Bybit vs Deribit: A Comprehensive Comparison of Crypto Derivatives Platforms

Bybit vs Deribit: Comparison at a Glance

When selecting a cryptocurrency trading platform, two notable exchanges you might encounter are Bybit and Deribit. Each offers distinct features tailored to different types of traders. Below, you’ll find a comparative table that will assist you in grasping the fundamental differences and offerings of the two platforms.

| Feature | Bybit | Deribit |

|---|---|---|

| Founded | 2018 | 2016 |

| Founder(s) | Ben Zhou | John Jansen |

| Headquarters | British Virgin Islands | Netherlands |

| Supported Cryptocurrencies | Multiple, including BTC, ETH, XRP, EOS | Primarily BTC and ETH |

| Trading Volume | High, offering deep liquidity | Also high, with a strong focus on derivatives |

| Leverage | Up to 100x for some products | Up to 100x for some products |

| Trading Fees | Competitive, with maker and taker fee structure | Differential fees based on maker/taker trades |

| Deposit Methods | Crypto deposits. No fiat currency. | Crypto deposits. No fiat currency. |

| Security | Two-factor authentication (2FA), cold wallet storage | Two-factor authentication (2FA), cold wallet storage |

| Regulation | Not heavily regulated | Not heavily regulated but complies with necessary legal requirements |

Bybit, established in 2018 by Ben Zhou, prides itself on user-friendly interfaces and a wide array of available cryptocurrencies. They provide tools for novice and expert traders alongside strong security measures such as 2FA and cold wallet storage.

Conversely, Deribit, launched in 2016 by John Jansen, is based in the Netherlands and offers specialized services in Bitcoin and Ethereum derivatives. Similar to Bybit, it emphasizes security with measures like 2FA while providing competitive trading volumes and different fee structures that cater to makers and takers.

Your choice will depend on various factors like preferred cryptocurrencies, desired leverage, fee sensitivity, and specific features that match your trading style.

Bybit vs Deribit: Futures Products and Services

When considering futures trading in the cryptocurrency derivatives market, Bybit and Deribit both offer competitive products.

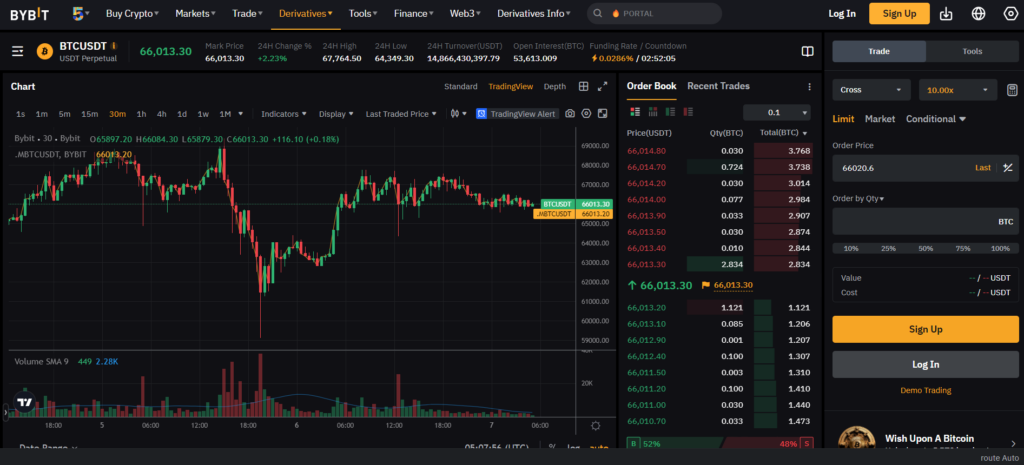

Bybit is recognized for its perpetual contracts, which do not have an expiry date and allow you to trade pairs like BTCUSD, ETHUSD, EOSUSD, and XRPUSD. This can provide you with the flexibility to hold positions for as long as you deem necessary.

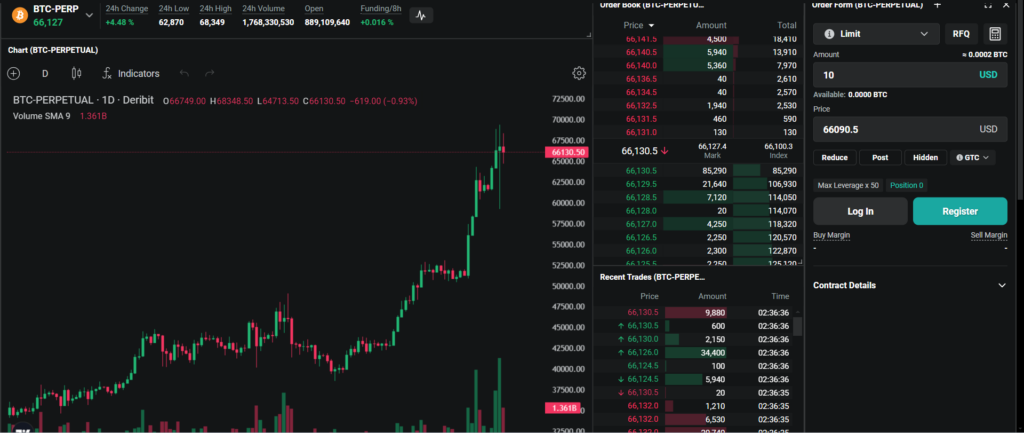

On the other hand, Deribit is well-known among options and futures traders. Their offering is quite comprehensive in that sphere, especially because they provide a market for Bitcoin and Ethereum options, a product not commonly found on all exchanges. Their BTC/Weekly Futures and perpetual contracts for BTC and ETH set them apart for traders looking for those specific markets.

| Feature | Bybit | Deribit |

|---|---|---|

| Contracts | Perpetual (BTCUSD, ETHUSD, EOSUSD, XRPUSD) | Futures, Perpetual (BTC, ETH), Options |

| Expiry | None (Perpetual) | Weekly (Futures), None (Perpetual) |

| Options Trading | Not Available | Available |

| Innovation | User-friendly platform | First to offer Bitcoin and Ethereum options |

| User Experience | Streamlined interface for traders | More complex, geared towards experienced traders |

The trading fee structures also differ between both platforms, which could influence your decision. Bybit has a flat fee structure, while Deribit implements a maker and taker fee model, which might be preferable depending on your trading strategy.

Your experience and objectives will dictate which platform’s futures products and services align best with your needs. Bybit’s intuitive interface makes it a hit for those who require simplicity and directness, while Deribit’s specialized options trading may appeal to more advanced cryptocurrency traders looking for more sophisticated financial instruments.

Bybit vs Deribit: Futures Contract Types Available

When you consider futures trading on Bybit and Deribit, you’ll notice that both platforms offer a range of contracts to fit different trading preferences.

Bybit is known for its inverse perpetual contracts for Bitcoin (BTC), Ethereum (ETH), EOS, and other major cryptocurrencies. These contracts allow you to trade with up to 100x leverage. It features both COIN-M futures (margin in the underlying asset) and USD-M futures (margin in USD). You can also find linear perpetual contracts for BTC and ETH, which differ from inverse by their direct tie to the asset as opposed to the inverse’s linkage to the underlying asset’s fiat value.

- COIN-M Futures: Margin in the underlying cryptocurrency

- USD-M Futures: Margin in USD

Deribit specializes in BTC and ETH offerings. This platform is particularly recognized for its extensive options market but also provides access to perpetual contracts and futures. Deribit’s inverse futures contracts on BTC and ETH also offer high leverage, with the exact rates varying depending on the contract’s terms.

- Perpetual Contracts: No expiration, with leverage up to 100x

- Inverse Futures: Payout in cryptocurrency

Both platforms require you to maintain adequate margin requirements to manage the risks associated with high leverage. As you choose your platform, consider the types of contracts offered, their margin requirements, maximum leverage, and decide what aligns best with your trading strategies:

- Bybit leans towards a diverse set of futures contracts paired with high leverage options.

- Deribit offers similar leverage but with a focus primarily on BTC and ETH.

Bybit vs Deribit: Liquidity and Volume

Liquidity measures how quickly and easily you can buy or sell assets without impacting the market price. A liquid market will have a tight bid-ask spread, indicating a smaller difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

Bybit’s liquidity levels tend to be high, meaning your trades are executed efficiently with minimal slippage. Slippage occurs when there is a discrepancy between the expected price of a trade and the price at execution. The order book depth on Bybit typically supports large orders, which is crucial for maintaining a robust market.

In contrast, Deribit also provides considerable liquidity, although the actual levels can vary depending on the specific asset traded. The exchange is well-equipped for handling crypto derivatives trading, similar to Bybit. When you engage with Deribit, the order books also show resilience, contributing to a productive trading environment.

Regarding trading volume, Bybit often showcases an impressive volume, indicating that a significant amount of assets change hands on the platform. This high volume reinforces its liquidity, providing you with the confidence that the market can absorb your trades, even of considerable size, without substantial price impact.

Deribit similarly records a strong trading volume, particularly in its options and futures contracts. The platform’s interface with its volume metrics aids in transparency, guiding you in making informed decisions based on current market activities.

Metrics and Rankings:

- Liquidity and volume data for Bybit and Deribit can be sourced from aggregator platforms like CoinMarketCap.

- Ensure to check the latest rankings and metrics, as these are dynamic and change with market conditions.

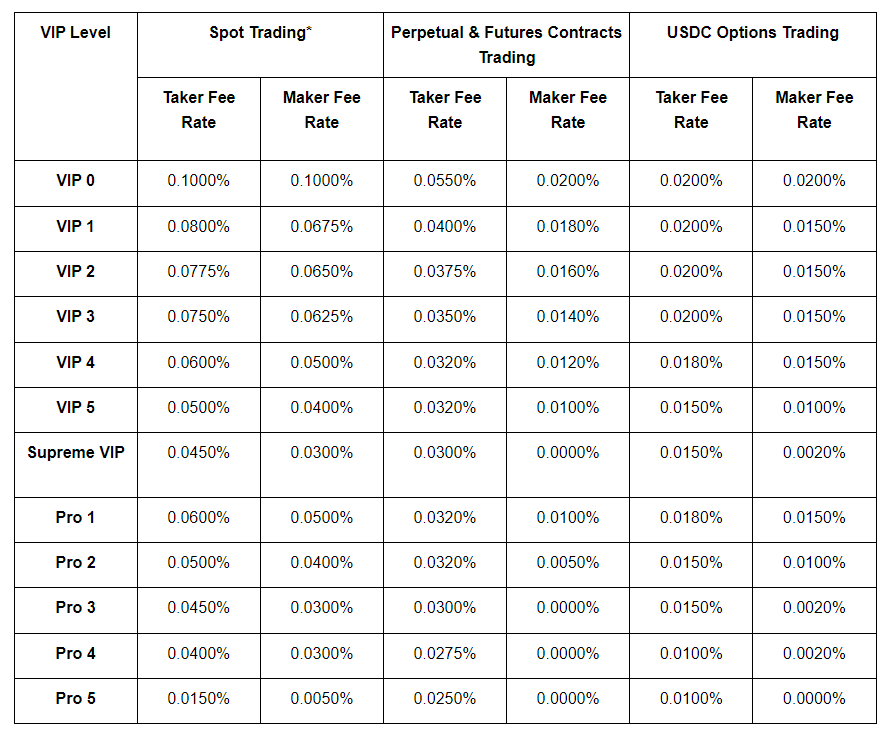

Bybit vs Deribit: Trading Fees and Rewards

When trading cryptocurrencies, the fees you encounter can influence your overall profitability. Bybit and Deribit, as exchanges, have distinct fee structures and incentives that cater to different types of traders.

Bybit employs a maker-taker fee model where if you provide liquidity (maker), you earn a rebate, while taking liquidity (taker) incurs a fee. There are scenarios such as:

- Maker Rebate: 0.025%; effectively earning $2.50 on a $10,000 trade.

- Taker Fee: 0.075%; costing $7.50 for the same trade size.

Bybit also incentivizes traders with no deposit fees and competitive withdrawal fees at a fixed rate of 0.0005 BTC.

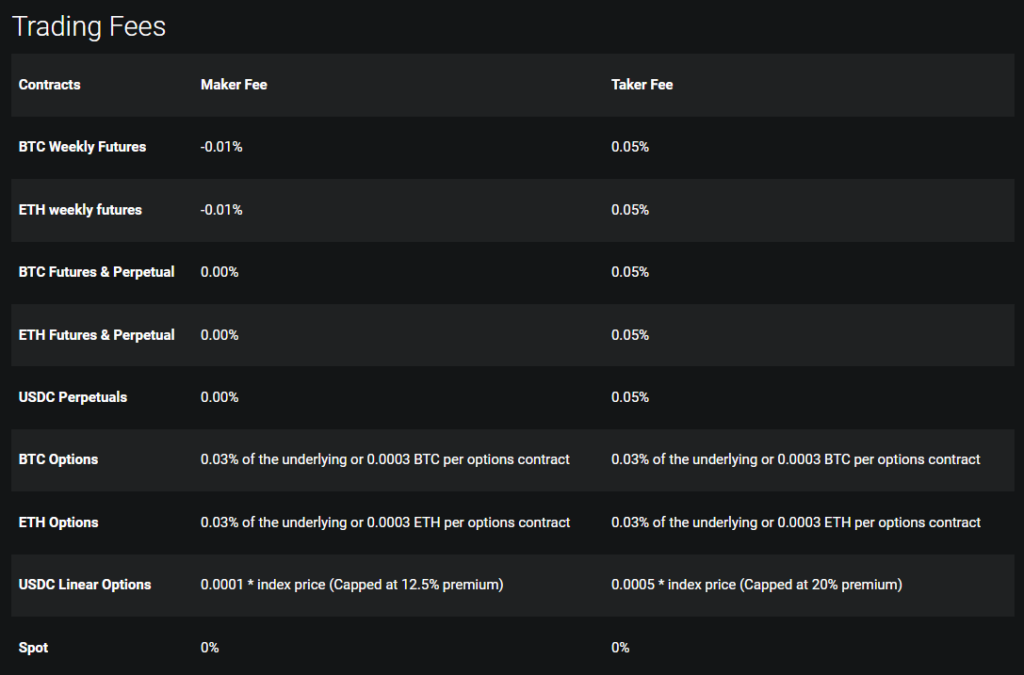

Deribit also operates on a maker-taker model but has a differentiated fee schedule based on the product:

BTC/Weekly Futures:

- Maker: –0.01% (rebate)

- Taker: 0.05%

BTC/ETH Perpetual:

- Maker: NIL

- Taker: 0.05%

Deribit’s withdrawal fees are structured around the standard network fee, which can vary depending on the blockchain’s current congestion.

Both platforms do not have deposit fees, which means you can fund your account without direct charges. However, always be aware of the funding rate for perpetual contracts, as this can affect your trading cost when positions are held open over multiple funding intervals.

Bybit vs Deribit: Deposits & Withdrawal Options

When considering Bybit and Deribit, you’ll find that both exchanges offer different mechanisms for deposits and withdrawals. Each has its own implications on speed, cost, and ease of use.

Bybit:

Deposits:

- Methods: You can deposit using cryptocurrencies.

- Fees: No fees charged for depositing.

- Supported Currencies: Major cryptocurrencies like BTC, ETH, and more.

- Processing Time: Typically swift, depending on the blockchain.

- Limits: Vary per cryptocurrency; there is no minimum deposit limit.

Withdrawals:

- Fees: There is a withdrawal fee, which varies per cryptocurrency.

- Processing Time: Withdrawal requests are processed three times a day.

- Limits: Minimum and maximum withdrawal amounts depend on the specific cryptocurrency.

Deribit:

Deposits:

- Methods: Fund your account with cryptocurrencies.

- Fees: No deposit fees imposed.

- Supported Currencies: Primarily BTC and ETH.

- Processing Time: Arrival time depends on network congestion.

- Limits: No minimum deposit requirement; maximum limit is not specified.

Withdrawals:

- Fees: Withdrawal fees are higher than Bybit’s and vary by cryptocurrency.

- Processing Time: Handled typically within 24 hours.

- Limits: Limits are set for withdrawals but are subject to change based on market conditions.

Bybit vs Deribit: KYC Requirements & Limits

When you sign up for Bybit or Deribit, you’ll encounter Know Your Customer (KYC) procedures that aim to secure the platform and your transactions. These requirements are part of the account opening process and involve submitting personal information.

Bybit has enforced stringent KYC policies since December 15, 2022. For fiat transactions like purchasing crypto or engaging in Peer-to-Peer (P2P) services, providing detailed personal information is mandatory. Below is a breakdown of their KYC tiers:

- Basic Verification: Requires your email address and phone number.

- Advanced Verification: Submission of a government-issued ID and proof of address.

The limits on your Bybit account for trading, deposits, and withdrawals correlate directly with your KYC level. Two-factor authentication (2FA) via SMS or email enhances the security of your Bybit account.

Deribit, while also adhering to KYC norms, may differ in its approach. Deribit’s verification process is also geared towards preventing money laundering and illegal activities. Procedures at Deribit include:

- Initial Verification: Request for a government-issued ID and a selfie.

- Full Verification: Includes the above along with additional information on source of funds.

Deribit utilizes 2FA, which serves as an extra layer of security when accessing the platform and executing transactions. The limits for withdrawals at Deribit are based on the speed of the transaction, with higher fees for faster processing.

Bybit vs Deribit: Order Types

When you approach cryptocurrency trading, understanding and utilizing various order types is crucial for both strategy implementation and risk management. Bybit and Deribit provide a range of order types to facilitate your trading needs.

Bybit supports several order types:

- Market orders: These allow you to buy or sell immediately at the current market price.

- Limit orders: You set the price at which you want to buy or sell.

- Stop orders: Also termed stop-loss orders, they trigger a buy or sell when the market reaches a specific price.

- Conditional orders: These are executed when set conditions are met, including price and time.

- Post-only orders: Ensure the order enters the order book, which can increase the likelihood of paying a maker fee instead of a taker fee.

- Reduce-only orders: They guarantee that an order will only reduce a position, not increase it.

Deribit offers a similar range, but with some variations specific to the platform:

- Market orders: Immediate execution at available market prices.

- Limit orders: Execution at a price set by you.

- Stop limit orders: Hybrid between stop orders and limit orders, setting the price at which the order converts into a limit order.

- Stop market orders: A stop order that converts into a market order when triggered.

- Advanced orders: Include conditional orders that can be set up for more sophisticated trading strategies.

Both Bybit and Deribit’s order types are designed to accommodate your trading strategies and help with effective risk management. Additionally, these order types can be employed by trading bots for automated trading strategies, further assisting in managing positions and potential losses. Utilizing stop-loss orders and take-profit orders can help protect your investments from unexpected market movements, enabling you to secure gains or prevent losses.

Bybit vs Deribit: Security and Reliability

When you’re exploring the security and reliability of cryptocurrency exchanges, Bybit and Deribit stand out with their protective measures. Both platforms use a mix of cold and hot wallets to manage user assets, with the bulk being held in cold storage to mitigate theft risk.

Bybit ensures your account’s safety with two-factor authentication through email and SMS. Your activity is consistently logged, allowing you to monitor any unauthorized access. Also, they store over 95% of users’ funds in cold wallets, emphasizing their commitment to security.

Deribit also prioritizes security, with around 99% of client funds in cold wallets. Like Bybit, they offer two-factor authentication and API keys, which can be restricted to ensure they’re only used as authorized. Deribit’s history of swiftly managing incidents, such as the flash crash in September 2019 where they covered all user losses, reflects their commitment to reliability and user protection.

Both exchanges maintain a strong stance on regulatory compliance, actively updating their protocols to meet global standards. If you encounter an issue, customer support is a crucial component, and each exchange offers dedicated services to assist you.

Here’s a quick rundown of their security measures:

| Feature | Bybit | Deribit |

|---|---|---|

| Two-Factor Authentication | Yes (Email & SMS) | Yes |

| Cold Wallet Storage | >95% of funds | ~99% of funds |

| Hot Wallet | Minimal use | Minimal use |

| Incident Resolution | Not specified | Active coverage |

| Regulatory Compliance | Yes | Yes |

| Customer Support | 24/7 | 24/7 |

Bybit vs Deribit: User Interface & Experience

When you are exploring cryptocurrency exchanges like Bybit and Deribit, the user interface (UI) and overall experience are vital factors to consider.

Bybit is known for its user-friendly UI that caters especially well to newcomers. Its clean and intuitive layout ensures that you can navigate the platform with ease. The web-based trading platform maintains a balance between functionality and simplicity, allowing you to engage with the trading interface without feeling overwhelmed. Moreover, Bybit extends its accessible experience to its mobile app, which reflects the desktop’s ease of use, thus staying connected on-the-go is seamless.

Deribit, in contrast, offers a more complex UI. While this might be appealing if you are a seasoned trader who requires advanced functionality, it can be quite daunting if you are new to crypto derivatives. Menus, cascades of data, and detailed graphs make the experience rich, yet there’s a steep learning curve involved. The trading interface is sophisticated, with features aimed at experienced traders who need in-depth analytical tools.

Both platforms have their respective layouts designed with specific users in mind. If your priority is straightforwardness and a gentle learning curve, Bybit stands out. For high-level traders looking for a robust and intricate system, Deribit excels. User scores generally indicate satisfaction with Bybit’s easy navigation and Deribit’s detailed interface, respectively. Despite the difference in complexity, both provide the essential functions expected from a crypto exchange, including a full suite of trading tools.

Bybit vs Deribit: Regulation and Compliance

When you engage with cryptocurrency derivatives exchanges like Bybit and Deribit, understanding their compliance with regulatory frameworks is crucial.

Bybit, headquartered in the British Virgin Islands, adheres to the jurisdiction’s regulatory requirements. They maintain a commitment to protecting clients’ funds and operating within the bounds of international financial laws. Bybit focuses on maintaining robust security measures and ensuring that their platform can withstand the volatility of the cryptocurrency markets.

On the other hand, Deribit, was initially established in the Netherlands but relocated to Panama due to regulatory changes. They offer services globally, excluding areas like the United States and Japan due to stricter regulatory climates. Deribit places an emphasis on compliance, conducting ongoing audits and reviews to maintain their operational integrity.

Both platforms operate with an understanding that the landscape for cryptocurrency regulation is evolving. They must stay vigilant and adaptable to changes in legal standards, both to safeguard their users’ interests and to maintain their market positions. As trading platforms, they continuously monitor regulatory developments and adjust their compliance strategies accordingly.

Conclusion

In comparing Deribit and Bybit, your choice hinges on specific trading preferences and priorities.

Both platforms excel in derivatives trading with up to 100x leverage and maintain competitive trading fees.

Deribit offers a maker rebate for BTC/Weekly Futures and zero fees for maker transactions on its perpetual contracts, making it attractive if you engage in strategies that earn rebates.

Bybit’s fees are slightly higher, notably for USD Coin (USDC) options where the minimum taker fee is 0.01%, but it’s renowned for its user-friendly experience.

Deribit stands out for affordable and speed-variable withdrawal fees, ranging from 0.0002 to 0.0015 BTC, while Bybit fortifies your account security via both email and SMS two-factor authentication. Your security concerns might lean you towards Bybit.

Your decision may also be influenced by liquidity and technological stability.

Deribit is recognized for its leading position in crypto options trading, which may imply better liquidity, especially for large volume traders.

Conversely, Bybit’s robust platform appeals to a broad user base, from beginners to veterans.

For novice traders, the intuitive interface and slight security edge could make Bybit more suitable.

Experienced traders, particularly those focusing on options and employing maker strategies, might prefer Deribit’s fee structure and liquidity in the options market.

Comparing Bybit & Deribit Against Competitors: