Bybit vs MEXC: An Unbiased Exchange Comparison

Bybit vs MEXC: Introduction

When you’re venturing into the cryptocurrency trading arena, the choice of exchange is a pivotal decision that impacts the effectiveness of your trading strategy.

Bybit and MEXC are two leading exchanges that have established themselves as prominent platforms in the trading space.

Bybit was launched in 2018, providing traders with a comprehensive derivative trading platform. On the other hand, MEXC, established in the same year, caters to a wide audience offering spot and derivative trading options.

Key Differences:

The specifics of each exchange’s offerings, including fee structures, supported coins, and additional features, can directly influence your trading experience. Betting on the right platform requires a nuanced understanding of these components.

| Feature | Bybit | MEXC |

|---|---|---|

| Founded | 2018 | 2018 |

| Founder | Ben Zhou | No public information |

| Supported Coins | Over 890 cryptocurrencies | Over 1700 cryptocurrencies |

| Trading Fee | Ranges from 0% to 0.05% depending on contract | Zero spot trading fees; low futures fees |

| Withdrawal Fee | Can vary due to network congestion | Not specified; could be subject to network fees |

| Leverage | Yes, with varying levels depending on asset | Yes, competitive leverage options available |

| Deposit Methods | Multiple, including crypto and fiat transfers | Multiple, including crypto and fiat transfers |

| Products | Futures, spot trading, perpetual contracts | Futures, spot trading, leveraged tokens |

By facilitating this juxtaposition between Bybit and MEXC, you can leverage the information presented here to forge a path through the landscape that aligns with your trading preferences and needs.

Bybit vs MEXC: Futures Products and Services

When assessing futures products and services, you’ll notice Bybit and MEXC each provide distinctive options.

Bybit: Recognized for its significant liquidity, Bybit excels in derivatives and futures trading.

You have the opportunity to engage in various futures contracts, which are one of the mainstays of Bybit’s offering. They offer a robust platform that caters to your futures trading needs with a straightforward user interface and stable performance.

- Liquidity: High liquidity, minimizing slippage

- Variety: Several types of futures, including inverse and perpetual contracts

- Leverage: Offers high leverage which can vary per contract for increased trading flexibility

MEXC: Alternately, MEXC presents a different approach to futures products. MEXC extends beyond traditional futures by providing spot and derivatives markets, including both Futures and Perpetual contracts.

- Coin Support: Offers over 1700 coins, including low-cap altcoins

- Trading Pairs: Hosts more than 2000+ trading pairs

- User Experience: Special features for margin and quantitative traders looking for diversified options

Here’s a quick comparison to help clarify:

| Feature | Bybit | MEXC |

|---|---|---|

| Liquidity | High | Varied |

| Supported Contracts | Inverse, Perpetual | Futures, Perpetual |

| Coin Variety | Over 890 coins | Over 1700 coins |

| Trading Pairs | Not specified | 2000+ pairs |

| Leverage | High | Scaled with the instrument |

Both platforms give you their own set of strengths – Bybit with liquidity and contract variety, and MEXC with a broad coin selection and margin support services. Your choice might hinge on whether you prioritize range or the specificity of futures trading capabilities.

Bybit vs MEXC: Futures Contract Types Available

When you compare the futures contract types available on Bybit and MEXC, you’ll notice several offerings tailored to different trading strategies and risk profiles.

Bybit:

- Inverse Perpetual Contracts: These require margin and profit/loss to be in the base cryptocurrency, such as BTC/USD. You can use leverage up to 100x.

- Linear Perpetual Contracts: Margins and profits are handled in a stablecoin like USDT, simplifying the process for those averse to dealing with multiple cryptocurrencies. Leverage here also goes up to 100x.

- Inverse Futures Contracts: They are similar to inverse perpetuals but have an expiry date. They are designed for short-term trading.

- Options: Bybit offers options contracts which provide more strategy flexibility for traders.

MEXC:

- COIN-M Futures: These are cryptocurrency-margined futures with potential for high leverage, where both risk and reward can be significant.

- USD-M Futures: Settled in USDT, they offer seamless trade execution, and like Bybit, you can leverage up to 100x. They are better suited for traders looking to avoid base currency volatility.

Each exchange has its margin requirements which dictate the minimum amount of funds you must maintain in your account to keep positions open. These requirements are crucial to consider as they directly impact your available leverage and risk level.

It is essential to understand how these contracts work and align with your trading needs. Bybit’s leverage extends across most of its contract types, providing a uniform experience. Meanwhile, MEXC’s diversity in contract types caters to a broader range of preferences, especially for those who value a wide selection of cryptocurrencies.

Bybit vs MEXC: Liquidity and Volume

When you trade cryptocurrencies, liquidity and volume are crucial factors that contribute to the efficiency of your trades.

On Bybit, you can execute large orders with minimal slippage, maintaining the value of your transaction. This strong liquidity is maintained across a diverse range of over 1,000 crypto assets.

Bybit Liquidity

- Spot: High liquidity ensures quick trade execution.

- Futures: Designed for leveraged trades with competitive liquidity.

MEXC, on the other hand, offers a broad selection of cryptocurrencies, facilitating trading in both mainstream and lower-cap altcoins.

Even though it also boasts significant liquidity, slight variations occur when compared to Bybit. The extensive coin selection on MEXC does maintain a healthy level of liquidity, ensuring your orders are filled efficiently, yet Bybit shows the edge with its slightly better liquidity overall.

MEXC Liquidity

- Spot: Zero fees appeal to a wide user base, enhancing liquidity.

- Futures: A low-fee structure supports a liquid futures market.

Regarding volume, your trading experience is shaped by the frequency and the number of assets traded on the exchanges.

Both Bybit and MEXC see high trade volumes, indicative of active trading communities and robust market movement, ensuring you can trade with the confidence that there is a consistent flow of transactions.

Metrics and ranking sources are essential for accurate liquidity and volume data for each exchange.

While specifics may fluctuate daily, Bybit often ranks high on liquidity charts. Data from market aggregators or financial analytics platforms can provide real-time insights into the liquidity and trading volumes of Bybit and MEXC.

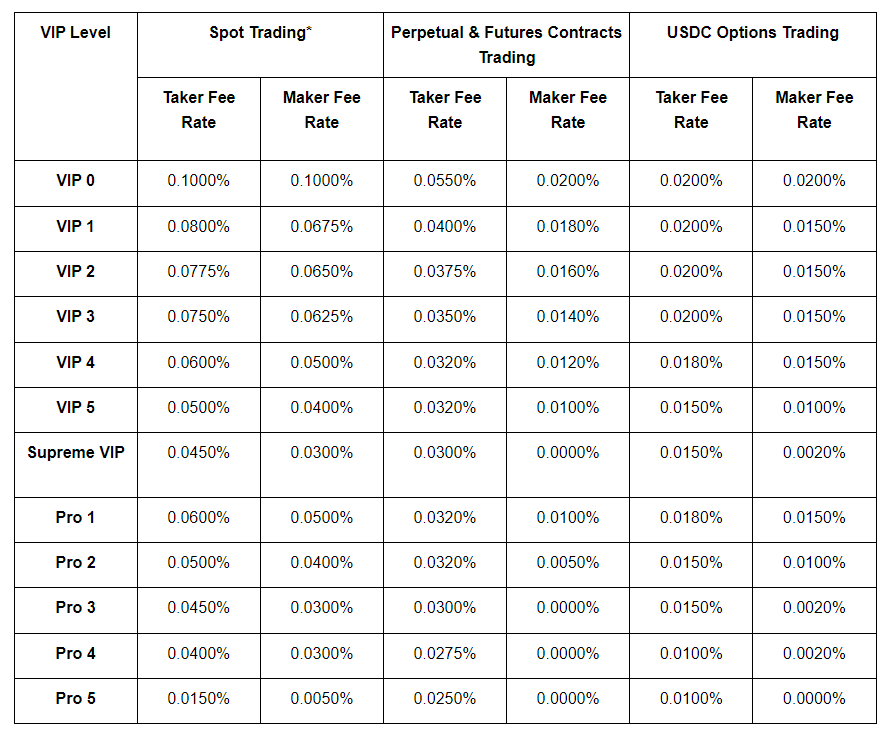

Bybit vs MEXC: Trading Fees and Rewards

When trading cryptocurrencies, understanding the fee structure and rewards can significantly impact your profitability. Bybit and MEXC both offer competitive fee systems but differ in certain aspects.

Bybit Fee Structure:

- Spot Trading: Depending on the type of contract and user’s trading volume, Bybit trading fees range from 0% to 0.05%.

- Derivatives Trading: For derivatives, makers are charged a fee of 0.01%, whereas takers are charged 0.06%.

- Withdrawal Fees: These are subject to change based on network congestion but are typically lower compared to other exchanges.

MEXC Fee Structure:

- Spot Trading: MEXC outshines most exchanges by offering 0% fee on spot trading.

- Futures Trading: For futures, they maintain a nominal taker fee of just 0.01%.

- Withdrawal Fees: Fees vary and may not be as low as Bybit’s.

Reward Programs and Discounts:

- Bybit Rewards: Offers “Bybit Earn,” among other incentives, tailored to increase your investment value.

- MEXC Rewards: Incorporates quantitative trading features and supports margin trading.

For calculating fees, if you’re spot trading on Bybit with a trade volume of $1,000, your fees could be zero.

However, a similar trade on MEXC would guarantee no fees. On the flip side, a futures trade on Bybit could incur a $0.60 fee for takers on a $1,000 contract, whereas MEXC would only charge $0.10.

Always review the tiered fee structures as they often provide discounts for higher volume traders.

With Bybit and MEXC, your level of activity may unlock more favorable terms, enhancing your trading experience.

Bybit vs MEXC: Deposits & Withdrawal Options

When you consider the logistics of funding your trading account, Bybit and MEXC offer different terms for deposits and withdrawals that can affect your choice of platform.

Bybit:

- Deposits: You can deposit cryptocurrencies for free, with the processing times depending on the respective blockchain network. Bybit does not support fiat deposits directly.

- Withdrawals: Charges vary depending on the cryptocurrency, influenced by network congestion. While the processing time is relatively quick, the minimum and maximum limits for withdrawals are set and vary by currency.

MEXC:

- Deposits: Similarly, MEXC doesn’t charge fees on deposits of cryptocurrencies. They support a wider range of coins compared to Bybit, and like Bybit, the processing time depends on the blockchain.

- Withdrawals: MEXC charges fees on withdrawals which are generally low. These fees, however, can be subject to changes with network activity. The platform maintains minimum and maximum withdrawal limits, which are currency-specific.

Bybit has a simpler fee structure with its zero fees for spot trading, making it attractive if you value straightforward cost management.

In contrast, MEXC’s appeal lies in its extensive selection of supported cryptocurrencies, offering more options for deposits.

It’s important to note that payment methods like bank transfers, credit cards, or e-wallets vary in their availability on each platform and should be verified for current support and associated fees.

For both exchanges, fund transfer speeds depend on the asset and network conditions.

Be sure to check the latest terms directly on Bybit’s and MEXC’s platforms before executing any transactions to ensure that you have the most accurate and updated information.

Bybit vs MEXC: KYC Requirements & KYC Limits

When you engage with cryptocurrency exchanges, understanding the Know Your Customer (KYC) requirements is crucial. They dictate the security and accessibility of the services.

Bybit and MEXC have different takes on KYC procedures, directly impacting how you can use each platform.

Bybit operates under a tiered KYC system. Here’s what you should know:

- Level 0: No KYC required; you can deposit, trade, but withdrawals are limited.

- Level 1: Providing personal details increases your withdrawal limits.

- Level 2: Uploading an ID document and proof of address; this level typically offers you the highest limits.

On MEXC:

- Mandatory KYC: You must complete identity verification to access most trading features.

- Procedure: It involves submitting government-issued ID, proof of address, and sometimes a selfie.

- Privacy: This may limit anonymity but enhances account security.

Withdrawal & Deposit Limits:

Each exchange has its own set of limits based on your KYC status.

Bybit provides a relatively more accessible platform for low-volume traders who prioritize privacy, with limited functionality without verification. On the other hand, MEXC requires a complete KYC process for all users. This emphasizes security over privacy, which may restrict access for those not willing to share personal information.

Bybit vs MEXC: Order Types

When comparing Bybit and MEXC, it’s important to understand the variety of order types each platform offers to accommodate your trading strategies and risk management.

Bybit supports several order types:

- Market Orders: Execute immediately at the best available current market price.

- Limit Orders: Set a specific price to buy or sell, executing when the market reaches your specified price.

- Stop Orders: Also known as stop-loss orders, they become market orders once the stop price is reached.

- Conditional Orders: Trigger based on predefined conditions, such as market prices or time.

- Post-Only Orders: Ensure the order adds liquidity to the market and will only execute as a maker order.

- Reduce-Only Orders: A safety feature for positions, ensuring the order only reduces a position, not increases it.

MEXC provides a similar assortment of order types with nuances that cater to various trading preferences:

- Market Orders: Allow for instantaneous trades at the current market rate.

- Limit Orders: Submit an order with a specific price limit, which executes when the asset hits that price.

- Stop-Limit Orders: Combine stop orders with limit orders, letting you set a stop price and a limit price.

- Iceberg Orders: Divides large orders into smaller limit orders to hide the actual order quantity.

- IOC (Immediate or Cancel) Orders: Must be executed immediately; any unfilled portion is canceled.

- FOK (Fill or Kill) Orders: An order that must be filled in its entirety immediately or not at all.

Both Bybit and MEXC offer these orders to enhance your control over trading. Their distinct features like MEXC’s Iceberg Orders or Bybit’s advanced conditional orders can be deciding factors based on your trading requirements.

Bybit vs MEXC: Security and Reliability

When you consider the security measures implemented by Bybit and MEXC, it is clear that both exchanges prioritize the protection of your funds and personal data.

Bybit utilizes several layers of security:

- Cold Storage: Your funds are predominantly stored offline, reducing the risk of unauthorized access.

- Two-Factor Authentication (2FA): This adds an extra layer of security when logging in and processing withdrawals.

- IP Whitelisting: Limits access to your account from unfamiliar sources.

- Bug Bounty Program: Encourages the identification and reporting of system vulnerabilities.

Bybit has established a robust record of security, proactively enhancing its systems. Past security challenges were met with swift resolutions, reinforcing the exchange’s dedication to reliability.

MEXC implements distinct safeguards:

- Hybrid KYC: Blends anonymity with identity verification, aiming to prevent fraud while respecting privacy.

- Zero Fees for Spot Trading: Makes it a secure and cost-effective option for frequent trading.

- Low Fees for Futures: Attracts savvy traders with an emphasis on maximizing returns.

MEXC has had a stable performance in terms of security, with no significant security breaches reported. However, any platform is susceptible to risks, so diligence is always necessary.

Both Bybit and MEXC have strived to remain in compliance with evolving regulatory standards. Bybit is recognized for its thorough regulatory adherence, which should give you added confidence in its reliability.

In terms of customer support, Bybit offers extensive services, which can be particularly beneficial should you face any issues. MEXC also provides customer support, though the quality and speed may vary.

While both exchanges have mechanisms to protect your assets, always use your own best practices to secure your investments.

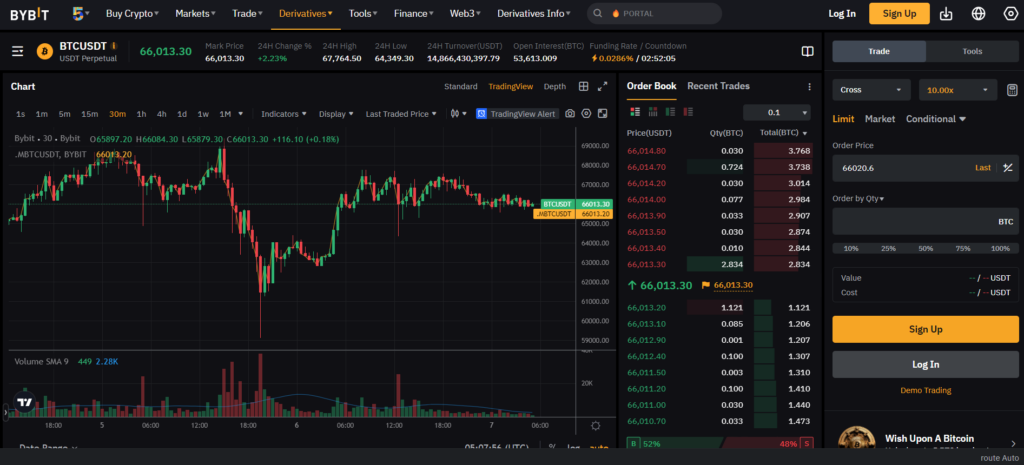

Bybit vs MEXC: User Interface & Experience

When you log into Bybit, the first thing you’ll notice is its streamlined interface. Designed for simplicity, it allows you to view market data and execute trades efficiently.

Whether you’re on a desktop or mobile, Bybit makes trading accessible from anywhere. Its platform is tailored for both new and experienced traders, focusing on speed and clarity.

MEXC, on the other hand, presents you with a robust trading environment. The platform supports over 1,700 coins, catering to traders interested in a wide variety of assets including low-cap altcoins.

MEXC’s interface balances comprehensive functionality with user-friendliness, accommodating the needs of diverse traders.

| Feature | Bybit | MEXC |

|---|---|---|

| Design | Clean, clear, professional | Detailed, comprehensive |

| Mobile App | Available, streamlined | Available, feature-rich |

| Ease of Use | High (suited for all levels) | High (with additional tools for experts) |

| Functionality | Strong, with advanced trading tools | Extensive, with a wide range of assets |

Feedback from users often underscores Bybit’s reliable performance and user-centric design which are crucial for real-time trading decisions.

MEXC’s customer reviews frequently highlight the wide asset selection and innovative features which provide a more extensive trading experience.

In summary, both Bybit and MEXC offer efficient user interfaces and comprehensive trading experiences. Your choice may hinge on whether you prioritize a straightforward platform with strong performance (Bybit) or a more expansive asset range and toolset (MEXC).

Bybit vs MEXC: Regulation and Compliance

When examining the regulatory stance and compliance measures of Bybit and MEXC, your understanding of their adherence to legal standards is crucial.

Bybit operates with a focal point on regulatory compliance. They are known to engage actively with regulatory bodies to ensure their operations are within the legal frameworks of the regions they serve.

Bybit’s comprehensive approach to compliance includes:

- Registration or licensure in multiple jurisdictions

- Adherence to international KYC (Know Your Customer) and AML (Anti-Money Laundering) standards

- Implementation of robust security protocols such as two-factor authentication (2FA) and cold storage of digital assets, bolstering trust and safety for your transactions.

Bybit has faced challenges typical to cryptocurrency exchanges, navigating evolving regulations and adapting its operations to meet the stringent requirements of various countries.

In contrast, MEXC takes a more hybrid approach to KYC, which can be appealing if you prefer flexibility.

Their compliance efforts encompass:

- A large selection of cryptocurrencies, striving to maintain legal compliance for each asset

- Protocols aimed at user protection and the prevention of illicit activities

MEXC’s commitment to regulatory standards has led to a vast offering of digital assets while attempting to stay abreast of legal expectations.

However, ongoing changes in global regulations demand constant vigilance and adaptation from both exchanges to avoid potential controversies.

Conclusion

When choosing between MEXC and Bybit, your decision should be guided by your trading preferences and needs.

MEXC stands out for offering zero fees on spot trading and a wide selection of over 1,700 cryptocurrencies. This makes it an excellent choice if you are interested in exploring a broad array of digital assets, including low-cap altcoins.

In contrast, Bybit is noted for its lower withdrawal fees, a diverse range of trading products, and competitive leverage options. With support for more than 890 coins, it is well-suited for traders looking for strong liquidity and a robust platform.

- For fee-conscious spot traders:

- MEXC might be more beneficial with its fee structure.

- For traders seeking low withdrawal fees:

- Bybit is the preferable option.

- In terms of crypto offerings:

- MEXC provides a wider range.

It is also worth noting that Bybit has been recognized for its compliance efforts and additional services like staking and lending.

Meanwhile, MEXC, with its hybrid KYC approach, may appeal to users looking for a balance between privacy and regulatory adherence.

Before committing to an exchange, assess the importance of trading fees versus withdrawal fees, range of cryptocurrencies, additional services, and the platform’s approach to security and compliance. Your individual requirements will ultimately determine the most suitable exchange for you.

Comparing Bybit & MEXC Against Competitors: