Phemex vs Bitget: Comparing Features and Performance for Traders

Comparison at a Glance

Phemex and Bitget are two best crypto futures trading platforms that you can choose to trade on in 2024. Below is a concise comparison between these two platforms:

| Feature | Phemex | Bitget |

|---|---|---|

| Founded | 2019 | 2019 |

| Founders | Jack Tao and other 8 ex-Morgan Stanley executives | Sandra Lou |

| User Base | Over 5 million active users | 2 million users |

| Trading Products | Spot, Contract, Derivatives, Leverage | Spot, Futures, Perpetual, Dual Investment, Staking, Copy Trading |

| Fees | Low futures contract fees (0.01 – 0.06% per trade) | Trading fees vary |

| Supported Coins | Many, but not specified in search results | Over 400 cryptocurrencies |

| Leverage | Offers leverage trading, details not provided in search results | Offers leverage trading, details not provided in search results |

| Security | Two-factor authentication, cold storage, regular security audits | Security features not detailed in search results |

| Deposit Methods | Multiple, including fiat | Fiat via wire transfer; Cryptocurrencies; Debit/Credit cards, Apple Pay, Google Pay |

| Global Availability | Restricted in some countries | Globally available |

Remember that trading on these platforms comes with their respective features and products that cater to different preferences. Phemex is noted for its security measures and user trust, but Bitget offers a broader range of trading features and is globally available.

You should evaluate the fees, available coins, and deposit methods to better understand which platform aligns with your trading needs.

Futures Products and Services

When engaging in futures trading, you will find that both Phemex and Bitget present a range of options catering to your investment strategies.

Phemex:

- Offers futures trading with leverage up to 100x.

- Relatively low futures contract fees ranging between 0.01% – 0.06% per trade.

- Known for a user-friendly interface that facilitates an accessible trading experience.

Bitget:

- Provides a higher leverage option for futures, reaching up to 125x.

- Features a more extensive variety of futures products, such as Spot, Futures, Perpetual, and Dual Investment.

| Feature | Phemex | Bitget |

|---|---|---|

| Leverage | Up to 100x | Up to 125x |

| Contract Fees | 0.01% – 0.06% | Varies (Competitive rates) |

| User Interface | Intuitive and easy to navigate | Comprehensive with advanced functionality |

| Product Depth | Standard futures options | Wide range, including innovative products |

While Phemex excels in simplicity and low fees, making it suitable if you prioritize a straightforward trading experience, Bitget stands out if you seek high leverage and a broader spectrum of futures products that may align with more intricate trading strategies.

Remember, your choice should align with your trading preferences and risk tolerance.

Consider the security measures, user convenience, and the fee structure that each platform offers to make an informed decision tailored to your trading goals.

Futures Contract Types Available

When considering futures contract types on Phemex and Bitget, you have a variety of options that cater to different trading strategies and preferences.

Phemex offers you both inverse perpetual contracts and linear perpetual contracts.

The inverse perpetual contracts allow you to trade with cryptocurrency as margin, meaning the contracts are quoted and settled in the coin itself, like Bitcoin (BTC) or Ethereum (ETH). Phemex provides up to 100x leverage for these contracts, appealing if you’re seeking high leverage opportunities.

Conversely, linear perpetual contracts on Phemex are quoted and settled in a stablecoin, such as USDT, giving you a way to predict your profits and losses in a currency with stable value. These also have up to 100x leverage, and the margin is posted in a stablecoin.

Bitget broadens your trading horizon with inverse futures contracts, COIN-M futures, USD-M futures, and even options.

Inverse futures contracts work similarly to inverse perpetual contracts, using the cryptocurrency itself for margin. The COIN-M futures are settled in the underlying crypto asset, which may be advantageous if you hold or prefer to earn the actual coin.

The USD-M futures at Bitget are settled in USDT (a stablecoin), offering a familiar valuation while trading. You’ll find this particularly beneficial for direct comparisons with fiat-based financial products.

Bitget also gives you the possibility to trade options, providing a different risk profile and strategic possibilities compared to futures.

You should understand that while higher leverage like the up to 125x offered by Bitget can amplify gains, it equally increases your risk level.

Be aware of your margin requirements and ensure you’re comfortable with the risk involved.

Both exchanges offer robust trading systems for futures contracts, but the right choice for you will depend on your specific trading needs and risk tolerance.

Liquidity and Volume

When considering Phemex and Bitget for your trading needs, liquidity and volume are two key factors that influence how efficiently and effectively you can execute trades.

High liquidity implies the presence of a large number of buyers and sellers, which typically results in tighter bid-ask spreads and better prices for you.

Phemex:

- Ranking and Metrics: Not specifically provided by the search results.

- Implication for You: You could experience lower slippage and quick order fills, given Phemex’s significant user base which may contribute to its liquidity.

Bitget:

- Ranking and Metrics: Not specifically provided by the search results.

- Implication for You: The variety of trading features might attract substantial trading volumes, implying potentially high liquidity that facilitates efficient trade execution with minimal impact on price.

Liquidity often correlates with the trading volume, which is the total value of trades within a specific timeframe.

An exchange with a higher volume might indicate robust liquidity, minimizing the risk of price manipulation and providing stable prices during market fluctuations.

Trade Volume Sources:

Trade volume data can be sourced from exchange-reported figures as well as third-party aggregators like CoinMarketCap, which provide updated volume rankings.

Effects on Trading:

- Reduced Slippage: Your trades are less likely to cause major price changes.

- Better Execution: Orders are filled promptly, giving you a competitive edge.

In this aspect, both Phemex and Bitget can offer you distinct advantages depending on their liquidity and volume.

Always consult up-to-date analytics from reliable sources before trading.

Trading Fees and Rewards

When trading on Phemex or Bitget, you need to understand their fee structures and the potential rewards involved. This plays a crucial role in your overall profitability and trading strategy.

Phemex has a distinct approach to fees, providing both maker and taker offers.

A premise of their structure is charging 0.1% for both maker and taker fees on trades. However, Phemex also has a unique zero-fee spot trading option for premium users, which can substantially reduce trading costs.

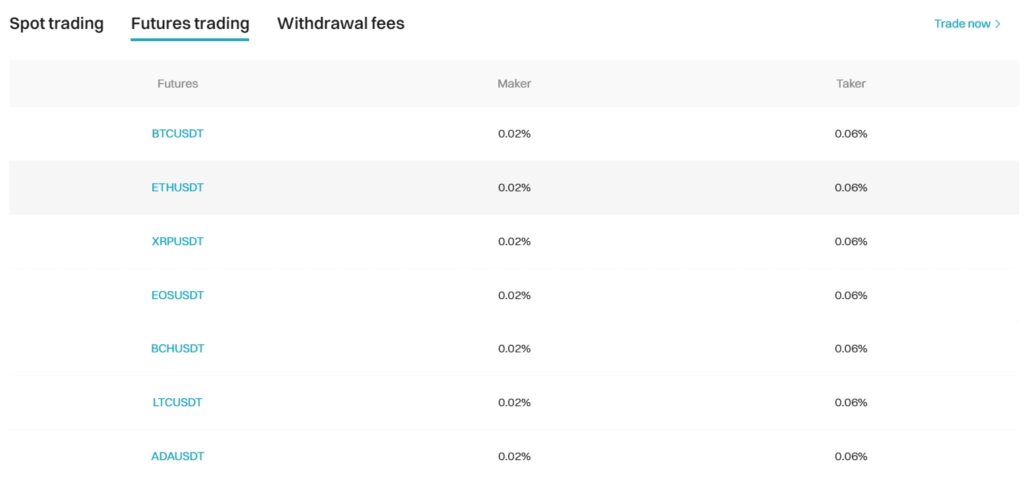

In contrast, Bitget differentiates its fees between makers and takers.

The fees you’ll encounter on Bitget in futures trading are generally 0.02% for makers and 0.06% for takers. Spot trading fees are consistent for both parties at 0.1%.

Additionally, if you’re holding BGB tokens, you’re eligible for a 20% discount on spot fees, similar to how some rewards are provided in decentralized finance (DeFi).

Looking at rewards, staking on Phemex could earn you up to 10% rewards on your assets, depending on the amount and asset type.

Bitget also offers benefits for using their native token, BGB, which can be used to reduce fees or earn staking rewards.

| Exchange | Maker Fee | Taker Fee | Spot Trading Fee | Futures Trading Fee | Staking Rewards |

|---|---|---|---|---|---|

| Phemex | 0.1% | 0.1% | 0% for Premium Members | 0.01%-0.06% per trade* | Up to 10% on staked assets |

| Bitget | 0.02% | 0.06% | 0.1% (20% off with BGB) | 0.02%-0.06% for m/t | DeFi-like rewards with BGB |

*Fees may vary based on the asset and trading volume.

Keep in mind that withdrawal and deposit fees may also apply, depending on your payment method and the specifics of each exchange.

These could include network fees for cryptocurrency transactions or fees associated with fiat gateways.

Make sure to review the complete fee schedule of each platform and understand how these might impact your trading decisions.

Deposits & Withdrawal Options

When choosing between Phemex and Bitget for your trading needs, you must consider how deposits and withdrawals work on these platforms.

Phemex offers zero fees on withdrawals for certain premium accounts and provides free deposits as well.

You can transfer funds into your Phemex account through various methods. These include bank transfer, debit or credit card, or crypto transfers from external wallets.

For Bitget, the scenario is slightly different. Although there are no fees on deposits, withdrawals incur a network fee. This fee isn’t fixed and can vary depending on the digital asset and the prevailing network conditions.

Here’s a quick breakdown to guide your decisions:

| Feature | Phemex | Bitget |

|---|---|---|

| Deposit Fees | Free | Free |

| Withdrawal Fees | Free for premium accounts; otherwise varies | Network fee (varies with asset & market) |

| Fiat Entry | Via third-party services | Via third-party services |

| Processing Times | Typically fast | Typically fast |

| Crypto Options | 400+ cryptocurrencies | 150+ cryptocurrencies |

Your choice between Phemex or Bitget may be influenced by the specific cryptocurrencies you intend to trade and whether you prefer to avoid any withdrawal fees.

Keep in mind that while both exchanges facilitate rapid processing, the actual timing might be affected by external factors such as network congestion. Always review the exchange’s policies and current fees before initiating transactions to ensure you have the most up-to-date information.

KYC Requirements & KYC Limits

Phemex and Bitget both have Know Your Customer (KYC) protocols, but they differ in terms of requirements and limits.

Phemex:

- Offers a light KYC option that provides you with access to basic features. You can deposit, trade, and withdraw up to certain limits without full verification.

- For full account functionality, you’ll need to provide more detailed documentation.

- Verification usually requires uploading an ID and a selfie, with approval often completed quickly, given the correct submission of documents.

Bitget:

- Recently introduced mandatory KYC requirements for all users, new and existing.

- New users must complete KYC upon registration; existing users had a grace period to comply.

- Full KYC requires personal identification documents to access the platform’s complete offering.

Here’s how this impacts you:

| Aspect | Phemex | Bitget |

|---|---|---|

| Privacy | Offers a degree of anonymity with light KYC. | Requires full KYC, limiting anonymity. |

| Security | Enhanced with proper verification for full features. | Mandatory KYC increases account security. |

| Accessibility | Without full KYC, features are limited. | Full access only after KYC verification. |

| Deposit/Withdraw Limit | Certain limits apply without full KYC. | All users must follow the same limits post-KYC. |

| Verification Time | Quick if documents are in order. | N/A |

Order Types

When you trade on Phemex or Bitget, understanding the various order types each platform offers is critical for executing your trading strategies efficiently and managing risks effectively.

Phemex supports several order types:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Set the maximum or minimum price at which you are willing to buy or sell.

- Conditional Orders: Automatically executed when certain conditions are met.

- Additionally, Phemex allows you to utilize:

- Stop Limit Orders: Triggered at a chosen price and filled at the limit price or better.

- Take Profit/Stop Loss (TP/SL): Designed to lock in profits or minimize losses.

Bitget also provides a robust variety of order types, including:

- Market Orders: For instant execution at current market prices.

- Limit Orders: To specify the price at which you want to sell or buy.

- Stop Orders: Helpful in setting a sell or buy order when an asset hits a certain price.

- Post-Only Orders: Ensure the order adds liquidity to the market by executing only as a maker.

- Reduce-Only Orders: Ensures the order only reduces a position, not increases it.

- One-Cancels-the-Other (OCO): Pairs two orders, where the execution of one cancels the other.

For advanced traders, Bitget’s Dual Investment, which pairs crypto investment with a non-principal guaranteed fixed return product, is noteworthy. Such offerings reflect risky but potentially rewarding opportunities depending on market movements.

Traders can benefit from these order types to tailor their trading approach. They can aim for immediate execution with market orders or precise entry points with limit and conditional orders. Both Phemex and Bitget equip you with tools to align your trades with your risk tolerance and strategy.

Security and Reliability

When you trade on Phemex or Bitget, your security is a primary concern for both exchanges.

Phemex utilizes robust security features to protect your assets, notably:

- Two-factor authentication (2FA)

- Cold storage for safeguarding most user funds

- Regular security audits

- Continued updates to combat potential threats

Moreover, user reviews often reflect a strong trust in Phemex’s security measures.

Bitget also places a high emphasis on the safety of your funds, offering:

- A Protection Fund to cover potential losses

- The use of hot and cold wallet solutions

- Two-factor authentication (2FA)

- SSL encryption for secure online transactions

Both platforms have had to navigate the evolving landscape of security threats. However, there have been no widely reported incidents that question their integrity or the safety of user assets.

In terms of reliability, adherence to regulations keeps both exchanges accountable.

While Bitget is globally available, you should be aware that Phemex may have restrictions in certain countries due to regulatory reasons. It’s essential to consider this, depending on your location, to prevent any inconvenience.

You can typically rely on quality customer support from both exchanges, which is key to handling any potential issues quickly and efficiently.

Their support channels include various methods such as email, live chat, and help desks, which ensure that you can get assistance when needed.

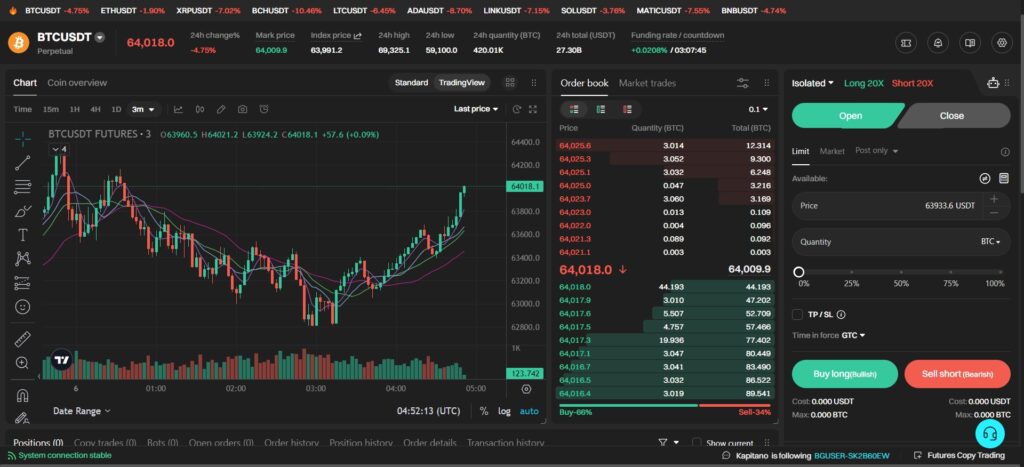

User Interface & Experience

When choosing between Phemex and Bitget, you’ll find that both platforms prioritize user experience through their interfaces.

Phemex offers:

- A clean and well-organized interface

- User-friendly navigation

- A suite of trading tools and charting options

Bitget counters with:

- A modern, intuitive user interface

- Easily accessible charting tools and trading indicators

In terms of ease of use, both exchanges present a streamlined experience, making it straightforward for you to engage with the markets.

The speed of trade execution and overall performance is reliable, ensuring you don’t miss out on fleeting market opportunities.

Design-wise, both platforms lean towards minimalism, giving you a clutter-free environment that focuses on functionality. The inclusion of advanced tools allows both novice and experienced traders to analyze and trade effectively.

User Feedback:

- Phemex users appreciate the platform’s intuitive nature, which simplifies the trading process, allowing for a smooth operation.

- Bitget users often highlight the platform’s modern interface and comprehensive toolset, enhancing their trading strategy implementation.

Functionality remains a strong point for both exchanges, as each platform supports a variety of order types, further empowering your trading decisions.

To summarize, your choice between Phemex and Bitget might come down to personal preference regarding specific interface elements or certain features that better align with your trading needs.

Regulation and Compliance

When you are considering Phemex and Bitget, it’s crucial to examine their adherence to regulation and compliance. These factors ensure that you are trading legally and that your funds are safeguarded.

Phemex: This platform is mindful of its regulatory responsibilities. Although specific licensing details may not be clearly provided in public resources, your interaction with Phemex suggests that it is taking steps to comply with international regulations.

Users have reported that it restricts access from certain countries due to regulatory measures. Additionally, Phemex underscores its commitment to security through regular audits.

Bitget: Your experience with Bitget will reflect its approach to trading features and global availability.

Despite Phemex’s restrictions in some areas, Bitget extends its services worldwide.

Notably, Bitget’s approach to compliance is to integrate protective measures for assets, as indicated by the establishment of a Protection Fund.

Bitget’s use of multiple wallet types and two-factor authentication also signifies a strong security protocol, indirectly suggesting compliance with various regulatory requirements.

As you navigate these platforms, you have to remember that compliance is not static. Both platforms may face future challenges as regulations evolve, particularly with the cryptocurrency sector’s rapidly changing legal landscape. Therefore, continuously staying informed about each exchange’s status is in your best interest.

Conclusion

When choosing between Phemex and Bitget, the decision largely boils down to your specific trading needs and preferences.

Both platforms have strong user bases. Bitget boasts 2 million users, and Phemex has over 5 million active users. Each provides a range of services, including spot, futures, and leverage trading.

Security: Phemex takes safety seriously. It uses 2FA and cold storage for most funds, and it commits to regular security updates. Trust is high among its users.

Trading Features: If you’re looking for a wide array of trading options, Bitget might edge out Phemex. It offers Spot, Futures, Perpetual, Dual Investment, Staking, and Copy Trading.

Global Availability: Bitget has a global reach, while Phemex may be restricted in certain countries.

Fees: For traders keen on saving costs, Phemex provides lower futures contract fees ranging from 0.01% to 0.06% per trade.

Deposits and Payments: Bitget supports fiat currency deposits via wire transfer. It also offers a range of deposit options, including Apple Pay and Google Pay. On the other hand, Phemex offers a wider variety of payment methods and supports many cryptocurrencies.

Comparing Phemex and Bitget Against Competitors: