Bybit vs Binance: An In-Depth Comparison of Leading Crypto Exchanges

In the dynamic world of cryptocurrency exchanges, two names often come to the fore: Bybit and Binance. Understanding the distinct features of each platform can help you make an informed decision.

Bybit, although a newer player in the market, has risen rapidly in popularity, offering a user-friendly experience with a focus on leverage and perpetual contracts. On the other hand, Binance stands as a juggernaut in the space, known for its extensive list of supported tokens and a vast array of trading options catering to both novice and experienced traders.

You might be weighing the options between the fee structures, security measures, and the variety of trading pairs available.

Each platform’s trading fees can greatly affect your overall trading costs. Binance provides a tier-based fee structure that rewards users with higher volumes or significant BNB stakes. On the other hand, Bybit offers competitive fees and prioritizes security with measures like cold storage and multi-signature wallets.

Your choice of exchange could be influenced by the range of products and features on offer.

Bybit excels in its futures trading, while Binance offers a more extensive suite including spot trading, futures, and other financial products.

As for support, Bybit brings to the table more than 300 token pairs and high leverage options, while Binance boasts over 1600 token pairs and a heavy trading volume, underscoring its dominance in liquidity and market depth.

| Feature | Bybit | Binance |

|---|---|---|

| Foundation Year | 2018 | 2017 |

| Founder(s) | Ben Zhou | Changpeng Zhao (CZ) |

| Supported Coins | Offers spot trading on over 300 token pairs | Over 1600 token pairs available |

| Leverage | High leverage up to 100x on perpetual contracts | Leverage trading available |

| Average Trading Volume | Around $400 million (average 24-hour volume) | Approx. $12.5 billion (average 24-hour volume) |

| Trading Products | Spot trading, derivatives, and leverage trading | Spot trading, derivatives, leveraged tokens, NFT marketplace |

| Deposit Methods | Crypto deposits | Crypto deposits, bank transfer, credit/debit, P2P trading |

| Trading Fees | Competitive fees with a focus on the ease of copy trading | Tier-based fees, with reductions for BNB stakeholders and volume |

| Security Features | Cold storage, multi-signature wallets | Cold storage, multi-factor authentication, insurance fund |

Bybit vs Binance: Futures Products and Services

When examining the futures trading platforms of Bybit and Binance, you will notice they both offer robust services but with varying specifics.

Bybit presents a straightforward fee structure for its futures products. You will encounter a maker fee of 0.025% and a taker fee of 0.075%. Bybit is particularly known for its user-friendly platform that comprises over 250 futures contracts. A standout point is Bybit’s high server uptime, hovering at 99.99%, which points to a reliable trading experience.

On the other hand, Binance futures come with a slightly different fee distribution:

- Maker Fee: 0.020%

- Taker Fee: 0.040%

Binance has the edge in variety, boasting an expansive listing of over 1600 token pairs for futures trading—marking a clear distinction in size when compared to Bybit’s more than 300 token pair offerings.

Additionally, Binance reels in a hefty 24-hour trading volume of approximately $12.5 billion, dwarfing Bybit’s $400 million and underscoring Binance’s significant market share.

While both platforms follow a Maker-Taker fee model akin to many cryptocurrency exchanges, Binance also offers a wide range of other products, including spot trading, options trading, leveraged tokens, an NFT marketplace, and staking services. These add depth and breadth to Binance’s ecosystem, potentially enhancing your trading experience with more tools and options at your disposal.

Bybit vs Binance: Futures Contract Types Available

Bybit offers a range of futures contracts, including inverse perpetual contracts and inverse futures contracts. Inverse contracts allow you to trade cryptocurrencies against another cryptocurrency such as Bitcoin rather than a fiat currency. These contracts are particularly advantageous if you prefer to have your margin and settlement in the base cryptocurrency.

For Bybit, the maximum leverage can reach up to 100x, but it’s crucial for you to be cautious with leverage to avoid significant losses. You should always be mindful of the risks of high leverage and maintain adequate margin to meet your needs.

Binance, on the other hand, provides a broader scope of futures contracts. You have access to USD-M futures which are linear contracts settled in USDT or BUSD. COIN-M futures allow you to trade contracts that are settled in the cryptocurrency itself, similar to the inverse contracts.

Binance delivers more variety with options trading, expanding your strategies to include hedging and speculative trades.

The maximum leverage on Binance might vary based on the contract type, but it also offers leverage up to 125x which is slightly higher than Bybit’s offerings. Keep in mind that with greater leverage comes greater responsibility; it’s important to manage your trades prudently.

| Feature | Bybit | Binance |

|---|---|---|

| Inverse Perpetual | Available | Not Available |

| Linear Perpetual | Not Available | Available (USD-M) |

| Inverse Futures | Available | COIN-M Futures |

| Maximum Leverage | Up to 100x | Up to 125x |

| Options Trading | Not directly available | Available |

| Settlement Currency | Base cryptocurrency, USD | Cryptocurrency, USDT |

While Binance offers more variety and slightly higher leverage, Bybit provides a simpler selection with a strong focus on cryptocurrency as a margin currency. Your choice should align with your trading preferences and strategies.

Bybit vs Binance: Liquidity and Volume

When comparing Bybit and Binance, liquidity and trading volume play crucial roles in your trading experience. High liquidity and volume ensure smoother transactions with minimal slippage, directly affecting your trade execution efficiency.

Binance typically stands out in terms of volume, boasting an impressive trading volume averaging around $12.5 billion over a 24-hour period. This extensive volume signifies a vast number of traders and transactions, which usually translates to higher liquidity. A well-populated order book on Binance means you can execute large orders without significantly impacting the market price.

In contrast, Bybit has a lower trading volume, around $400 million over 24 hours. Though Bybit’s volume is smaller compared to Binance, it still maintains sufficient liquidity for most traders.

While slippage may be more noticeable on Bybit during volatile market conditions, it generally provides a reliable trading environment for both perpetual and futures trading.

When you’re considering the right exchange for your trading needs, look at the metrics like the bid-ask spread and the depth of order books provided by each platform. Rankings and liquidity data can usually be found on market analytics platforms, which aggregate this information from the exchanges directly.

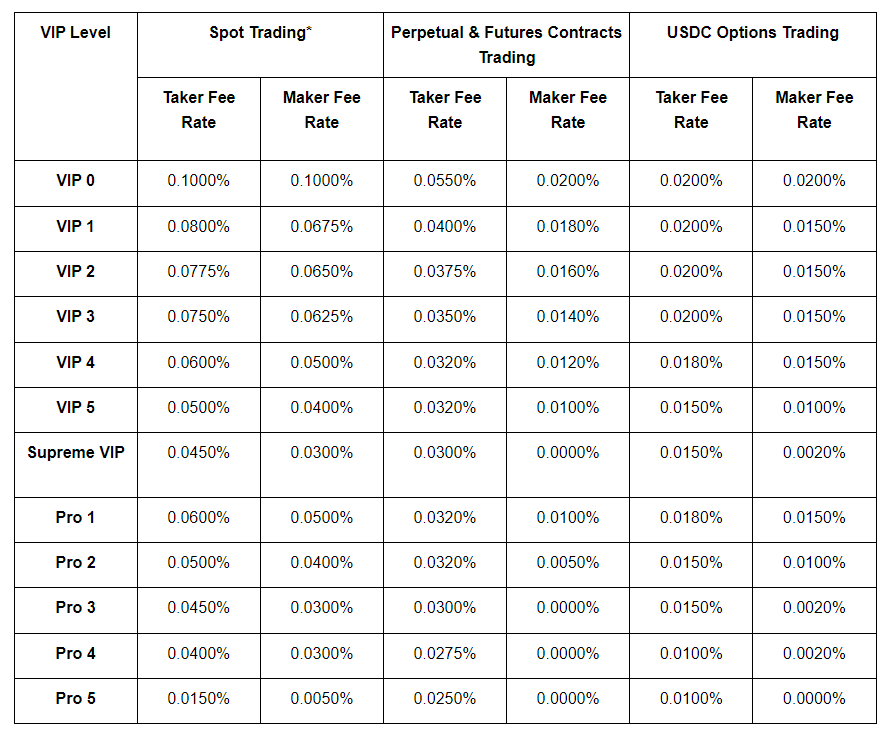

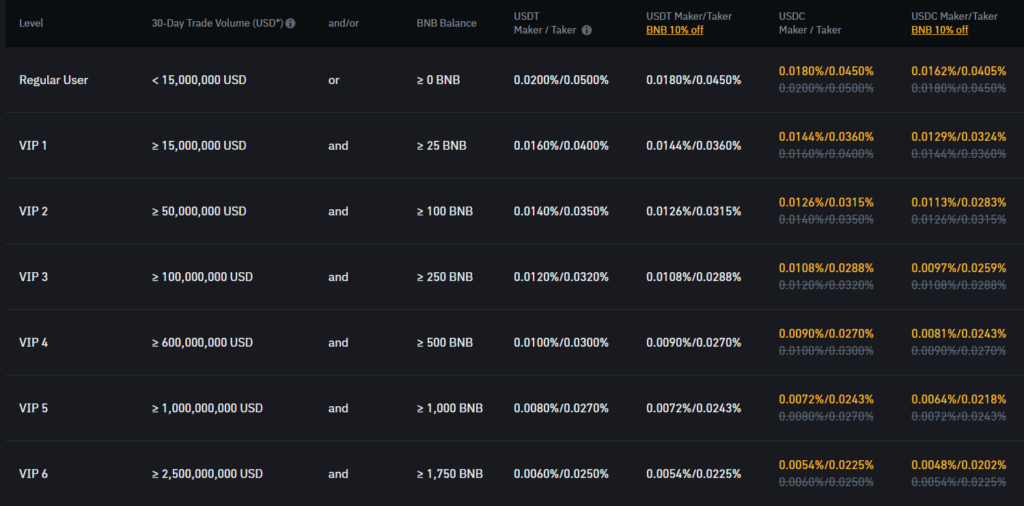

Bybit vs Binance: Trading Fees and Rewards

In comparing Bybit and Binance, you’ll find that both platforms have a tiered fee structure based on your trading volume. However, there are key differences in their fees and rewards that could influence your trading experience.

Bybit Fees:

- Maker Fee: 0.025%

- Taker Fee: 0.075%

Rewards at Bybit are typically tied to trading competitions or through their referral program. Traders can earn bonuses for signing up or making their first deposit under certain promotional conditions.

Binance Fees:

- Spot Trading Taker Fee: 0.10%

- Futures Trading:

- Maker Fee: 0.020%

- Taker Fee: 0.040%

Binance offers a comprehensive reward system, giving users Binance Coin (BNB) discounts, referral bonuses, and tiered VIP perks based on trading volume. This rewards mechanism can significantly reduce your trading expenses over time.

When considering a trading product like futures, calculate your fees as follows:

- Bybit: 1,000 USD trade * 0.075% taker fee = 0.75 USD

- Binance: 1,000 USD trade * 0.040% taker fee = 0.40 USD

Deposit fees on both platforms are generally free, but withdrawal fees vary and depend on the currency. Bybit and Binance adjust their withdrawal fees based on blockchain conditions.

Bybit vs Binance: Deposits & Withdrawal Options

When assessing Bybit and Binance, you’ll find that both platforms ensure secure and diverse ways of managing your funds. As you navigate these cryptocurrency exchanges, understanding their deposit and withdrawal options is key.

Bybit does not charge for deposits, offering you a cost-effective way to fund your account. Your withdrawal options include a variety of cryptocurrencies, with a small fee that varies per coin. Bybit supports multiple digital currencies for both deposits and withdrawals.

Binance, on the other hand, provides an even wider selection that enhances your flexibility. Like Bybit, Binance does not impose a deposit fee, which is beneficial for frequent fund transfers. The withdrawal fees, similar to Bybit, are coin-specific, but Binance prides itself on a comprehensive range of payment options including:

- Fiat currency

- Wire transfers

- Bank transfers

- Credit cards

- Cryptocurrencies

The processing times for deposits are usually instant on both platforms. However, the withdrawal times can vary depending on the network load and your chosen cryptocurrency. Each platform enforces minimum and maximum transaction limits, which are in place to ensure security and compliance with regulatory standards.

Bybit vs Binance: KYC Requirements & KYC Limits

Both Bybit and Binance have implemented Know Your Customer (KYC) processes. These processes are crucial for ensuring the security of your account and adherence to regulatory compliance.

Bybit KYC Requirements:

- Level 1 Verification: Provides you with basic account access; requires your email and phone number.

- Level 2 Verification: Full access with higher withdrawal limits; requires a government-issued ID, proof of address, and a selfie verification.

Binance KYC Requirements:

- Basic Verification: Enables you with basic services using just your name, date of birth, and address.

- Advanced Verification: To unlock higher tiers of withdrawal and trading limits, you need to provide a government-issued ID, proof of address, and complete facial verification.

The KYC limits are directly tied to the level of verification completed.

Bybit KYC Limits:

- Without full KYC, you have a withdrawal limit but can still access most trading features.

- Upon completing Level 2 Verification, withdrawal limits are significantly increased.

Binance KYC Limits:

- After basic verification, you are allotted a modest withdrawal limit.

- Full verification unlocks the potential to increase these limits, as well as to engage with the full spectrum of Binance’s offerings.

Bybit vs Binance: Order Types

When trading cryptocurrencies, the diversity of order types can significantly impact your trading strategy and risk management. Bybit and Binance both offer a range of order options, each designed to give you flexibility and control over your trades.

Bybit includes:

- Market Orders: Execute immediately at the current market price.

- Limit Orders: Set a specific price for the order to trigger.

- Stop Orders: Specify a price at which the order converts into a market order.

- Conditional Orders: Trigger based on specific conditions being met.

- Post-Only Orders: Ensure the order adds liquidity, never taking it.

- Reduce-Only Orders: Used to reduce a position, not to increase it.

Binance provides:

- Market Orders: Also for immediate execution at prevailing market rates.

- Limit Orders: To establish a maximum or minimum price for execution.

- Stop-Limit Orders: A combination of stop and limit orders; executes once a specified price is reached.

- OCO (One Cancels the Other) Orders: A pair of orders wherein the execution of one cancels the other.

- Post-Only Limit Order: Ensures the order will be added to the order book and not filled immediately.

- Iceberg Orders: Large orders hidden except for a small visible portion.

Both platforms equip you with these tools to allow you to execute trades precisely and efficiently. You’ll find that Binance has a more extensive list, including the combination of stop and limit orders in the STOP-LIMIT order, as well as the adaptability of OCO orders for more complex strategies. However, both exchanges cater to most traders’ needs, offering the fundamental order types like market and limit orders while also providing mechanisms for reducing risk and enhancing potential profits through advanced order types.

Bybit vs Binance: Security and Reliability

When considering the security features that protect your funds and personal data, both Bybit and Binance have established robust measures.

Bybit:

- Cold-Wallet Systems: Your assets are stored offline, significantly reducing the risk of hacking.

- Two-Factor Authentication (2FA): Enhances your account’s security by requiring a secondary method of verification.

- No widespread security breaches have been reported affecting Bybit’s platform in recent history.

Binance:

- Advanced Protection: Implements state-of-the-art security features to safeguard assets.

- Compliance: It adheres to international regulations, adding a level of legal safety for your investments.

- In the past, Binance faced a security incident in May 2019, losing 7,000 BTC. They resolved the issue by compensating the affected users through their Secure Asset Fund for Users (SAFU).

Both platforms offer customer support, with Binance featuring a comprehensive Help Center. However, some users find difficulty in receiving timely support directly from Binance’s team. Bybit also provides customer support, with a focus on swift and reliable service.

In terms of reliability:

- Bybit is known for its 99.99% server uptime promising consistency in trade execution.

- Binance boasts a large infrastructure that has been generally reliable, despite high traffic volumes.

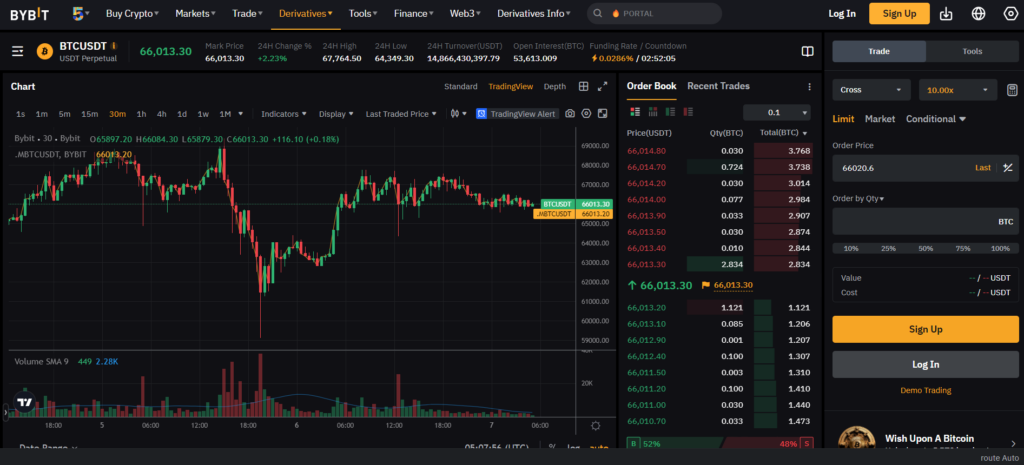

Bybit vs Binance: User Interface & Experience

When comparing the user interfaces and experiences of Bybit and Binance, you’ll discover both exchanges provide professional-grade platforms built with the trader in mind. Bybit is known for its streamlined approach, catering well to those focusing on derivatives trading. The interface tends to be intuitive, offering a user-friendly environment without overwhelming users with excessive details on the first glance. Their design emphasizes ease of use, which is favored especially by newer traders seeking functionality without complexity.

- Bybit’s strengths:

- User-friendly interface

- Responsive design

- Effective layout for derivatives market

Binance stands as a giant in the cryptocurrency exchange arena, providing a comprehensive trading hub. Its interface is customizable, allowing you to tailor the information and tools visible to your preferences. The advanced chart features and access to a deep order book are geared towards experienced users who demand extensive data insights.

- Binance’s strengths:

- Highly customizable trading interface

- Detailed charting tools

- Wide array of information and features

Comparison of Features:

| Feature | Bybit | Binance |

|---|---|---|

| Customizability | Limited | High |

| Design Simplicity | Yes | Somewhat |

| Advanced Tools | Sufficient | Extensive |

Feedback from users and experts often praises Binance’s comprehensive nature and speed while acknowledging it may present a steep learning curve for novices. Bybit, on the other hand, receives commendation for an accessible platform that doesn’t compromise on essential features for effective trading.

In your journey as a trader, your choice between Bybit and Binance might hinge on the preference for simplicity and user-centric design versus a requirement for thorough and customizable insights. Both platforms adhere to a high standard of user experience, however, the scale and depth of Binance’s features contrast with the more accessible approach taken by Bybit.

Bybit vs Binance: Regulation and Compliance

When choosing a cryptocurrency exchange, one of your key considerations should be regulation and compliance. Both Bybit and Binance operate in numerous countries and must comply with the varied regulatory landscapes.

Binance, as a global exchange, is known for actively seeking regulatory approval in different jurisdictions. For example, it has secured licenses or authorizations in some countries to operate legally within their borders. Binance has also established multiple regional headquarters to better align with local compliance and regulatory requirements. The exchange undergoes regular audits and implements rigorous anti-money laundering (AML) practices to maintain its standing.

Bybit similarly adheres to local laws and is proactive in implementing KYC (Know Your Customer) and AML procedures. Despite being younger than Binance, Bybit has been working to meet the regulatory standards set by various governments. It’s essential to note that both exchanges have faced regulatory challenges; Binance has been scrutinized by regulatory bodies in different countries, and Bybit, too, has encountered similar issues due to the inherently complex nature of crypto regulation.

| Aspect | Binance | Bybit |

|---|---|---|

| License Status | Holds licenses in certain jurisdictions | Seeks to comply with local regulations |

| Compliance Efforts | Establishes regional headquarters for compliance | Implements KYC and AML procedures |

| Regulatory Challenges | Faced scrutiny in various countries | Encountered compliance hurdles |

| Security Audits | Engages in regular security audits | Follows strict security protocols |

Conclusion

When considering Bybit and Binance for your cryptocurrency trading needs, you’ll find distinct features suitable for different trading styles.

Bybit:

- Offers spot trading on over 300 token pairs.

- Charges a maker fee of 0.025% and a taker fee of 0.075%.

- Renowned for advanced trading tools and high liquidity.

Binance:

- Provides an extensive range of over 1600 token pairs.

- Imposes a maker fee of 0.020% and a taker fee of 0.040%.

- Notable for its broad selection of coins, low fees, and a comprehensive mobile app.

As a trader or investor, your choice between Bybit and Binance should align with your priorities.

For frequent traders who value a wide selection and low fees, Binance could be the ideal choice. Its substantial trading volume indicates a robust platform appealing to both novice and experienced traders.

If you’re focused on futures trading or require sophisticated tools, Bybit may serve you better, albeit with a narrower range of tokens.

High liquidity on Bybit also ensures efficient trades, which can be critical for day traders or scalpers.

In making your decision, consider your trading habits, required features, and the importance of trading volumes and fees in your strategy.

Remember to use sound risk management practices regardless of the platform you choose.

Comparing Bybit & Binance Against Competitors: