tends to have lower leverage options, with a maximum of approximately 50x. This could be seen as a benefit if you’re looking to trade with less risk.

Both Bybit and Kraken have their own benefits and drawbacks depending on your trading preferences. Your choice between inverse or linear contracts, preference for high leverage or options trading, and the importance of margin currency will guide your selection. Remember to consider your risk tolerance and the margin requirements for each contract type before diving into futures trading on either platform.

Bybit vs Kraken: Liquidity and Volume

When you evaluate exchanges like Bybit and Kraken, knowing their liquidity and trading volume can significantly influence your trading experience.

Kraken:

- Liquidity: Known for strong liquidity, Kraken is reported to be one of the leading exchanges in terms of the euro trading volume. High liquidity means your trades are executed efficiently.

- Volume: Processes over $1 billion in daily spot trading. The substantial volume ensures minimal slippage, maintaining the price you expect when executing trades.

Bybit:

- Liquidity: Although Bybit is not predominantly known for its spot market liquidity, it shines as a large derivatives trading platform.

- Volume: Despite having lower spot volume, the high volume in derivatives indicates active markets, often resulting in efficient trade executions for derivatives.

Both metrics – liquidity and volume – are pivotal as they ensure swift trade execution and reduce slippage. Slippage refers to the difference between the expected price of a trade and the price at which it is executed. Higher liquidity usually leads to less slippage.

The volume and liquidity data for both exchanges often come from market insights and analytics platforms. These platforms rank exchanges using various metrics, offering you a transparent overview of each exchange’s performance regarding liquidity and trading volume.

When choosing between Bybit and Kraken, consider how each platform’s unique liquidity and volume profiles align with your trading strategies and needs.

Bybit vs Kraken: Trading Fees and Rewards

When trading cryptocurrencies, fees and rewards are essential factors in your trading strategies and overall experience. Both Bybit and Kraken have unique fee structures and rewards that cater to different types of traders. Here’s what you need to know:

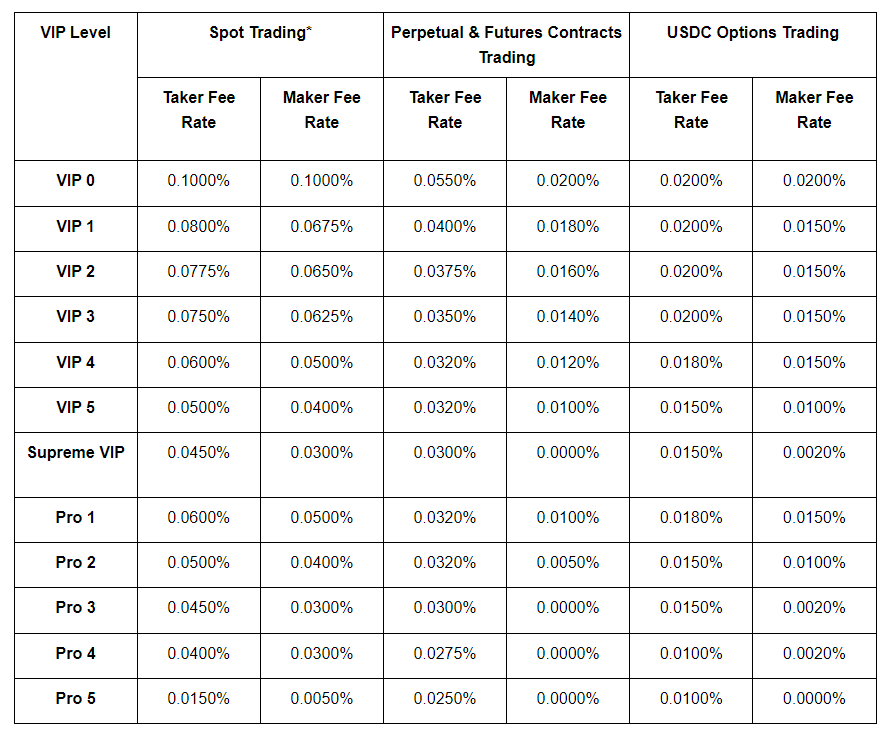

Bybit Fees

- Maker Fee: 0.01% for derivatives, 0.1% for spot trades

- Taker Fee: 0.06% for derivatives, 0.1% for spot trades

- Withdrawal Fee: Standard network fee applies

- Deposit Fee: Free

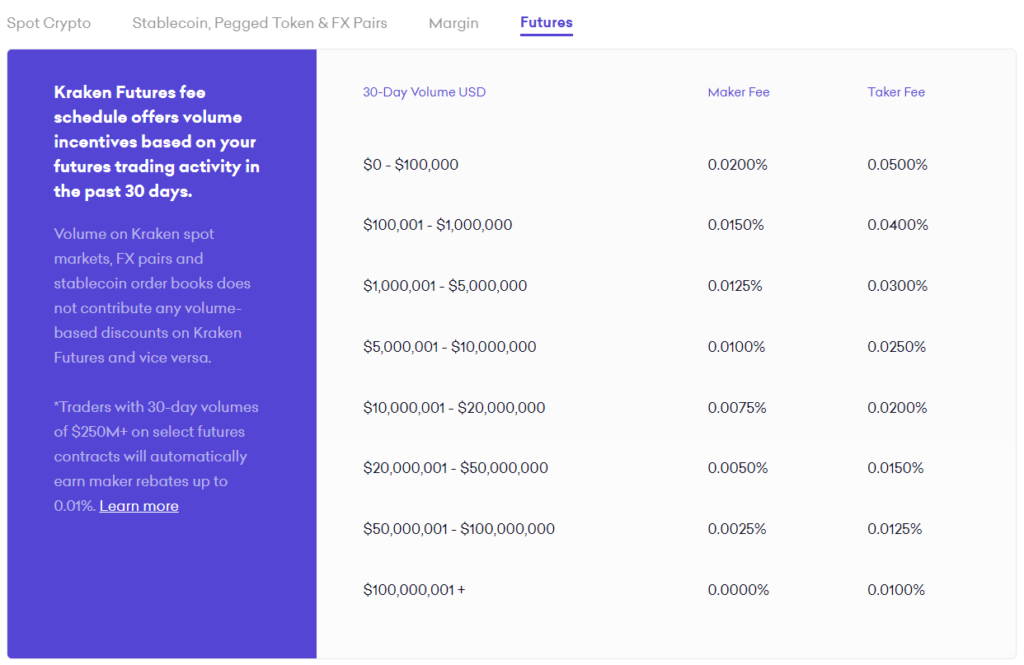

Kraken Fees

- Maker Fee: Up to 0.16%

- Taker Fee: Up to 0.26%

- Withdrawal Fee: Depends on the cryptocurrency

- Deposit Fee: Varied; some methods are free, others have a small charge

Examples:

- If you are a maker in a derivatives trade on Bybit, your fee on a $1,000 trade would be $0.10.

- As a taker on Kraken, a similar spot trade could cost you up to $2.60 in fees.

Discounts and Bonuses:

Bybit incentivizes high-volume traders with potential fee discounts, with the highest-level traders enjoying zero fees on market maker orders. Kraken’s fee structure is tier-based, where higher trading volumes over a 30-day period result in lower fees.

Impact on You

As a trader, your profitability is influenced by these fees. Lower fees can mean higher margins on successful trades. Bybit’s competitive derivatives fees provide an edge for frequent traders, while Kraken’s tiered structure rewards consistent high-volume trading.

Selecting the right exchange requires balancing between fees, rewards, and your individual trading volume and habits. By understanding the nuances of Bybit and Kraken’s fee structures, you tailor your trading activities to maximize your returns and minimize costs.

Bybit vs Kraken: Deposits & Withdrawal Options

When considering Bybit and Kraken for your cryptocurrency exchange needs, understanding their deposit and withdrawal options is crucial for managing your funds efficiently.

Bybit supports various cryptocurrencies for deposits and withdrawals, with processing times being relatively quick and transactions hitting your account typically within minutes after the necessary confirmations on the blockchain. For deposits, there is no fee, while withdrawals incur the standard network fee which is subject to change based on blockchain conditions. You should be aware of the minimum withdrawal amounts which can vary by cryptocurrency.

In contrast, Kraken provides a broader range of supported currencies, including both fiat and cryptos. You have multiple options to fund your account:

- Cryptocurrencies: Like Bybit, Kraken allows crypto deposits with network fees and variable processing times depending on the token.

- Fiat: Bank transfers (wire, SEPA, etc.), with timeframes varying by method and region. Local regulations can also affect the speed of your fiat transactions.

Withdrawal options on Kraken are similarly diverse, including both crypto and fiat channels. However, keep in mind that fiat withdrawals may come with a flat fee and can take several days to process, especially for international bank wire transfers. Minimums and maximums for withdrawals depend on your verification level and chosen currency.

Here’s a quick comparison:

| Feature | Bybit | Kraken |

|---|---|---|

| Deposit Fees | None (crypto) | Varies (crypto & fiat) |

| Withdrawal Fees | Network fees (crypto) | Flat fees + network fees |

| Fiat Options | None | SEPA, Wire, others |

| Processing Time | Minutes (crypto) | Minutes – Days (crypto & fiat) |

| Min/Max Limits | Varies by crypto | Varies by level & currency |

For both platforms, it’s essential to verify your account to increase your deposit and withdrawal limits. The choice between Bybit and Kraken may come down to your preference for dealing strictly with crypto or requiring fiat transactions as part of your trading activities.

Bybit vs Kraken: KYC Requirements & KYC Limits

When comparing the KYC (Know Your Customer) policies of Bybit and Kraken, you’ll find that each platform has distinct requirements that affect your experience in terms of privacy, security, and accessibility.

Bybit has traditionally been known for its lenient KYC policies. You can start trading on Bybit with just an email verification, which allows for a certain degree of anonymity. However, to enhance account security and access higher withdrawal limits, you’re encouraged to complete additional verification steps.

Bybit Verification Levels:

- Level 0: Email verification – Daily withdrawal limit of 2 BTC

- Level 1: Government-issued ID and facial recognition – Increased withdrawal limits

In contrast, Kraken applies a more rigorous KYC procedure from the outset, which can be seen as a commitment to security and regulatory compliance. As a Kraken user, you must complete different levels of verification to unlock various features and higher limits.

Kraken Verification Levels:

- Starter: Name, email, date of birth, and phone number – Deposit and trade digital assets – No fiat transactions or withdrawals

- Intermediate: Government ID, proof of residence, face photo – Deposits, withdrawals, and trading with higher limits

- Pro: Additional financial information and KYC documentation – Highest limits for deposits, withdrawals, and trading

It’s important to understand how these policies impact you:

- For privacy-conscious traders, Bybit’s entry-level requirements might be preferable, allowing trading with minimal personal information exposure.

- Security-focused users may find Kraken’s thorough approach reassuring, helping to prevent fraud and ensuring compliance with financial regulations.

- Accessibility varies; while Bybit allows quick market entry, Kraken’s structured levels ensure that you are progressively verified for more substantial financial activities.

Each exchange’s KYC policy outlines the necessary documents, typically including a government-issued ID and proof of residence. The verification process is designed to match international regulatory standards, aiming to protect both the exchange and its users from illicit activities.

Bybit Vs Kraken: Order Types

When you’re trading on Bybit and Kraken, understanding the order types each platform offers is crucial for executing your trading strategies and managing risks effectively.

Bybit provides you with a range of order types:

- Market Order: This lets you buy or sell immediately at the current market price.

- Limit Order: You can set the price at which you want to buy or sell.

- Conditional Order: Acts as a stop order that triggers a limit or market order when certain conditions are met.

- Post-Only Order: Guarantees you’ll pay the maker fee and not take liquidity from the order book.

- Reduce-Only Order: A feature to ensure that your order will only reduce your position, not increase it.

Bybit’s order types are designed to offer you flexibility in fast-paced markets, allowing you to act quickly with market orders or set precise entry and exit points with limit and conditional orders.

Kraken, on the other hand, also supports various order types:

- Market Order: Enables immediate purchase or sale at the best available current price.

- Limit Order: Set a specific price to execute your trade.

- Stop Loss Order: Specify a price at which your trade will close to minimize potential losses.

- Take Profit Order: Define a price to lock in profit once the market reaches your target.

- Stop Loss-Take Profit Order: Combine both stop loss and take profit in a single order.

- Settle Position Order: Allows you to settle an open margin position at the current market price.

Kraken’s order types are aimed at helping you manage your strategies with precision and provide various options to suit the diverse needs of traders. Whether you’re looking to capitalize on market movements with market orders or you’re setting strategic entry and exit points with stop losses and take profits, Kraken caters to your needs.

Each platform’s unique order types contribute to a comprehensive trading environment, allowing you to tailor your approach based on market conditions and your individual risk tolerance.

Bybit Vs Kraken: Security And Reliability

When comparing Bybit and Kraken in terms of security, it’s clear that both platforms take your digital safety seriously.

Bybit implements robust security measures such as two-factor authentication (2FA), and it uses advanced SSL encryption to protect your trading activities. Additionally, Bybit employs cold wallet storage systems to safeguard your assets offline, significantly reducing the risk of theft through hacking.

Similarly, Kraken consistently focuses on your account’s security with its own 2FA and strict data encryption protocols. Kraken’s dedication to security is comprehensive, they also utilize cold storage techniques to manage and protect your funds. Neither Bybit nor Kraken has suffered any successful hacking attempts, showcasing their reliability in protecting users’ funds and data over the years.

Regulatory compliance is another component of a secure and reliable exchange. Kraken is known for its adherence to regulatory standards and has a solid reputation for legal compliance across various countries. Bybit also follows regulatory guidelines, although the specifics may vary depending on your region, you should verify its adherence to your local laws.

In terms of customer support, both exchanges offer guidance and resources to resolve any issues you may face promptly. This support factor contributes to the overall reliability of their service.

It’s crucial to review each platform’s history and updates for any security incidents, and how they were resolved to ensure ongoing improvements align with the best practices in digital asset protection.

Bybit Vs Kraken: User Interface & Experience

When evaluating the user interface of Bybit and Kraken, you’ll find that each platform has developed an environment suited to different types of traders. Bybit’s layout is streamlined and intuitive, making it favorable for traders who prefer a clear and direct approach to executing trades. You’ll notice that Bybit’s interface is highly responsive, with minimal lag, which is crucial for fast-paced trading environments. To learn more about the trading experience, you can check this Bybit futures trading tutorial.

Kraken, on the other hand, emphasizes providing a comprehensive experience. It manages to balance sophistication with user-friendliness, catering to both beginners and more experienced traders. You have access to a wide array of trading tools and features, which are neatly organized within the platform. Kraken’s dashboard may appear more complex at first due to the depth of features available.

Ease of Use:

- Bybit: Simplified navigation with a focus on speed.

- Kraken: More features but with a steeper learning curve initially.

Design & Functionality:

- Bybit: Clean design with essential tools for trading efficiency.

- Kraken: Detailed and customizable interface, adaptable to user preference.

Feedback from users often cites Kraken’s learning resources as a valuable component for new users, allowing them to get accustomed to the platform quickly. Bybit users appreciate the straightforward design that helps them make quick decisions without unnecessary clutter.

In summary, Bybit is ideal if you desire a more focused trading interface with all the fundamental tools at your fingertips. Kraken is your go-to if you’re seeking a feature-rich platform with options for extensive analysis and a variety of order types. Your choice boils down to your trading style and your desire for complexity or simplicity in the trading experience.

Bybit Vs Kraken: Regulation And Compliance

When you consider platforms for cryptocurrency trading, understanding their adherence to regulations is crucial. Both Bybit and Kraken serve a broad international audience and must navigate complex regulatory environments accordingly.

Bybit is not available in several countries, including the United States, Singapore, and Canada, largely due to stringent local regulations against derivatives markets. Despite these restrictions, Bybit extends its services to over 150 countries globally. As of the current date, Bybit’s regulatory status in other jurisdictions remains efficient in delivering derivatives, spot markets, and other cryptocurrency trading services, maintaining compliance where it operates.

Kraken, on the other hand, is known for its commitment to regulatory compliance. It operates in the United States with a strong commitment to adhering to the legal requirements set by regulatory bodies. Kraken has secured licenses where necessary and continues to collaborate with authorities to ensure a secure and regulated trading environment. Its reputation for upholding high compliance standards helps foster trust among novices and experienced traders alike.

| Aspect | Bybit | Kraken |

|---|---|---|

| Countries Restricted | United States, Singapore, Canada | Varies by region, more permissive in the US |

| Compliance | Conforms to local regulations where available | Actively secures licenses and works with regulatory bodies |

| Audits/Certifications | Not specified in the provided data | Often involves third-party audits to ensure compliance |

Bybit’s services are tailored to adapt their offerings to comply with regional regulations, while Kraken’s approach to compliance involves obtaining the necessary licenses and undergoing audits to align with legal frameworks, enhancing the security and trust for its users. Keep in mind that regulations are subject to change and can impact the availability and operations of both platforms.

Conclusion

When comparing Bybit and Kraken, it’s evident that each platform caters to different types of users in the cryptocurrency trading space.

Bybit

- Liquidity: Lower than Kraken with a score of 593

- Audience: Often preferred by traders looking for competitive leverage options

- Offerings: Provides access to trading of popular tokens, staking, loans, and NFT transactions

Kraken

- Liquidity: Higher liquidity with a score of 748

- Audience: Attracts a diverse audience, including novices and experienced traders

- Offerings: Known for its user experience, wide feature range, and attention to security

For Beginners:

If you’re new to cryptocurrency trading, Kraken’s user-friendly platform and deep liquidity might be more suitable for your needs, ensuring easier execution of trades.

For Experienced Traders:

However, if you seek leverage and a variety of advanced trading options, Bybit could align better with your requirements.

Both exchanges are reputable and offer distinct advantages. Your choice should be aligned with your trading preferences, experience level, and need for liquidity. Remember, the most suitable exchange for you depends on your personal trading goals and strategies.

Explore how Bybit & Kraken compare to their competitors: