Bitcoin Futures Basis Trade & Carry Trade Strategy: Maximizing Profit in Cryptocurrency Markets

Bitcoin futures are financial contracts that obligate you to buy or sell Bitcoin at a predetermined future date and price. The introduction of these futures has allowed traders to speculate on the price of Bitcoin without necessarily holding the cryptocurrency itself.

With Bitcoin futures, you can hedge against price fluctuations, benefiting from its price changes while mitigating the risk of direct ownership.

The basis trade in the context of Bitcoin futures involves exploiting the price difference between the spot price of Bitcoin and the price of the futures contract. When these prices diverge, a carry trade can be executed.

In a carry trade, you buy Bitcoin at the current spot price and sell futures contracts simultaneously. The goal is to profit from the convergence of the futures price to the spot price as the futures contract approaches expiration.

Understanding and employing basis and carry trade strategies are critical as they help to stabilize return profiles and offer chances to profit in a highly volatile market like cryptocurrency. Investors utilize these techniques to potentially generate returns that are less dependent on the overall market’s direction.

Understanding Bitcoin Futures

Before delving into the specifics, it’s essential for you to understand that Bitcoin futures allow you to speculate on the future price of Bitcoin without directly owning it. This offers a way to hedge against risk and make profit predictions.

Basics of Futures Contracts

Futures contracts are legal agreements to buy or sell an asset at a predetermined price at a specified time in the future. The futures market is where these contracts are traded.

When you engage in futures trading, you’re not buying or selling the asset right away; instead, you’re trading the contract that represents the asset.

Unlike spot trading, where the actual asset is immediately exchanged, futures trading does not require immediate ownership. This provides flexibility and the opportunity for risk management, as you can guard against price fluctuations without having to hold the underlying asset.

Bitcoin Futures Explained

Bitcoin futures function like other futures contracts, with Bitcoin as the underlying asset. Exchanges, such as the Chicago Mercantile Exchange (CME), offer these futures contracts, allowing participants to speculate on the future price of Bitcoin.

The futures contract price often differs from the spot price of Bitcoin, which is its current market price. Through futures contracts, you’re betting on the price at which Bitcoin will be traded at a future date, not its current price.

Bitcoin futures are integral to the futures market as they enable price prediction and provide a tool for managing the financial risk associated with Bitcoin’s price volatility. By paying attention to the price of futures contracts, you can gain insights into market expectations regarding the future prices of Bitcoin.

The Mechanics of Basis Trade

This section delves into the structure and function of basis trade, a strategy used by investors to capitalize on the price differential between a commodity’s spot market and futures market.

Defining Basis Trade

Basis trade involves exploiting the price difference between the spot price of an asset and its futures contract price. This differential, known as the basis, can either reflect a premium—where futures are priced higher than spot—in a situation known as contango, or a discount, where futures are priced lower, called backwardation.

Your strategy hinges on this basis, and whether it widens or narrows influences your potential profit or loss.

Factors that can influence the basis include:

- Market supply and demand

- Time to futures contract expiry

- Interest rates

- Storage costs (for physical commodities)

Cash and Carry Arbitrage

In cash and carry arbitrage, you buy the asset at its spot price while simultaneously selling futures contracts. The goal is to lock in the price discrepancy as your profit.

For example, if Bitcoin trades at $30,000 in the spot market and the three-month future contract trades at a premium of $31,500, the basis is $1,500.

You can buy Bitcoin at the spot price and sell the futures contract, planning to deliver the Bitcoin when the contract expires.

This trade assumes that upon the expiry of the futures contract, the spot price will align with it. In contango, you expect the spot prices to rise, whereas in backwardation, you anticipate the spot price will fall by the contract’s expiry.

In efficient markets, the basis often aligns with the cost of carry—the cost of holding the asset until the futures contract’s expiry.

Carry Trade Strategy

In the context of Bitcoin futures, a carry trade strategy is a technique where you can potentially gain profit from the difference in yield between the spot market and futures contracts.

Execution of Carry Trade

To execute a carry trade in the Bitcoin futures market, you would buy Bitcoin in the spot market while simultaneously selling Bitcoin futures contracts .

This trade capitalizes on the yield derived when the futures price is higher than the spot price, known as “contango”.

Here’s a simplified step-by-step guide:

- Borrow capital at a low interest rate.

- Use the borrowed funds to purchase Bitcoin at the current market price.

- Sell an equivalent amount of Bitcoin through futures contracts expiring at a later date, ideally when the price is higher than the spot price.

- Upon expiration of the futures contract, complete the transaction thereby capturing the price difference as profit, minus the borrowing costs.

This market-neutral strategy aims to hedge against market fluctuations as the spot and futures positions should offset each other.

Carry Trade Risks and Benefits

While the carry trade strategy may seem appealing, it’s crucial you understand the risks and benefits associated with it.

Benefits:

- Yield Opportunities: If executed correctly, you stand to gain the differential between the futures and spot prices.

- Market-Neutral: By hedging your position, you mitigate risks associated with direct exposure to Bitcoin price volatility.

Risks:

- Market Reversal: If the market moves from contango to backwardation (where futures prices are below the spot price), the strategy may result in losses.

- Operational Risks: Execution risk, including slippage and timing, can affect the profitability of the trade.

- Liquidity Risk: In volatile markets, you might face difficulties entering or exiting positions without affecting market price.

- Credit Risk: Borrowing to finance the trade introduces credit risk, depending on the lender’s stability.

Executing Basis and Carry Trades

When you engage in basis trading with Bitcoin, you’re essentially capitalizing on the difference between the spot price of Bitcoin and the futures contract price. Carry trading, or cash and carry arbitrage, is a similar strategy aimed at exploiting market inefficiencies.

Here’s a concise guide to executing these strategies.

Step 1: Identifying Opportunities

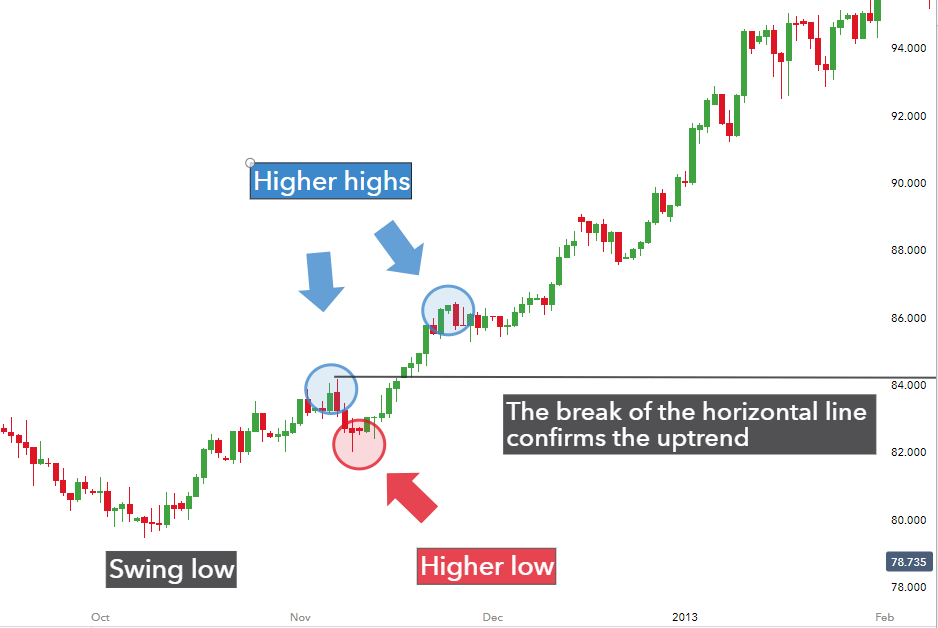

First, identify the spread between the futures and spot prices. A positive spread, where futures prices are higher, indicates a potential basis or carry trade opportunity.

Step 2: Executing the Trade

For Basis Trade:

- Buy Bitcoin in the spot market.

- Simultaneously, sell Bitcoin futures contracts with the expectation that the futures price will decline to the spot price as the contract approaches expiry.

For Carry Trade:

- Involve borrowing capital to buy Bitcoin.

- Then sell futures contracts; these should be held until expiry to realize the benefits.

Step 3: Monitoring the Trade

Keep an eye on:

- Price Convergence: As the futures contract nears its expiry date, it should converge with the spot price.

- Interest Rates: Impact borrowing costs for the carry trade.

- Market Volatility: Unexpected market movements can affect basis levels.

Tools and Platforms

For trading Bitcoin futures, use credible platforms such as:

- Derivative exchanges (e.g., CME Group or Binance Futures)

- Trading software with robust data analysis tools.

Case Studies

The Bitcoin Futures Basis Trade: In October 2021, the launch of several bitcoin futures ETFs increased buy pressures on bitcoin futures contracts. This market condition created an excellent opportunity for investors to engage in a basis trade.

Typically, this involves purchasing bitcoin on the spot market and simultaneously selling bitcoin futures contracts, locking in the difference as profit upon the contracts’ expiration.

Profitable Carry Trade Execution:

- Initial Action: Borrowing USDT to purchase bitcoin in the spot market.

- Holding Period: Until the futures contract expiry, which in one instance was on June 25.

- Outcome: A net yield of approximately 32% in annualized terms.

In January following the ETF launches, an average of 66,000 bitcoin futures contracts were traded daily on CME. This was a 50% month-on-month increase, signaling robust interest and market participation in carry trades.

Investor Strategy Post-ETF Launch:

To capitalize on market inefficiencies, some investors employed a simple “cash and carry trade,” by buying bitcoin and selling futures on CME, which yielded an annualized return of about 30%.

Market-Neutral Bitcoin Bets: With the rise of the futures premium above 10%, the market-neutral bitcoin “basis” trade offered an attractive annualized double-digit return. This became even more appealing with the introduction of spot bitcoin ETFs affecting the market dynamics.

Frequently Asked Questions

In this section, we’ll cover some of the key aspects of Bitcoin futures basis and carry trade strategies, focusing on how they work, the strategies used by traders, the factors influencing basis prices, the relationship with spot prices, and the associated risks.

How does the basis trade work in the context of Bitcoin futures?

The basis trade in Bitcoin futures involves buying or selling Bitcoin spot and taking the opposite position in Bitcoin futures contracts. Your aim is to profit from the convergence of the futures price to the spot price as the contract approaches expiration.

What strategies are commonly used for carry trading with cryptocurrencies?

In cryptocurrency carry trading, you typically borrow one asset with a lower yield and invest in another with a higher yield. For example, borrowing fiat currency at low interest rates to purchase cryptocurrencies that may offer higher returns in futures markets.

What factors influence the basis price in Bitcoin futures contracts?

The basis price in Bitcoin futures is influenced by factors such as the implied financing rate, the time left to contract maturity, the perceived volatility of Bitcoin, and market liquidity.

How is Bitcoin’s spot price related to futures basis and carry trade strategies?

Bitcoin’s spot price is crucial as it determines the success of both basis and carry trade strategies. You’ll monitor the spot price to gauge potential convergence with futures prices and to manage the spread or difference which forms the basis for your potential profit.

What are the risks associated with Bitcoin futures basis and carry trading?

The main risks include market volatility that can significantly affect both spot and futures prices, unexpected changes in interest rates, liquidity constraints, and the risk of the spot and futures prices not converging as expected.

Market Implications

When you engage in Bitcoin futures basis and carry trades, you directly influence market dynamics.

The basis trade takes advantage of the price differential between the spot price of Bitcoin and the futures contract price. If the futures price is higher than the spot price (a situation known as contango), traders can buy Bitcoin in the spot market and simultaneously sell futures contracts. This allows them to lock in the price difference as profit upon contract settlement.

Conversely, when the futures price is lower than the spot price (backwardation), you might sell Bitcoin in the spot market and buy futures contracts. This strategy forecasts that the price will converge by the contract’s maturity. Hedge funds and institutional investors typically do this to enhance liquidity and stabilize prices over time.

Carry trades involving Bitcoin could add a layer of complexity to market pricing mechanisms. These trades can also impact volatility, as the actions of numerous traders seeking to exploit market inefficiencies can lead to more substantial price movements, especially around the settlement dates of futures contracts.

As you consider the future of Bitcoin basis and carry trades, understand that market conditions evolve, and so does the viability of these strategies.

Regulation, technological advancements, and shifts in investor sentiment can significantly change the risk-reward profile of such trades. Therefore, stay informed and adapt your strategies to the changing landscape to maintain an edge in the market.

Further Reading: Check Out These Related Posts