Bybit vs BitMEX: Comparing Features and Performance for Traders

Bybit vs Bitmex: Introduction

Cryptocurrency trading platforms are essential for digital asset transactions and investments. Two of the most notable exchanges in this sphere are Bybit and BitMEX. You may find yourself comparing these platforms to discern which suits your trading needs and preferences.

Bybit has established itself as a user-friendly exchange with a simple fee structure. It offers an array of services including spot trading and derivatives. BitMEX, on the other hand, is known for its comprehensive derivatives marketplace and deep market liquidity.

Founded in 2018, Bybit is relatively young but has quickly gained a reputation for its robust trading system and customer service. In contrast, BitMEX was founded in 2014 and is recognized as a pioneering platform in crypto derivatives trading.

Here’s a concise table comparing the two exchanges based on several criteria:

| Feature | Bybit | BitMEX |

|---|---|---|

| Supported Coins | BTC, ETH, XRP, EOS, and more | BTC, ETH, XRP, and others |

| Leverage | Up to 100x on certain contracts | Up to 100x on certain contracts |

| Trading Volume | Over $800 million daily (average) | Over $2 billion daily (average) |

| Deposit Methods | Cryptocurrency only | Cryptocurrency only |

| Trading Fees | – 0.075% taker fee – 0.025% maker rebate | – 0.25% taker fee – 0.050% maker rebate |

| Founders | Ben Zhou | Arthur Hayes, Samuel Reed, Ben Delo |

| Foundation Year | 2018 | 2014 |

Both platforms cater to a global audience and have carved out substantial market shares in the crypto trading arena. Deciding between Bybit and BitMEX will depend on your trading strategies, preferences for certain crypto products, and consideration of fee structures. It’s important to stay informed and choose wisely to ensure your investments align with your financial goals.

Bybit vs Bitmex: Futures Products and Services

When exploring the futures products and services offered by Bybit and BitMEX, you’ll notice they both focus on providing robust trading options for cryptocurrency enthusiasts. These platforms cater to various trading preferences with their respective futures contracts and features.

Bybit presents you with perpetual contracts and inverse futures as part of its futures offerings. In terms of granularity, you have the advantage of entering and exiting positions with relative ease, given the liquidity and real-time trading capabilities. Bybit stands out with a flat fee structure, charging you a 0.075% taker fee while incentivizing makers with a 0.025% rebate.

BitMEX, on the other hand, is known for its deep liquidity pool, which ensures order fulfillment even for large-volume trades. Besides perpetual contracts, traditional futures, and quanto futures are available, diversifying your trading opportunities.

| Service | Bybit | BitMEX |

|---|---|---|

| Perpetual Contracts | Available | Available |

| Inverse Futures | Available | Not specified |

| Quanto Futures | Not specified | Available |

| Taker Fee | 0.075% | Up to 0.075% |

| Maker Rebate | -0.025% | Up to -0.050% |

Your user experience is also a key consideration with these platforms. Bybit’s interface is designed for intuitive navigation and includes innovative features such as mutual insurance against loss in volatile market conditions. Meanwhile, BitMEX offers a more traditional approach, better suited if you’re accustomed to desktop trading with a focus on analytical tools.

Keep in mind the importance of leverage when dealing with futures. Both Bybit and BitMEX provide high leverage options, but it’s crucial to trade responsibly, considering the associated risks.

Bybit and BitMEX each cater to different preferences, with their futures products designed to meet the needs of diverse trading styles and strategies. Whether you prioritize a straightforward fee structure or diverse contract types, assessing your requirements will lead you to the exchange that best aligns with your trading goals.

Bybit vs BitMEX: Futures Contract Types Available

Bybit and BitMEX are both known for their variety of futures contracts that cater to different trading strategies and preferences. On Bybit, you have access to Inverse Perpetual Contracts, which allow you to speculate on the price of cryptocurrencies against BTC or another base cryptocurrency. They also offer USDT-Perpetual Contracts, a type of linear contract quoted and settled in USDT, making it easier for you to calculate your profits and losses.

BitMEX, on the other hand, also specializes in Inverse Perpetual Contracts and introduces Inverse Futures Contracts. The inverse contracts on BitMEX enable trading against the value of a fixed amount of the quote currency (such as XBTUSD), which may appeal if you’re looking to hedge your BTC holdings or speculate on price movements of Bitcoin versus fiat currencies.

Both platforms provide choices regarding margin and leverage. They allow high leverage, with BitMEX providing up to 100x and Bybit up to 100x on certain contracts. Keep in mind, while high leverage might increase potential profits, it also raises potential risks and may lead to a quicker liquidation if the market moves against you.

| Contract Type | Bybit Options | BitMEX Options |

|---|---|---|

| Inverse Perpetual | BTC, ETH against USD | BTC, ETH, and others against USD |

| Linear Perpetual | USDT contracts for major cryptos | Not available |

| Inverse Futures | Not available | XBT, ETH against USD |

| Options | Not available | Not available |

Remember, trading futures requires a thorough understanding of the market and an acceptance of the risks, especially when using leverage. Ensure you manage your risks carefully and use the trading tools both platforms offer to protect your investments.

Bybit vs Bitmex: Liquidity and Volume

When selecting a cryptocurrency exchange, you often consider both liquidity and trading volume as vital metrics. Liquidity refers to how quickly and easily an asset can be bought or sold at a stable price. A higher liquidity typically implies less slippage and ultimately better execution for your trades.

BitMEX, established as a leader in cryptocurrency derivatives trading, boasts significant liquidity. With an average daily trading volume exceeding $2 billion, your trades are less likely to impact the market price, thus offering a more stable trading environment.

In contrast, Bybit reports an average daily trading volume of over $800 million across its assets. While this is lower compared to BitMEX, it still provides decent liquidity, enabling you to execute trades effectively, with reduced risk of market disruption.

| Exchange | Average Daily Volume |

|---|---|

| BitMEX | Over $2 billion |

| Bybit | Over $800 million |

Your experience on these platforms may vary, as volume can fluctuate due to market conditions, time of day, and the specific asset being traded.

Regarding market size, BitMEX ascends as the more substantial platform, hosting the world’s largest Bitcoin futures market by volume. This sizeable volume is an indicator of the exchange’s ability to handle large orders without significant price changes.

When you are deciding between Bybit and BitMEX, assess their liquidity and volume to match your trading needs. Higher volume can equate to lower slippage and potentially better prices on large volume trades. Keep in mind that both platforms are competitive in this aspect, and your preference may depend on the specific features each offers.

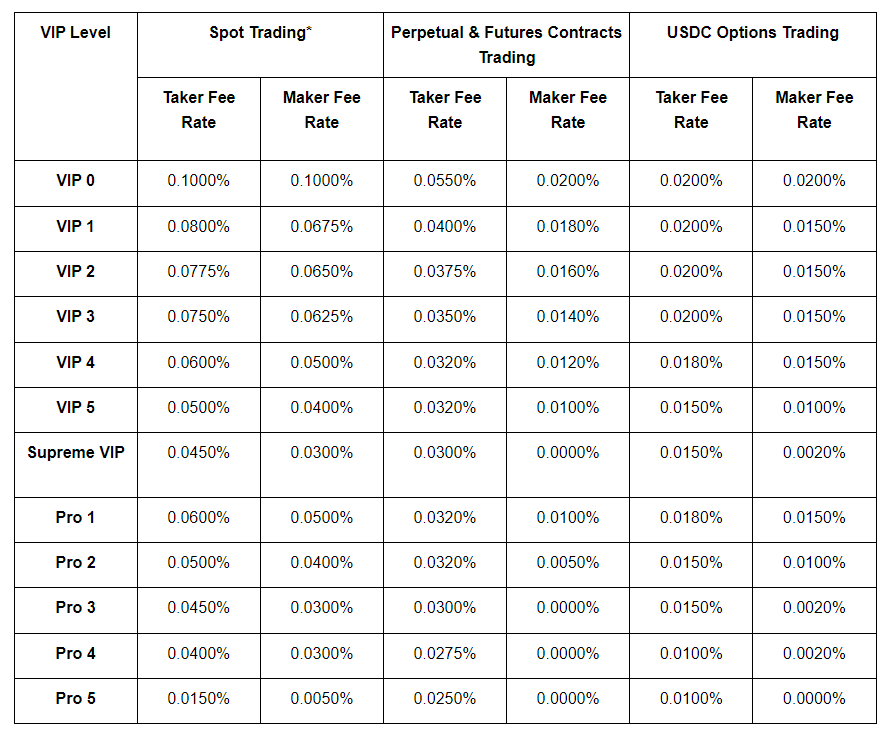

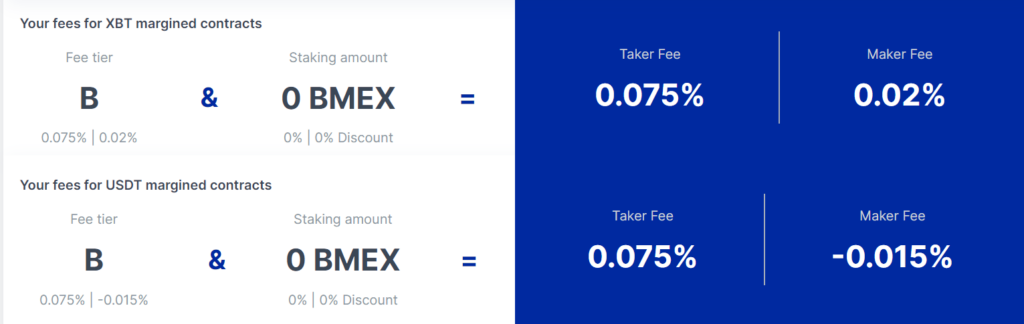

Bybit vs Bitmex: Trading Fees and Rewards

When considering Bybit and BitMEX, it’s important to compare their trading fee structures. Bybit offers a maker fee of -0.025% and a taker fee of 0.075%, which incentivizes market-making activities by providing a rebate for limit orders adding liquidity to the market. BitMEX matches Bybit’s taker fee of 0.075%, but their fee for market makers is also 0.025%, eliminating the maker rebate.

In terms of deposit and withdrawal fees, Bybit does not charge for deposits but does have a minimal withdrawal fee that corresponds to the blockchain’s minimum network fee. BitMEX also allows free deposits and applies a similar minimal withdrawal fee structure, depending on the blockchain used.

Here is an example of how fees would apply to a $10,000 trade:

Bybit

- Maker Fee: -$2.50 (rebate)

- Taker Fee: $7.50

BitMEX

- Maker Fee: $2.50

- Taker Fee: $7.50

Both platforms also offer rewards and incentives such as trading bonuses for new users, which may affect your decision. The reward programs can be a great way to increase your trading capital, but be sure to understand the terms and conditions of each offer.

Regarding leverage trading, both exchanges offer competitive leverage options, with BitMEX offering up to 100x on some products, compared to Bybit’s maximum of 100x. However, higher leverage increases risk, so use these features with caution. Always keep in mind that while fees are a crucial part of trading, the reliability, platform features, and liquidity are also significant factors to consider.

Bybit vs Bitmex: Deposits & Withdrawal Options

When evaluating Bybit and BitMEX, you’ll find that both exchanges offer distinct options for depositing and withdrawing funds. Bybit supports various fiat currencies, and your deposit methods include bank transfers, SEPA, and FPS among others. On the other hand, BitMEX, primarily known for cryptocurrency transactions, may have a more limited scope regarding fiat currency options.

Bybit Deposit Options:

- Fiat Currencies Supported: Multiple, including USD, RUB, BRL

- Methods: Bank Transfer, SEPA, FPS

- Processing Times: Varies by method

Bybit Withdrawal Options:

- Withdraw in Fiat: Options such as USD supported

- Fee Structure: Nominal withdrawal fee

- Limits: Minimum and maximum limits apply

With Bybit, the variety in payment methods adds to your convenience, allowing you to choose based on your preference for speed or cost. The nominal fee for withdrawals is competitive, helping to manage your costs.

BitMEX Deposit and Withdrawal Options:

- Fiat Support: Mainly cryptocurrency-focused

- Methods: Primarily crypto deposits and withdrawals

- Processing Times: Generally fast due to crypto transactions

- Limits: Restrictive measures may apply

BitMEX typically processes transactions quickly, a standard in cryptocurrency exchanges. However, its focus on crypto means you have to plan for currency conversion if your funds are in fiat.

Comparison Table:

| Feature | Bybit | BitMEX |

|---|---|---|

| Fiat Deposit Methods | Multiple | Limited |

| Deposit Processing | Varies | Fast (Crypto) |

| Fiat Withdrawal Support | Yes | Cryptocurrency-focused |

| Fees | Nominal for withdrawal | Market standard |

| Withdrawal Limits | Yes | Yes |

Remember, the deposit and withdrawal options influence factors like transaction speed and cost. Bybit’s multiple methods provide a broader choice, while BitMEX’s crypto-centric system caters to efficient processing times. Choose the platform that aligns with your financial preferences.

Bybit vs Bitmex: KYC Requirements & KYC Limits

Bybit and BitMEX have distinct Know Your Customer (KYC) requirements that can influence your experience on each platform.

Bybit’s KYC: You can trade on Bybit with just an email address or mobile number. However, there are different levels of KYC verification that affect your limits:

- Level 0: No KYC – Small withdrawal limits

- Level 1: ID verification – Increase in withdrawal limits

- Level 2: Proof of Address – Higher withdrawal limits but full KYC

You are not required to perform KYC for basic usage, but your access to higher withdrawal limits and certain features improves with each verification level.

BitMEX’s KYC: BitMEX requires full KYC for all its users. The following is needed:

- Verification: Government-issued ID, proof of residence, and a selfie

- Limits: No trading, deposits, or withdrawals without completion of the KYC process

Once verified, you are granted full access to their services without any limits on your account.

| Exchange | KYC Required? | Documents | Non-KYC Limits |

|---|---|---|---|

| Bybit | Optional | ID, Proof of Address | Yes, limited withdrawals |

| BitMEX | Mandatory | Government ID, Proof of Residence, Selfie | No access without KYC |

Your privacy and security are impacted by these policies. Bybit allows for more anonymity if that’s your preference, while BitMEX ensures all users are verified, which might add a layer of security. Depending on your verification status, both exchanges will provide you with different access and limits regarding trading and financial operations.

Bybit vs Bitmex: Order Types

When trading cryptocurrencies, order types are crucial tools that provide you with flexibility and precision. Both Bybit and BitMEX offer a range of order types that can help you execute your trading strategies and manage your risks effectively.

Market Orders: This is where you buy or sell an asset immediately at the best available current price. Both Bybit and BitMEX support market orders, which are useful when you need to enter or exit the market quickly.

Limit Orders: With limit orders, you specify the price at which you want to buy or sell an asset. Your order will only be filled if the market reaches your specified price. Bybit and BitMEX provide this type of order, allowing you to have control over the price at which you trade.

Stop Orders: These are designed to limit potential losses or lock in profit by triggering a market order once the asset hits a specified price. Both exchanges allow for stop orders, which can be crucial for risk management.

Conditional Orders: These are orders that are automatically submitted or canceled when certain conditions are met. Both platforms offer conditional orders as a way to automate your trading strategies.

Post-Only Orders: This order type ensures that you pay the maker fee and avoid the taker fee by adding liquidity to the market. Your order gets canceled instead of matched if it would have executed immediately against the order book. Both Bybit and BitMEX feature post-only orders.

Reduce-Only Orders: Reduce-only orders are used to reduce your position, not increase it. They are particularly useful for managing existing positions and preventing the opening of new ones. Both exchanges support this order type.

Each platform might have its unique nuances for these order types, but the overarching purpose remains the same: to give you meticulous control over your trading activities and risk exposure. By understanding and utilizing the order types offered, you can navigate the cryptocurrency markets with better precision.

Bybit vs Bitmex: Security and Reliability

When assessing the security and reliability of Bybit and BitMEX, your top priority is how well these platforms protect both your funds and personal data. Let’s examine their security features, historical incidents, and customer support that contribute to their trustworthiness.

Bybit:

- Cold Wallet Storage: Your assets are secured mainly through offline cold wallets, minimizing the risk of online hacks.

- Security Protocols: Includes robust encryption, two-factor authentication (2FA), and multi-signature wallets.

- Reliability: Offers a strong track record with minimal unscheduled downtime.

- Incidents: Bybit has maintained a solid security record with no major hacks reported.

- Regulatory Compliance: Bybit tends to adapt quickly to regulatory changes, enhancing trust.

- Customer Support: Noted for responsive customer service, which is crucial for handling any potential issues effectively.

BitMEX:

- Cold Wallet Storage: Like Bybit, BitMEX secures the bulk of digital assets in offline cold storage systems.

- Security Protocols: Implements rigorous security measures such as 2FA and multi-signature deposit and withdrawal schemes.

- Reliability: Experienced issues related to system overloads in the past, but has since worked on enhancing trading engine capacity.

- Incidents: BitMEX has faced a couple of legal challenges and scrutiny over its operating practices.

- Regulatory Compliance: Has run into regulatory issues, particularly with the CFTC and DOJ investigations in 2020, leading to a shift in executive management to rebuild user trust.

- Customer Support: Provides a competitive level of support, though has faced criticism in times of peak market activity.

Both Bybit and BitMEX demonstrate a commitment to security, employing industry-standard practices to secure your investments on their platforms. Each has had different challenges to overcome, particularly in the area of regulatory compliance. They continue to evolve and bolster their systems to provide you with a secure trading environment.

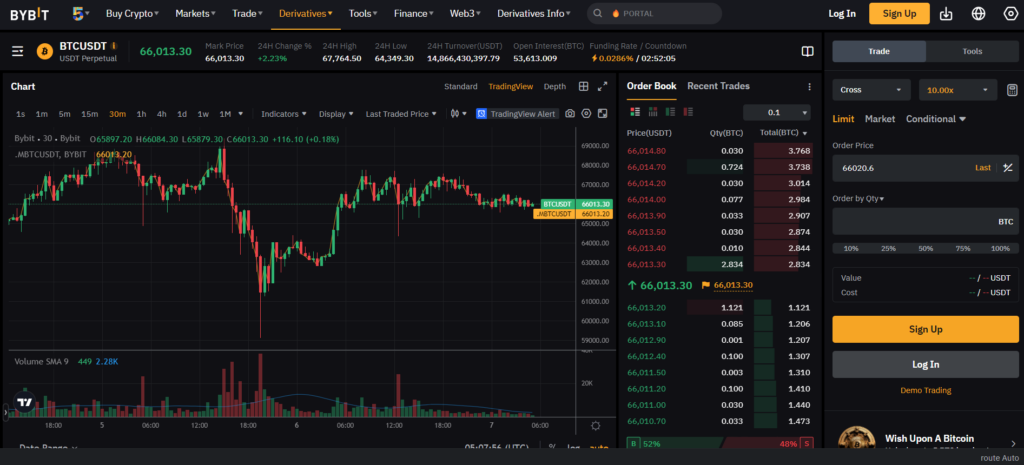

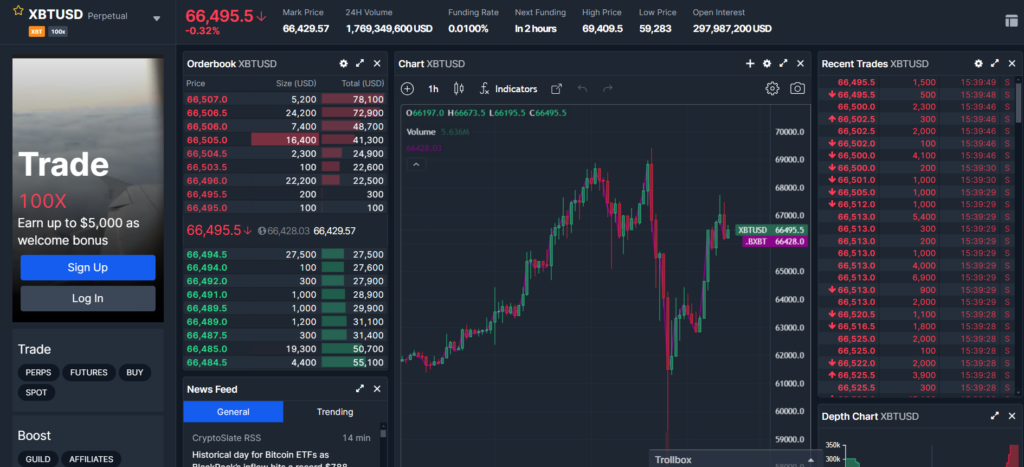

Bybit vs Bitmex: User Interface & Experience

When evaluating Bybit and BitMEX, you’ll notice they both offer platforms designed with the trader in mind, but your experience may vary depending on your preferences and trading style.

Bybit is known for its sleek, modern design, contributing to a user-friendly experience. Firstly, you’ll find the interface intuitive, making navigation straightforward even if you’re new to crypto trading. The trading view is well-organized, with critical elements like order books, charting, and trade history easily accessible. The platform’s speed is also commendable, with rapid order execution and minimal downtime, which is vital during volatile market conditions.

| Feature | Bybit | BitMEX |

|---|---|---|

| Design | Modern & Clean | More Technical |

| Navigation | Intuitive | Steeper Learning Curve |

| Speed | Fast Execution | Reliable |

| Accessibility | User-Friendly | Advanced Users |

In contrast, BitMEX offers a robust interface that you might find more technical. This can be advantageous if you are an experienced trader looking for advanced trading tools. Even though the platform’s design may seem daunting at first, the functionality it provides is comprehensive. The charting tools are extensive, but they may come with a steeper learning curve.

User feedback often highlights Bybit’s smoother user experience compared to BitMEX, especially for newer traders. BitMEX, while reliable in performance, may be better suited for those already familiar with trading platforms that offer high levels of customization and detailed analysis tools.

Both platforms provide the functionality needed to trade effectively, but your personal preference in design and ease of use will likely determine which interface you prefer.

Bybit vs Bitmex: Regulation and Compliance

When examining the regulatory framework for Bybit and BitMEX, it’s important for you to consider the adherence of both platforms to international compliance standards.

Bybit has expanded its compliance measures by procuring a license from the British Virgin Islands and establishing a headquarters in Singapore, known for its strict financial service regulations. The platform operates with a focus on user security and adheres to Anti-Money Laundering (AML) guidelines.

BitMEX, on the other hand, faced legal scrutiny in 2020 from the U.S. Commodity Futures Trading Commission (CFTC) and the Department of Justice (DOJ). They were charged with failing to implement required AML procedures. Since then, BitMEX has taken significant strides in reforming its compliance measures, including implementing mandatory KYC (Know Your Customer) checks.

Compliance Measures:

- Bybit:

- License: Acquired from British Virgin Islands.

- KYC: Mandatory for withdrawal exceeding certain limits.

- Headquarters: Established in regulatory stringent Singapore.

- BitMEX:

- Challenges: Previously faced charges from CFTC and DOJ.

- Reforms: Instituted stringent KYC and AML policies post-legal scrutiny.

- Audits: Underwent external audits to ensure compliance improvement.

Each platform’s commitment to compliance is underscored by their ongoing efforts to align with the legal requirements of the jurisdictions they serve. As you consider your options, remember to review the most current compliance information, as regulations continue to evolve in the fast-paced crypto market environment.

Conclusion

In evaluating Bybit and BitMEX, your experience and preferences play a crucial role in determining the right exchange. Both platforms have their strengths, which cater to the unique needs of traders.

Bybit is commended for its customer support and user interface, which may appeal to you if these factors are priorities. The exchange is renowned for its responsiveness and intuitiveness, making it a solid choice for both new and experienced traders.

On the other hand, BitMEX stands out for its high liquidity and large trading volume, especially if you’re dealing with big order sizes or trading Bitcoin futures. This can be particularly beneficial if you’re an institutional trader or someone who appreciates a long-standing reputation in the market.

| Aspect | Bybit | BitMEX |

|---|---|---|

| Customer Support | Strong | Moderate |

| User Interface | Intuitive | Complex |

| Liquidity & Volume | Good for retail traders | Excellent for large-scale trading |

| Overall Experience | Suited for beginners and regular traders | Preferred by professionals and institutions |

Your decision should align with your specific needs. If exceptional customer service and an easy-to-navigate platform are what you seek, Bybit might be more to your liking. Conversely, if you’re involved in higher volume trading and demand deep liquidity, BitMEX may suit you better.

Choose the platform that aligns with your trading style and priorities to optimize your trading experience.

Comparing Bybit & BitMEX Against Competitors: