Kraken vs Binance: Comparing Top Cryptocurrency Exchanges

Kraken vs Binance: Comparison at a Glance

When considering Kraken and Binance, you’re looking at two of the leading cryptocurrency exchanges.

Both crypto futures trading platforms offer a range of features tailored to different types of traders.

To help you understand the key differences, this table compares their main attributes.

| Feature | Kraken | Binance |

|---|---|---|

| Founded | 2011 | 2017 |

| Founder(s) | Jesse Powell | Changpeng Zhao (CZ) |

| Supported Coins | Extensive, including popular and lesser-known | Extensive, one of the highest in the market |

| Fees | Ranging from 0% to 0.26% | Ranging from 0% to 0.10% |

| Leverage | Up to 5x | Up to 100x for certain pairs |

| Trading Volume | High, though generally lower than Binance | One of the largest trading volumes globally |

| Deposit Methods | Bank transfer, crypto, others | Bank transfer, credit card, crypto, others |

Kraken, established by Jesse Powell in 2011, is known for its security and has built a strong reputation as a trusted platform.

It offers a user-friendly interface that accommodates both beginners and experienced traders, though some US residents (New York or Washington state) might find restrictions.

Alternatively, Binance, founded in 2017 by Changpeng Zhao, is a newer but fast-growing exchange.

It is acclaimed for its high liquidity and a vast array of trading pairs.

Binance offers competitive fees which can be further reduced by using their native cryptocurrency, Binance Coin (BNB), and by increasing trading volume.

Each exchange brings its unique advantages to the table and your choice will depend on your specific trading requirements, volume, and the importance you place on fees versus service features.

Kraken vs Binance: Futures Products and Services

When examining futures trading, both Kraken and Binance offer robust platforms for your trading needs.

On Kraken, you have access to futures trading with up to 50x leverage, providing ample opportunity for those looking to trade on margin.

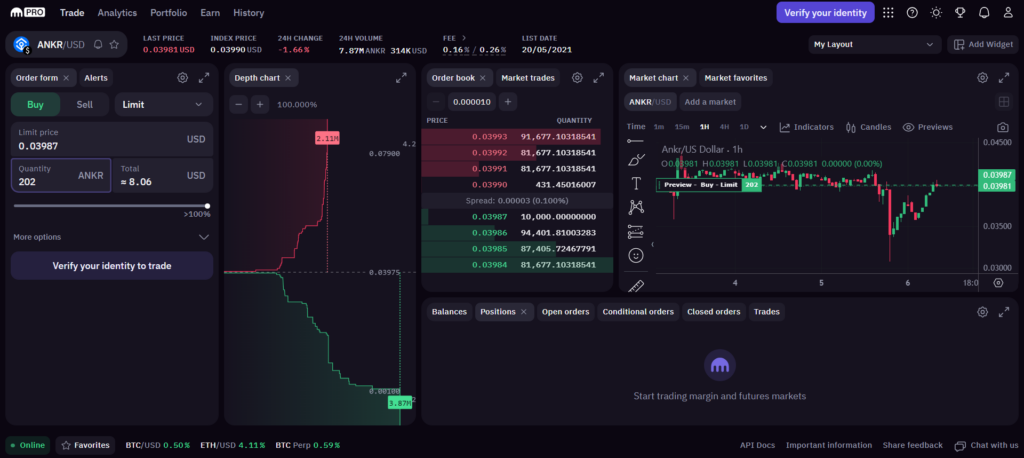

The futures interface is user-friendly, supporting both novice and seasoned traders with advanced charting features.

In contrast, Binance boasts a comprehensive futures platform with even higher leverage options, peaking at 125x.

This might appeal if you’re looking for deep liquidity and a wide range of pairings.

Binance Futures includes not only USDⓈ-M futures, which are stablecoin-margined, but also COIN-M futures, which are cryptocurrency-margined.

Key Takeaways:

- Available Pairings: Binance outshines Kraken in the diversity of available pairings for futures contracts.

- Leverage Options: Binance provides higher leverage options compared to Kraken, which might be attractive to high-risk traders.

- Toolkits for Traders: Both exchanges offer an array of analytical tools and features, but your preference for interface style might guide your choice.

- Innovations: Binance frequently introduces new products and services, which might offer a fresher experience if you’re looking for innovative trading options.

Liquidity and Volume: Binance typically has higher trading volumes, which can result in better liquidity—crucial for engaging in futures markets without significant slippage.

Keep in mind that while higher leverage might present increased profit potential, it also carries a higher risk of losses. Thus, consider your experience level and risk tolerance when choosing the right platform for your futures trading activities.

Kraken vs Binance: Futures Contract Types Available

Kraken and Binance offer different types of futures contracts that cater to various trading strategies and preferences.

Understanding the nuances between them will help you make informed decisions based on your trading needs, risk tolerance, and the capital at your disposal.

Kraken primarily features Inverse Perpetual Contracts, which are quoted in the underlying cryptocurrency. This means you’re betting on the price of the asset with the asset itself.

For example, a Bitcoin inverse perpetual would be quoted in BTC.

Kraken allows for a maximum leverage of up to 50x, but ensure you’re familiar with the margin requirements as leverage can amplify both gains and losses.

Binance, on the other hand, offers a wider array of futures contracts. They have both Inverse Perpetual Contracts and Linear Perpetual Contracts.

The latter type is denominated in USDT, which means that the gains and losses are tallied in a stablecoin, rather than the cryptocurrency itself, potentially reducing the complexity for those who think in fiat terms.

In addition to perpetual contracts, Binance provides Inverse Futures Contracts and COIN-M Futures, which are settled in the underlying asset, akin to Kraken’s offerings.

Conversely, USDⓈ-M Futures are settled in stablecoins. For options, Binance’s platform supports a broad assortment, including European-style options, a product not currently available on Kraken.

It’s worth noting that Binance offers leverage up to 125x on certain products, though this comes with an increased risk profile.

Before engaging in futures trading on either platform, you must consider the implications of leverage and ensure that you have a thorough understanding of the margin requirements, potential liquidation processes, and the risks involved with each type of contract.

Kraken vs Binance: Liquidity and Volume

When choosing a cryptocurrency exchange, understanding the liquidity and trading volume is imperative for your trading efficiency.

Execution speed and slippage—price changes between order placement and execution—can be notably influenced by these factors.

Kraken and Binance have different levels of liquidity and trading volumes, affecting how quickly and at what price your trades are filled.

Kraken:

- Liquidity: Moderate to high

- Trading Volume: Lower compared to Binance

- Unique Selling Point: Has a slight advantage for maker orders depending on your 30-day trading volume.

Binance:

- Liquidity: Very high

- Trading Volume: Highest in the world, providing rapid execution and minimal slippage.

- Unique Selling Point: Offers substantial volume discounts benefiting high-frequency traders.

Liquidity Rankings and Volume Data:

- Binance sits at the top as the world’s largest exchange by volume, translating to higher liquidity and often better pricing.

- Kraken offers competitive liquidity that can be more appealing to specific trading strategies, especially those favoring maker orders.

| Exchange | Liquidity Rank | 30-Day Volume | Fee Discounts |

|---|---|---|---|

| Binance | 1st | Highest | Yes, with BNB usage |

| Kraken | Lower rank | Moderate | Yes, based on volume |

High liquidity means that your trades are more likely to be executed promptly and closer to your desired price, which is a significant advantage that Binance holds.

However, your trading volume and chosen strategies will help determine the best fit for you, as even with lower volume, Kraken could align well with your trading needs.

Kraken vs Binance: Trading Fees and Rewards

When trading cryptocurrencies, understanding the fee structures of your chosen exchange is crucial.

Kraken and Binance have distinct approaches to their trading fees and reward systems, which can influence your trading strategies and potential profitability.

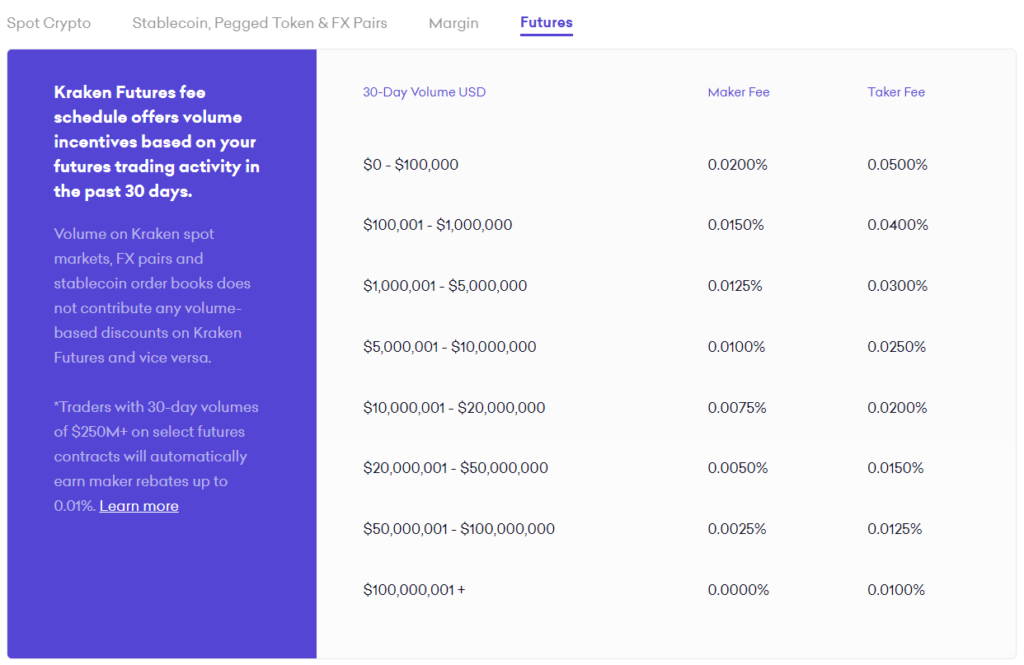

Kraken’s Fee Structure:

- Maker fees: range from 0.00% to 0.16%

- Taker fees: range from 0.10% to 0.26%

- Volume incentives: Lower fees for higher 30-day trading volumes

For example, if you place a limit order that adds liquidity to the market (a maker order), your fees might be lower than if you place an order that matches with an existing order (a taker order).

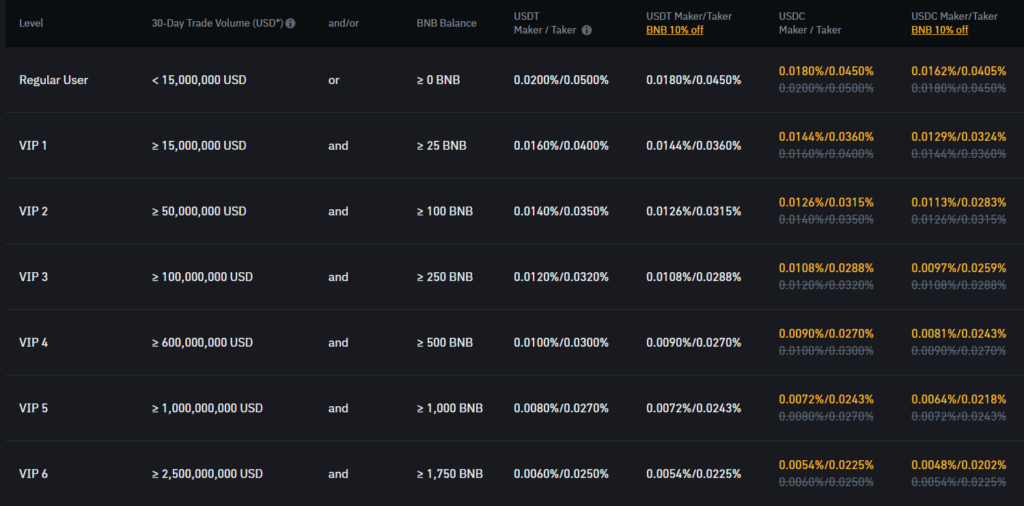

Binance’s Fee Structure:

- Maker and taker fees: start at 0.10%

- Fee discounts: using Binance Coin (BNB) to pay fees or maintaining higher 30-day trade volumes

To illustrate, a $1,000 trade as a maker or taker at the base rate costs you $1, but if you use BNB, the fee may reduce to $0.75, rewarding users for holding and using the platform’s token.

Both exchanges do not charge for crypto deposits but have varying fees for withdrawals, dependent on the currency.

Payment method and trading product can also affect fees, with certain methods like wire transfers incurring additional costs.

Rewards:

- Kraken offers staking rewards, allowing you to earn returns on your cryptocurrency holdings.

- Binance provides a broader range of staking rewards, particularly for U.S. customers, which may include higher rates or more options.

As you trade, consider how the combination of trading fees and available rewards align with your trading volume and style.

Also, think about how you might leverage discounts and rewards to optimize your trading outcomes.

Kraken vs Binance: Deposits & Withdrawal Options

When choosing between Kraken and Binance, you’ll want to consider how each platform supports deposits and withdrawals.

Both exchanges offer a range of options, but certain differences may sway your decision.

Kraken provides several fiat deposit and withdrawal methods, including bank transfers, wire transfers, and SEPA (for European customers).

The processing time usually ranges from 1 to 5 business days, depending on your location and the chosen method.

Kraken supports multiple currencies like USD, EUR, CAD, among others.

The minimum deposit amount varies based on currency, but there is generally no maximum.

For withdrawals, minimum and maximum amounts are also currency-dependent, and fees vary according to your selected payment method.

Binance offers diverse methods for you to fund your account as well.

These include bank transfers, credit/debit card payments, and third-party payment processors such as Simplex.

Binance’s processing times for deposits can be near-instant especially for crypto but may vary for fiat transactions depending on the method used.

Typically, the exchange supports a wide array of cryptocurrencies along with several fiat currencies for both deposit and withdrawal.

Binance also sets minimum and maximum limits for transactions, which are detailed in their fee schedule.

In terms of costs, both platforms may charge fees for depositing and withdrawing funds; however, Binance generally offers lower fees compared to Kraken.

It’s important for you to review the fee structures on both exchanges—as these can impact the overall cost of managing your funds.

Remember that both Kraken and Binance have security measures in place to safeguard your transactions, but always ensure that you follow the verification process and secure your account effectively to avoid any complications.

Kraken vs Binance: KYC Requirements & KYC Limits

When choosing a cryptocurrency exchange, understanding the Know Your Customer (KYC) requirements and the associated limits is essential for informed decision-making.

Kraken utilizes a tiered verification system. Your account’s withdrawal, deposit, and trading limits increase as you complete higher levels of KYC verification.

Initially, you need to supply basic personal information. For higher tiers, requirements include:

- Starter: Email, full name, primary address, and phone number.

- Intermediate: Valid government-issued ID, proof of residence, and a face photo.

- Pro: Additional verification through a KYC questionnaire.

Your tier status affects your daily and monthly deposit and withdrawal limits. For example, Starter accounts have restrictions on fiat transactions until upgraded to Intermediate or Pro, which offer significantly higher limits and additional features.

Binance operates similarly with a tiered approach to KYC:

- Basic Verification: Requires personal information but comes with lower withdrawal limits.

- Advanced Verification: Involves uploading government-issued ID and a facial recognition step.

Once your verification is complete, your deposit and withdrawal limits are substantially increased. Binance encourages the use of its native token (BNB) for additional fee discounts.

Both exchanges emphasize security through KYC to prevent fraud and maintain regulatory compliance. While KYC requirements can ensure a safe trading environment, they may also impact your privacy due to the personal data required.

Kraken vs Binance: Order Types

When trading on cryptocurrency exchanges like Kraken or Binance, understanding the order types available to you is crucial for executing your trading strategies and managing risks effectively.

Kraken offers a variety of order types:

- Market Orders: Allows you to buy or sell immediately at the best available current price.

- Limit Orders: You set the specific price at which you want to buy or sell.

- Stop Loss Orders: Automatically sells your asset when its price drops to a certain level to minimize losses.

- Take Profit Orders: Similar to a stop loss, but it closes your position to secure profits once a certain price is reached.

- Conditional Orders: Executed when specific conditions are met, combining stop loss and take profit strategies.

- Post-Only Orders: Ensures that the order is added to the order book and not matched with a pre-existing order, thus avoiding paying the taker fee.

- Settle Position Orders: Used to close a margin position at the market price.

Binance, on the other hand, also supports several order types:

- Market Orders: Execute immediately at the current market price.

- Limit Orders: You decide your buy or sell price and wait for the market to reach it.

- Stop-Loss Orders: Set a sell order for your assets if prices begin to fall to a certain threshold.

- Stop-Limit Orders: A stop order that turns into a limit order once the stop price is reached.

- OCO (One-Cancels-the-Other) Orders: This pairs a stop order with a limit order on the same asset; when one executes, the other is canceled.

- Trailing Stop Orders: Instead of setting a specific trigger price, it creates a moving trigger point at a certain distance from the market price.

- Post-Only Orders: Guarantees your order won’t be immediately executed as a market order, preserving the maker fee.

- Reduce-Only Orders: Ensures that an order only reduces your position, not increases it.

Both platforms have features that help you to control your trades effectively. Your choice will depend on your trading style and risk tolerance.

Kraken vs Binance: Security and Reliability

When you’re considering Kraken and Binance, security is paramount. Both exchanges have put in place robust security measures, but their approaches and track records do differ.

Kraken prides itself on its security protocols. Your deposits on Kraken are stored in cold storage, with only a fraction available online. Here are key points regarding Kraken’s security:

- Two-factor authentication (2FA): Enhances your account’s security.

- Global Settings Lock: Prevents changes to your account settings over a given period.

- Master Key: An additional layer for recovering your account.

- PGP/GPG Encryption: Keeps your emails secure.

Kraken’s reliability has been tested by time, and despite being one of the oldest exchanges, it has faced few significant incidents. Regulatory compliance is a strength for Kraken, as it adheres strictly to global regulatory standards.

Binance, being a newer and rapid growth platform, offers an innovative security system. Key security features include:

- SAFU (Secure Asset Fund for Users): An emergency insurance fund to protect users’ assets.

- Device Management: Reviews devices that can access your account.

- Anti-Phishing Code: Identifies authentic communications.

However, Binance has encountered several security incidents, including a significant hack in 2019. Since then, Binance has strengthened its security and reimbursed affected users via the SAFU fund. Binance’s regulatory compliance has been more scrutinized, given its expansive international presence and rapid product expansion, leading to differing policies based on the user’s location.

In customer support, both exchanges offer ticket systems, live chat, and extensive FAQs. However, your experience may vary, as response times can be inconsistent due to the high number of users on both platforms.

Kraken vs Binance: User Interface & Experience

When choosing a cryptocurrency exchange, the user interface (UI) and overall user experience (UX) are essential for efficient and comfortable trading. Your choice between Kraken and Binance may come down to personal preference in UI and UX.

Kraken provides a straightforward interface suited for both novice and advanced users. Kraken’s commitment to continuous improvement is evident in its response to user feedback about the mobile app’s UI and UX.

Especially if you’re new to crypto trading, you may appreciate Kraken’s approach to design which promotes ease of use without sacrificing advanced features for experienced traders.

On the other side, Binance boasts a diverse UI with multiple layouts catering to different user preferences. For beginners, Binance’s basic interface layout is user-friendly. However, its more intricate advanced trading interfaces might require some time to familiarize yourself with, especially if you dive into more complex trading functions.

The comparison in terms of speed and functionality tends to be more subjective. Users have reported that both platforms are generally reliable, though your experience might vary based on your location, the device you’re using, and network conditions.

Kraken:

- Mobile app responds to user feedback

- Prioritizes continual UI/UX enhancements

- One-on-one account support featured

Binance:

- Offers varied UI complexity

- Basic layout is beginner-friendly

- More advanced features for seasoned traders

The choice ultimately depends on your trading style and which platform’s interface you find more intuitive. It’s advisable to try both platforms and see which one aligns with your trading habits and preferences.

Kraken vs Binance: Regulation and Compliance

When you’re choosing a cryptocurrency exchange, understanding their approach to regulation and compliance is crucial. Both Kraken and Binance operate with regard to the legal and ethical standards of their respective jurisdictions, though their approaches and regulatory landscapes they navigate differ somewhat.

Kraken prides itself on its relationship with regulators. It is based in the United States and, as such, adheres to a strict regulatory environment. Kraken complies with legal requirements in all areas where it operates, ensuring a high level of safety and transparency:

- Registered: FinCEN-registered as a Money Services Business (MSB).

- Compliance: Implements robust Anti-Money Laundering (AML) and Know Your Customer (KYC) programs.

- Certifications: Pursues regular audits and maintains a transparent security practice.

In contrast, Binance has a more complex regulatory narrative:

- Global Presence: Due to its wider international presence, Binance adheres to a variety of regulatory standards.

- Adaptability: Actively adapts to the evolving global regulatory landscape with dedicated compliance efforts.

- Challenges: Has faced scrutiny in various regions and worked on enhancing its regulatory stature, such as by introducing KYC requirements across all its platforms.

Licenses and Audits:

While both exchanges take regulation seriously, they’ve had different journeys:

| Area of Comparison | Kraken | Binance |

|---|---|---|

| Licenses | Various US and EU licenses | Pursuing licenses in multiple jurisdictions |

| Audits | Regular third-party audits | Engages in compliance audits |

Your choice might hinge on how each platform aligns with the regulatory expectations in your region. Regulatory compliance ensures that you are engaging with a platform that values your financial safety and works within the bounds of the law.

Conclusion

In comparing Kraken and Binance, you’ve seen that each platform caters to different user needs.

Kraken is known for its straightforward user interface. This makes it a good choice if you prioritize ease of use and a less complex trading environment. Kraken’s fees range from 0% to 0.26%, which could be more favorable if you’re a low-volume trader or value a flat fee structure.

On the other hand, Binance offers a deeper array of features. Its maker-taker fees are competitively lower, sitting between 0% and 0.10%. The fee structure at Binance is more dynamic, taking into account your 30-day trading volume and offering discounts for holding BNB, its native cryptocurrency.

- For new traders seeking simplicity and willing to trade with slightly higher fees, Kraken could be your best fit.

- Experienced traders and those looking for a more extensive set of tools, lower fees, and don’t mind a more complex platform, might prefer Binance.

Remember, regional restrictions may influence your choice. For instance, Kraken does not operate in New York or Washington state. It’s also crucial to consider the type of trades you’re making and how the fee structures of each platform can impact your returns.

Take into account bank account fees, with Binance offering free transactions outside the U.S., while Kraken’s fees vary significantly.

Comparing Kraken & Binance Against Competitors: