BingX vs MEXC: Comparing Features and Performance of Popular Trading Platforms

Bingx Vs Mexc: Comparison at a Glance

When you’re choosing between two cryptocurrency exchanges, BingX and MEXC, it’s vital to have key information at hand. Below is a succinct table comparing various aspects of both exchanges to aid in your decision-making process.

| Feature | BingX | MEXC |

|---|---|---|

| Founded | Year – Specific Date Not Provided | Year – Specific Date Not Provided |

| Founder(s) | Names Not Provided | Names Not Provided |

| Trading Fees | Varied Fees; Discounts Available | Competitive Fees; VIP Discounts |

| Deposit Methods | Multiple Options Including Fiat | Multiple Cryptos and Fiat |

| Supported Cryptocurrencies | Wide Range; Specific Number Not Provided | Extensive; Exact Figures Not Provided |

| Trading Volume | High; Exact Numbers Vary | Large Volume; Changes Daily |

| Leverage | Offered; Cap Not Specified | Up to a Certain Limit; Exact Value Not Disclosed |

| Products | Spot, Futures, Copy Trading | Spot, Futures, ETFs, Staking |

While BingX and MEXC both rank highly on several crypto exchange lists, your specific needs will drive your choice. BingX offers unique features like copy trading, which may appeal to new traders, while MEXC boasts a diverse range of products including ETFs and staking opportunities.

Trading fees are a crucial consideration, and both exchanges offer a structure that may provide discounts based on volume or membership tier. The deposit options are versatile for both, accommodating both crypto and fiat currencies to ease the entry for various users.

Keep in mind the availability of leverage, which, while it can amplify gains, also increases risk. Be sure to understand the limits and rules each platform imposes. Lastly, remember to consider the breadth of supported cryptocurrencies — while both platforms offer a wide range, your specific investment interests should guide your choice.

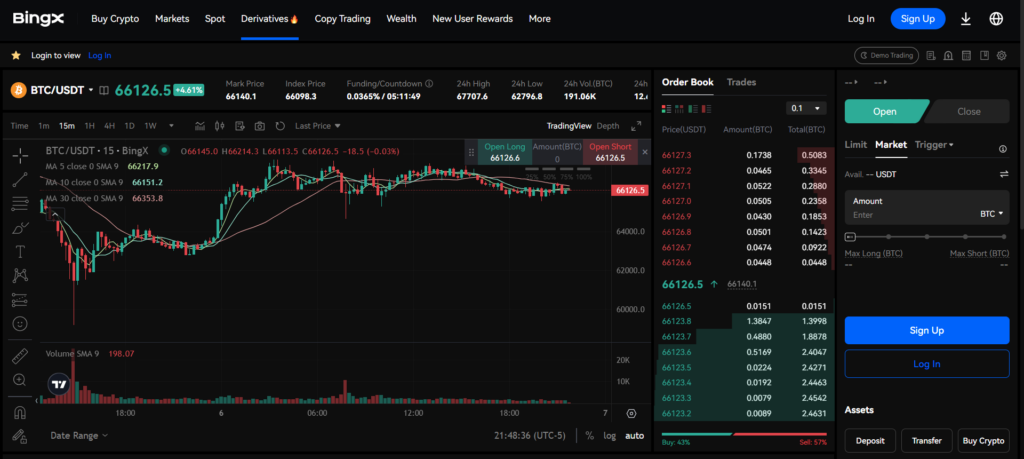

Bingx Vs Mexc: Futures Products and Services

When evaluating futures trading on BingX and MEXC, you’ll notice some differences in their offerings. BingX is known for its social trading feature, which allows you to follow successful traders and replicate their strategies. This can be particularly beneficial if you’re new to futures trading or want to leverage the expertise of seasoned traders.

MEXC, on the other hand, offers a wider array of futures products, including perpetual futures and traditional futures with specific expiry dates. This gives you more flexibility in your trading strategies and risk management.

| Feature | BingX | MEXC |

|---|---|---|

| Futures Types | Mainly perpetual | Perpetual and traditional |

| Leverage | Up to 125x | Up to 100x |

| Social Trading | Yes | No |

| Mobile App Trading | Available | Available |

Both platforms support high leverage, with BingX offering up to 125x and MEXC up to 100x, enabling experienced traders to amplify their trading positions. However, it’s crucial to understand the risks involved with high leverage.

While BingX has a simplified interface for newcomers, especially with its Copy Trading service, MEXC provides more comprehensive tools and products that might appeal to professional traders. Both exchanges provide mobile apps, ensuring you can trade and monitor your positions on the go.

In terms of user experience, BingX’s platform is streamlined and user-friendly, which can be less intimidating for beginners. MEXC, with its extensive range of services, may require a steeper learning curve but also offers advanced features for seasoned traders.

BingX vs MEXC: Futures Contract Types Available

When you’re exploring futures contract types on BingX and MEXC, you’ll discover that each platform offers a range of options catering to different trading strategies.

BingX provides:

- Linear Perpetual Contracts: Contracts quoted in USD, allowing for straightforward calculation of profits without the need for conversion. These are ideal if you prefer a direct understanding of your exposure in USD terms.

- Inverse Perpetual Contracts: Here, contracts are denominated in the cryptocurrency itself, which might be beneficial if you aim to increase your holdings in the base cryptocurrency.

The platform allows for high leverage, but remember, this increases both potential gain and risk. Margin requirements vary depending on the leverage and market conditions.

On MEXC, you will find:

- Inverse Futures Contracts: Tailored for traders who intend to hedge their portfolios or speculate on price movements of cryptocurrencies without direct exposure.

- Linear Perpetual Contracts: Similar to BingX, MEXC gives you contracts valued in USD.

- COIN-M Futures: You trade contracts collateralized and settled in the coin itself, suitable if you have a stockpile of a specific coin.

- USD-M Futures: If you prefer a more stable contract denomination, these are pegged and settled in USD, offering a hedge against crypto volatility.

- Options: MEXC provides added flexibility by offering options, allowing you to buy or sell at predetermined prices.

MEXC also features varying leverage options, with the maximum leverage available being considerable, albeit with associated risks. Margin requirements on MEXC, similar to BingX, will depend on the leverage you choose and the current market conditions.

Each contract type offers its own unique benefits and drawbacks, making it critical for you to understand your individual trading needs and risk tolerance. Both exchanges provide a robust selection of futures contracts, each with different specifications to cater to a diverse set of trading strategies.

BingX vs MEXC: Liquidity and Volume

When you trade on cryptocurrency exchanges, liquidity and volume are critical factors that affect your trades. Liquidity refers to the ability to buy or sell assets without causing a significant price change. Volume, on the other hand, indicates the amount of trading activity.

BingX and MEXC vary in their liquidity and volume, which can lead to differences in trading efficiency and execution. Higher liquidity and volume typically ensure better prices and faster executions, reducing the potential for slippage, where there’s a difference between the expected price and the executed price of a trade.

Liquidity Comparison

To measure liquidity, you can look at the order book depth and the bid-ask spread. A deeper order book and a narrower spread indicate better liquidity.

BingX:

- Order book depth: Moderate

- Bid-ask spread: Relatively tight

MEXC:

- Order book depth: High

- Bid-ask spread: Comparable to BingX

Volume Analysis

Trade volume is usually reported by the exchanges, but for accuracy, independent metrics and rankings from sources like CoinMarketCap or CoinGecko are preferable.

BingX:

- 24h Trading Volume: Moderate

- CoinMarketCap Rank: Might be available on the platform

MEXC:

- 24h Trading Volume: High

- CoinMarketCap Rank: Likely listed with detailed rankings

Your trading strategies should take into account these aspects of BingX and MEXC. A higher ranked exchange in terms of liquidity and volume can offer you smoother and more predictable trading experiences. Always consult the most recent data and independent sources to gauge the liquidity and volume of each exchange to better inform your trading decisions.

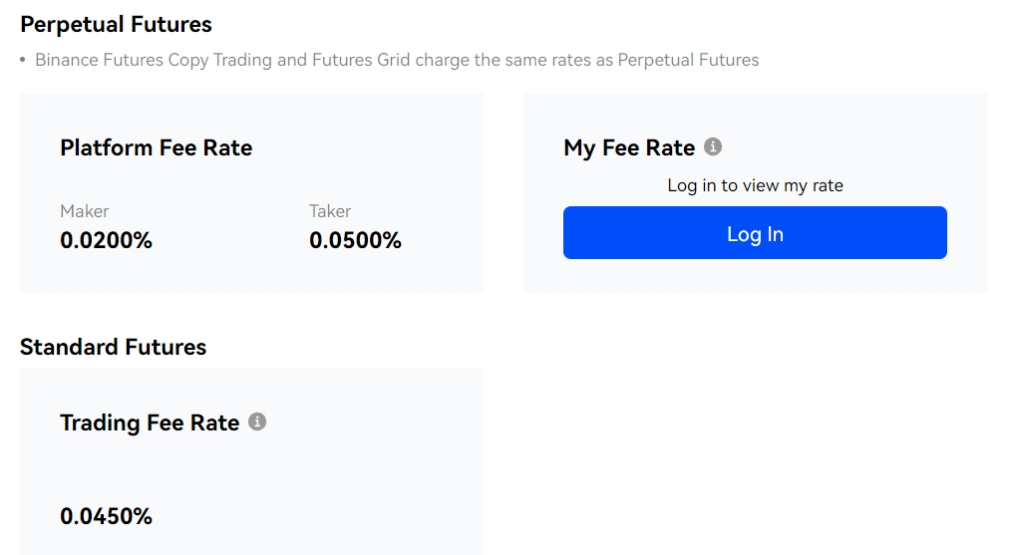

BingX vs MEXC: Trading Fees and Rewards

When trading cryptocurrencies, understanding the fee structure and possible rewards is crucial for your profitability. BingX and MEXC provide distinct approaches in their fee schedules and reward systems.

BingX:

- Trading Fees: BingX typically charges a 0.075% trading fee when you open and close positions.

- Deposit Fees: There are no fees for depositing cryptocurrencies.

- Withdrawal Fees: Fees for withdrawing digital assets vary, with popular cryptocurrencies like Ethereum (ETH) and Bitcoin (BTC) having specified rates.

For example, if you were to open and close a position worth $1,000, your trading fee on BingX would amount to $0.75. Rewards on BingX may include sign-up bonuses which can be as high as 200 USDT depending on promotional periods.

MEXC:

- Trading Fees: MEXC offers a different fee structure depending on whether you are a maker or taker in a transaction.

- Maker/Taker Fees: These may vary, and it’s essential to consult the latest fee schedule on the MEXC platform.

- Deposit Fees: Typically, MEXC doesn’t charge for deposits.

- Withdrawal Fees: As with BingX, these fees depend on the type of cryptocurrency you wish to withdraw.

MEXC also entices users with a deposit bonus, which could be up to 10%.

Both exchanges offer incentives to reduce trading fees; for instance, holding their native tokens or achieving a specified trading volume can avail you discounts. It is advisable to meticulously examine the fee schedule and rewards that each exchange provides before you engage in trading, as these can influence your transaction costs and benefits.

Bingx Vs Mexc: Deposits & Withdrawal Options

When comparing BingX and MEXC, you’ll find distinctions in their approaches to deposits and withdrawals that have a direct impact on your experience.

BingX:

- Currencies Supported: Offers a variety of cryptocurrencies for deposits.

- Payment Methods: Primarily crypto transfers.

- Deposit Fees: No fees for cryptocurrency deposits.

- Withdrawal Fees: Charges a fee, for example, for BTC and ETH withdrawals. For example, a flat rate like 0.007 BTC for Bitcoin.

- Processing Times: Typically quick, depending on network congestion.

- Limits: Varies per coin; ensure to check individual limits.

MEXC:

- Currencies Supported: Broad selection of supported cryptocurrencies.

- Payment Methods: Includes crypto deposits along with a 10% deposit bonus (as of the latest update).

- Deposit Fees: Competitive; specific fees vary per asset.

- Withdrawal Fees: Depends on the cryptocurrency, often adjusted based on blockchain conditions.

- Processing Times: Fast processing, although withdraw times can fluctuate with network activity.

- Limits: Minimum and maximum limits apply; varies for each crypto asset.

Bingx Vs Mexc: KYC Requirements & KYC Limits

When selecting a cryptocurrency exchange, understanding the KYC requirements and limits is crucial. BingX is tailored for users who prioritize privacy.

BingX KYC Requirements:

- No KYC: You can deposit, trade, and withdraw without identity verification.

- Verification Levels: If opting for verification, you would provide personal identification.

BingX KYC Limits:

- Withdrawal Limit: Up to 50K USDT daily withdrawal limit without KYC.

On the other hand, MEXC is a bit different concerning KYC norms.

MEXC KYC Requirements:

- KYC Mandatory: Unlike BingX, MEXC requires user verification to enhance security.

- Verification Documents: Requires government-issued ID and potentially additional documentation for higher tiers.

MEXC KYC Limits:

- Withdrawal Limit: KYC-compliant users can withdraw up to 30 BTC per day.

Here’s a comparative breakdown:

| Feature | BingX | MEXC |

|---|---|---|

| KYC Required | No (for basic level) | Yes |

| Daily Withdrawal | 50K USDT (no KYC) | 30 BTC (with KYC) |

| Verification Docs | Optional | Government-issued ID |

| Verification Tiers | Available | Multiple tiers present |

Bingx Vs Mexc: Order Types

When trading on cryptocurrency exchanges like BingX and MEXC, you have a variety of order types at your disposal which allow you to execute your trading strategies and manage risks effectively.

On BingX, you can use the following order types:

- Market Orders: Execute a trade immediately at the current market price.

- Limit Orders: Set a specific price to buy or sell, triggering only when the market hits that price.

- Stop Orders: Specify a price at which a market order is triggered to limit losses or protect profits.

- Conditional Orders: These are advanced orders that become active only when certain conditions are met.

MEXC offers a similar range of order types, including:

- Market Orders: Fill orders rapidly at prevailing market prices.

- Limit Orders: Trade at a price you set, which may provide more control over your entry or exit price.

- Stop-Limit Orders: Combine the features of stop and limit orders. A stop price prompts the limit order to execute.

- Post-Only Orders: Guarantee you pay the maker fee by only posting to the order book and not taking liquidity.

- Reduce-Only Orders: Ensure that an order only reduces a position, not increases it.

Both BingX and MEXC thus allow you numerous ways to engage with the market:

| Order Type | BingX Available | MEXC Available |

|---|---|---|

| Market Orders | Yes | Yes |

| Limit Orders | Yes | Yes |

| Stop Orders | Yes | No |

| Conditional Orders | Yes | No |

| Post-Only Orders | No | Yes |

| Reduce-Only Orders | No | Yes |

Bingx Vs Mexc: Security and Reliability

When you choose a cryptocurrency exchange, the security of your funds and personal data is paramount. Both BingX and MEXC take measures to ensure the protection of their users.

BingX: BingX prioritizes the security of its platform with a user-friendly interface that does not compromise on robust security protocols. BingX has implemented features such as two-factor authentication (2FA) and encrypted data storage to safeguard your assets. While specific past incidents haven’t been detailed here, protocols such as regular security audits are conducted to enhance the system’s reliability.

MEXC: On the other hand, MEXC offers a high degree of security with an impressive maximum leverage level of 200x. MEXC similarly employs 2FA and cold wallet storage for funds to minimize the risks of unauthorized access and hacking. MEXC also provides a copy trading feature, which while beneficial for beginners, should be used with caution due to the inherent risks of trading.

| Feature | BingX | MEXC |

|---|---|---|

| 2FA | Yes | Yes |

| Audit | Regular security audits | Information not specified |

| Storage | Encrypted data storage | Cold wallet storage |

| Compliance | Adheres to regulatory standards | Complies with international regulations |

Both platforms adhere to regulatory standards and aim to comply with international regulations to gain your trust. This is a sign of their commitment to security and reliability. Their customer support channels are crucial when you encounter issues, and the accessibility and responsiveness of these supports vary based on user experience and feedback.

You should review the history of any exchange, as past incidents often inform the current security measures. Although specific historical security issues are not mentioned here, it is essential to research these incidents for any exchange you consider. Understanding the resolution of past issues gives insight into the exchange’s capacity to handle future challenges.

Bingx Vs Mexc: User Interface & Experience

When you explore BingX and MEXC, you’ll notice distinctive differences in their user interfaces and experiences.

BingX is crafted to cater to beginners and experienced traders alike, showcasing a user-friendly interface. You’re greeted with a design that is both minimalistic and functional, ensuring you can navigate through the platform with ease. Key features include a streamlined dashboard, intuitive controls, and a clean layout, which collectively contribute to a positive user experience.

In contrast, MEXC offers a slightly more advanced user interface, which may be more appealing if you’re an experienced investor. The platform is praised for its robust security, and the layout includes comprehensive tools and analytics, albeit this could be slightly overwhelming if you’re new to crypto trading.

| Feature | BingX | MEXC |

|---|---|---|

| Interface | Simple and intuitive | Advanced and detailed |

| Navigation | Straightforward | Steeper learning curve |

| Customization | Limited but efficient | Extensive customization options |

| Security | Robust | Highly secure with additional features |

| Trading Tools | Adequate for beginners | Geared towards experienced traders |

| Accessibility | Easy access to essential features | Rich in features but may require guidance |

Both exchanges offer copy trading options, but MEXC stands out with high leverage options, attractive to risk-tolerant traders. BingX also includes this feature, yet it’s tailored more towards novices in the field.

Bingx Vs Mexc: Regulation and Compliance

When considering the regulation and compliance of BingX and MEXC, you’ll find that both platforms operate with a clear emphasis on adhering to the legal and ethical standards of the jurisdictions they are active in.

This commitment to regulatory frameworks ensures that your investments are handled within the bounds of the law and under regulatory oversight.

BingX:

- Licenses: BingX operates with licenses from multiple regulatory bodies. These licenses match the requirements in jurisdictions where it provides services.

- Audits: Regular audits are conducted to ensure adherence to financial regulations. They also establish trust through transparency with its users.

- Challenges: Like many exchanges, BingX must navigate constantly evolving global compliance laws to maintain its regulatory status.

MEXC:

- Licenses: MEXC has also gathered important licenses from financial regulators. These licenses show its thorough compliance with international financial laws.

- Certifications: The certification process that MEXC undergoes is aimed at protecting your assets and information. It also ensures the exchange’s services are secure.

- Controversies: MEXC has, like many others in the sector, faced challenges and controversies related to its compliance measures and the ever-changing regulatory landscape.

Your choice between BingX and MEXC should factor in their regulatory stance and history. Assess how each platform’s compliance efforts align with your need for a secure and legally sound trading environment.

Both BingX and MEXC have laid considerable groundwork in obtaining the necessary legal credentials. They have also established trust with users through consistent compliance with financial regulations.

Conclusion

In assessing both BingX and MEXC, your choice hinges on individual needs and preferences.

BingX is recognized for a user-friendly interface, making it a viable choice for beginners. Their trading fee is notably reasonable at 0.075%. The absence of deposit fees presents a cost-effective option for cryptocurrency transactions.

BingX

- User-friendly interface

- Trading Fee: 0.075%

- No deposit fees

In contrast, MEXC stands out with its diverse range of supported cryptocurrencies and competitive trading options. This is suitable for experienced traders seeking variety and advanced trading features.

MEXC

- Supports a wider range of cryptocurrencies

- Advanced trading options for experienced traders

Although each exchange has differing fee structures, it’s crucial to consider not just the fees but also the withdrawal options and security measures.

Your decision should also factor in:

- KYC Requirements: BingX and MEXC have distinct KYC processes. Your comfort with these requirements should guide your choice.

- Geographical Availability: Check whether the exchange operates in your country.

- Product Offerings: Compare the products like futures, spot trading, or staking options provided by both exchanges.

In summary, if you’re beginning your journey in the crypto market, BingX might be the exchange to start with due to its simplicity and cost-effectiveness. Conversely, if you’re seasoned in trading and are looking for a wider array of options and features, MEXC could be the more appropriate platform. Always ensure that your decision aligns with your trading style, experience level, and financial goals.

Comparing BingX & MEXC Against Competitors: